Road Accident Fund is at a crossroads

Transport Minister Barbara Creecy dissolved the RAF’s board to tackle governance issues, but its impact on victims remains uncertain.

Determination says a ‘reasonable broker’ would supplement a bulk email with an email or phone call to ensure the client is aware of new conditions.

Transport Minister Barbara Creecy dissolved the RAF’s board to tackle governance issues, but its impact on victims remains uncertain.

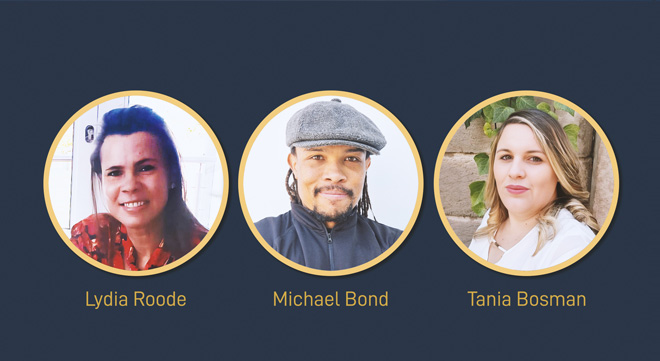

How MBSE graduates like Lydia Roode and Michael Bond leveraged the Higher Certificate in Short-term Insurance to excel in real-world scenarios.

The Tribunal agrees with the FSCA that the entity’s key individual did not ‘come clean’ about her past misconduct.

The final Notice removes confusing references to section 14(8), but calls for a wholesale carve-out of retail-to-retail transfers were turned down.

As rental demand surges, advisers can help clients navigate the insurance complexities of furnished, semi-furnished, and short-term lets.

The Companies Amendment Act has eased repurchase requirements, but many firms risk over-complying unless they update their MOIs.

With over 40 warnings issued this year, the FSCA is urging the public to steer clear of investment offers on social media that promise unrealistic returns and falsely claim ties to trusted financial brands.

The ‘tsotsi’ billboard did not cross the line into discriminatory or offensive content, says the Advertising Appeal Committee.

As a result of the declarator, the High Court ordered the Tribunal to revisit its decision regarding the R50m fine imposed on Viceroy Research.

Supreme Court rejects SARS’s argument that the expert’s opinion was tainted by self-interest because of the fee he would earn.

The FSCA’s success in collecting penalties remains uneven because of several structural and legal challenges.

The main reasons are the growing threat of populist policies and ensuring that children and grandchildren can study overseas, so they can compete for jobs globally.

Vehicles fitted with multiple tracking devices are more likely to be recovered. If hijackers disable one tracker, the backup can still guide response teams to your car.

The National Consumer Commission has named an additional 20 businesses that took payments but disappeared without delivering.

Nedbank’s TV commercial – featuring the tagline ‘Time is more valuable than money. Spend it wisely’ – appropriated Allan Gray’s proprietary advertising goodwill.

While Millennials and Gen X buckle under rising debt, Gen Z’s openness to credit education and digital tools offers hope for reversing South Africa’s deepening financial crisis.

From funeral policy breaches to crypto non-compliance and weak AML measures, the regulator’s latest report outlines its key priorities – with online harm topping the list.

Notifications