Clients often find insurance conversations challenging. They want to get through them quickly and enter them with a preconceived idea of what they want to talk about. But intermediaries can have more meaningful conversations that result in better outcomes for them and their clients if they move their clients from what is called System 1 to System 2 thinking.

This was said by Nick Clifton, the customer experience manager for Swiss Re Europe, who was a guest speaker at Sanlam’s recent Financial Confidence webinar for intermediaries.

Clifton spoke about how advisers can apply behavioural economics to have better conversations with their clients.

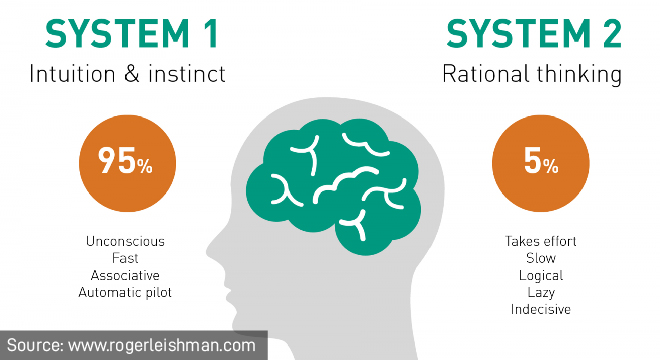

The context of his presentation was the two distinct ways in which the brain functions:

- System 1 decision-making takes place at the unconscious, associative and sub-conscious level and requires little effort. Simple examples are picking up a coffee cup or turning a door handle.

- System 2 thinking involves making decisions with an analytical frame of mind and requires more effort.

Clifton used the following example to illustrate how the technique called reframing can move a client from System 1 to System 2 thinking and result in better retention.

A client phones a call centre to cancel a policy. The function of a call centre is to help customers get things done. If the agent immediately responds by asking how he or she can assist in cancelling the policy, the agent is reinforcing what the client has already decided.

Instead, the agent can reframe the conversation by asking, “Can we first talk about why you are losing your valuable protection?” By substituting certain key words – “losing” instead of “cancelling”, “insurance policy” for “valuable protection” – the conversation has been reframed, and the client has been moved from low-energy System 1 (the expectation that a routine cancellation process will follow) to System 2, which requires more engaged thinking.

This example also illustrates how to harness the power of another insight from behavioural economics: loss aversion – we do not like to lose something we already have, or we find it much worse to lose something now than to gain something in the future.

How to kick off discussions where you know there could be difficulties

1. Create ease of processing

The process to take out insurance for the first time can be daunting for many people, and most people do not like to embark on something they don’t understand, Clifton said.

Often, clients are concerned about the unknowns in terms of how long or how difficult an insurance conversation will be. But the length of the process does not have to be a barrier, as long as clients are told what it entails, how it works and where they are in the process.

2. Make the conversation a conversation

Advisers may see themselves as a business talking to a consumer, but your clients don’t necessarily see you as a business and respond to you in that way.

Ultimately, remember that you are a person talking to another person, and you should try to make an insurance conversation like any other conversation, Clifton said. Adopt the mindset of how you would talk to a friend or relative who doesn’t understand insurance.

3. Moving clients from System 1 to System 2 thinking

If you want to talk about a specific policy, instead of coming from the policy perspective and talking about the terms and conditions, use verbal prompts that resonate with your client, Clifton said.

For example, if are talking about a decreasing or a level-term term policy, instead of starting by explaining what these terms mean, ask the client when their family is likely to face its biggest financial risk: is it early in the term, or do they want the same level of protection throughout? In this way, the conversation becomes about the client’s needs, concerns and risk tolerance. Then, when you talk about the policy itself, the client will see why one policy is more suitable than the other.

If you want to speak more generally about, say, a disability product, try to connect on a personal level. Ask the client whether they know of anyone who has been unable to work because of illness or injury and how that person managed financially. Either the person they knew had insurance, which helped them to manage financially, or they did not. This gets the client thinking about how they need to avoid what happened to their friend, relative or colleague because they didn’t have insurance, or that they want to manage in the same way as they did because they did have insurance.

How to address sensitive areas and topics

You are an expert in insurance and the policies that are available to address certain risks, but you are not a health expert or an expert on what’s best for your client’s health, Clifton said.

If your lack of expertise makes you feel uncomfortable about having conversations around health conditions, be honest about this. Clifton suggests you can say, “I can’t judge what’s important to you, but I can let you know what the right type of protection is to help you, so let me know what potential health issues concern you most.”

This allows clients to advise themselves in circumstances where you are not comfortable telling the client you want to talk about a specific condition.

When the client talks about those concerns, you can talk about the products they can get to provide a safety net or make them comfortable that their loved ones are protected.

If the client is still reticent, you can talk generally about what the cover does. This means the client does not have to open up about a specific concern but can self-choose from a list.

For example, you can say, “Disability income will pay if you are unable to work due to a number of illnesses or injuries, such as accidents, mental health, anxiety problems, as well as illnesses such as cancer and heart attacks.”

If you want to talk about a benefit such as mental health services, you can do it in general terms: “If you or your family needed help coping – perhaps with stress, anxiety, trauma, depression or even a recent bereavement – then this is an additional benefit you might find useful.”

In this way, you don’t have to ask the client directly whether they suffer from stress or anxiety, but you are giving them an opportunity to think about what concerns them.

Part 2 of this article will look at how to make the underwriting process easier for clients and how to overcome client objections.