A concerning trend can be observed in the membership profile of medical schemes over the past 16 years, says Paresh Prema, Alexforbes’s branch head: Actuarial and Technical Advisory Services.

Alexforbes Health recently released its 2022/23 Medical Aid Insights publication, which provides a comprehensive view of the performance of the medical schemes industry, as well as the changes and challenges the industry is facing.

Read: Most schemes rely on investments to achieve a net breakeven result – report

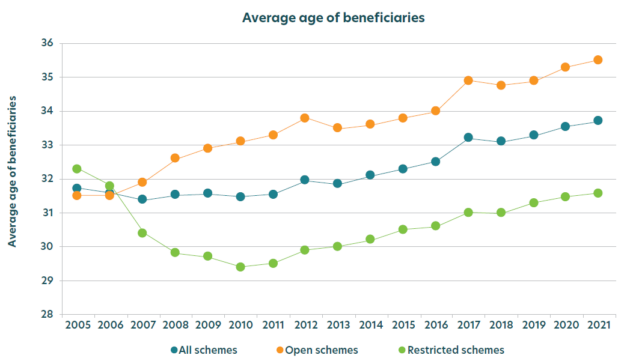

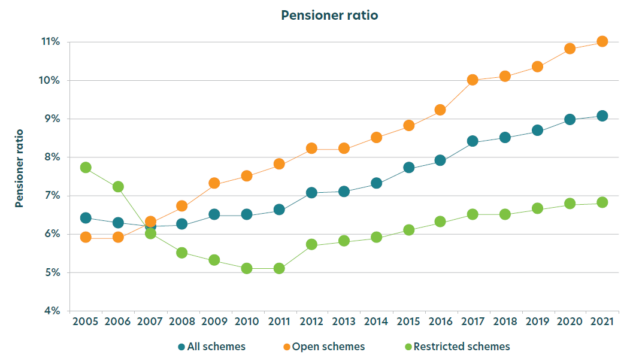

One of the most important factors that contributes to a medical scheme’s performance is the risk profile of its members. The key statistics in this regard are the average age of beneficiaries, pensioner ratio (percentage of beneficiaries over the age of 65), and average family size.

“As a scheme gets older, we expect the average claims per member to increase, with a benchmark of a 2% increase in average claims per year in average age,” the report said.

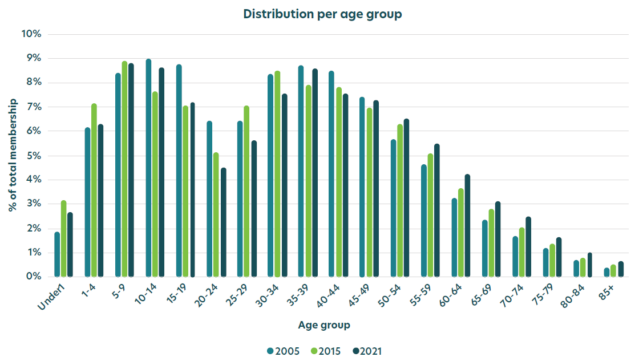

Prema said it was a concern that the proportion of older members has increased over the past 16 years, while the proportion of younger members has decreased, with an exception in growth in the age group 35 to 39 years, which is predominately driven by women seeking medical protection during childbearing age.

The graph below shows the number of members at various ages during 2005, 2015 and 2021.

The average pensioner ratio across the industry increased from 9% in 2020 to 9.1% in 2021. Open schemes were the main driver of this, with their pensioner ratio increasing from 10.8% to 11% over the year. This trend is in line with the ageing of the medical scheme population.

For medical schemes to remain affordable and accessible, they need a balance of membership at all ages – “a trend we are not seeing”. This shows that schemes need to take steps to ensure that coverage remains affordable and accessible to younger members, to manage claims, Prema said.

Contribution increases outpace inflation by nearly 2%

Medical scheme contributions have increased by an average of 7.3% a year over the past 22 years, resulting in actual increases in contributions per principal member exceeding CPI inflation by at least 1.8% a year, according to the report.

Over the same period, CPI inflation averaged 5.5% a year, while medical care and health expense inflation has averaged 6.9% a year, resulting in a gap of 1.4% a year.

Medical care and health expense inflation is based on the component of CPI that relates to doctors’ fees, nurses’ fees, hospital fees, nursing-home fees, medical and pharmaceutical products, and therapeutic appliances.

According to the report, only KeyHealth has, on average, implemented an annualised contribution increase below the average inflation rate of 5.5% between 2007 and 2023. The average annualised contributions for the country’s largest open schemes were:

- Bestmed: 9.8%

- Fedhealth: 9.7%

- Medshield: 9.2%

- Discovery: 8.9%

- Momentum: 8.8%

- Bonitas: 8.6%

- Medihelp: 8.6%

- Hosmed: 8.1%

- Sizwe: 7.4%

Note: these increases are based on the headline increases announced by individual schemes.

Fewer schemes, but more members

The number of registered medical schemes almost halved from the end of 2000 to the end of 2021, from144 to 73, mainly because of amalgamations among the smaller, less sustainable schemes.

The number of open schemes has decreased by 30 (64%) compared with a decrease of 41 (42%) restricted schemes over the past 22 years.

Despite the decrease in the number schemes, principal membership has grown by 60% (1.5 million), while the number of beneficiaries has increased by 36% (2.4 million) since 2000.

The 73 schemes operating at the end of 2021 had a total of 4.06 million principal members and 8.94 million beneficiaries.

The number of principal members increased by 0.84% in 2021, while the total number of beneficiaries covered increased by 0.5%, driven mainly by a growth in beneficiaries covered on restricted schemes.

“It is important to point out that this increase in membership followed a decline of 1.56% in 2020. Similarly, the number of beneficiaries increased by 0.5% in 2021 compared to a decline of 1.15% in 2020,” Prema said.

A total of 57.9% of principal members participated in open schemes at the end of 2021, with the balance of 42.1% participating in restricted schemes.

The industry’s net increase of 37 000 members over the 2021 financial year was driven by Discovery Health Medical Scheme and the Government Employees Medical Scheme, which grew by 22 499 and 22 578 principal members, respectively.

Discovery’s total market share, based on the number of principal members, has increased from 16% in 2001 to 33% at the end of 2021, compared with a decrease in market share for the rest of the open schemes from 54% in 2001 to 25% in 2021.