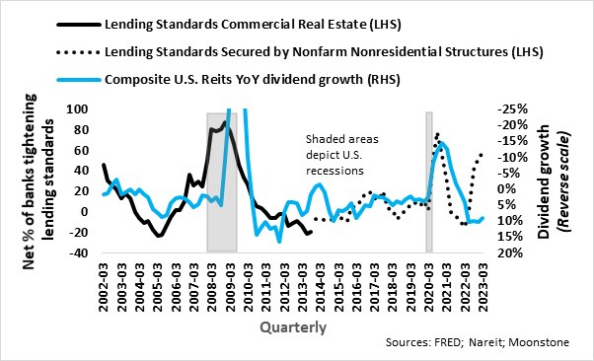

The big global credit crunch is here. In the third quarter of last year, the net percentage of US banks tightening their lending standards increased to more than 40% across commercial real estate sectors. The tightening continued through the first quarter to more than 60% – that was before the onset of the banking crisis. Although the contagion of recent bank failures appears to be stemmed, banks will be less eager to lend.

The net percentage of banks tightening lending standards is approaching the highs of the global financial crisis and the pandemic. It may even overshoot as a consequence of the ripple effect of the recent banking crisis. In the past, such levels preceded recessions, and the expected spike could bring forward the recession and the risk of a deeper downturn.

From a top-down perspective, the outlook for the profit and dividend growth of US real estate investment trusts (REITs) looks grim. Historically, the net percentage of US banks tightening lending standards secured by commercial real estate had a direct impact on the year-on-year dividend growth of the Composite US REITs index. Although in varying degrees, all sub-sectors of US commercial real estate are likely to experience downward pressure on rental income, profits, and dividends.

Property valuations are also likely to come under pressure as rising finance costs, lower rental income and rising vacancy rates bite. As in previous recessions, the delinquency rate on bank loans to commercial real estate (excluding farmland) is likely to soar from the current 0.68%, depending on the depth and duration of the economic downturn. Loan covenant breaches and outright defaults are likely to exert upward pressure on capitalisation rates. (The capitalisation rate is the rate of return on a real estate investment property based on the income that the property is expected to generate – Investopedia.)

REITs are not recession-proof investments.

US residential and office markets are under pressure

The US residential market is already under pressure. According to the recent Redfin Report, the median asking rent in March this year fell to the lowest level in 13 months, inter alia because of rising unemployment, recession fears and rising vacancies due to the supply glut resulting from the pandemic homebuilding boom. Home prices had the biggest annual drop in over a decade by falling more than 3.3% in March year-over-year, while the number of homes sold fell by more than 20%.

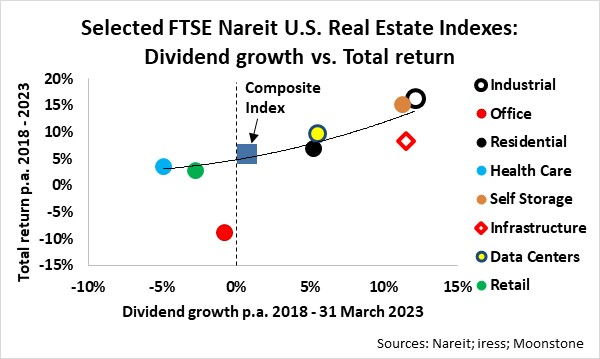

The US office market remains under immense pressure, particularly since the start of the pandemic. According to industry sources, the US CBD office market vacancy rate accelerated to 20% in 2022 from pre-pandemic levels of 12%. The FTSE Nareit US Office Index recorded negative dividend growth over the past five years, and its de-rating resulted in a negative total return (capital income plus dividend reinvested) of 8.8%.

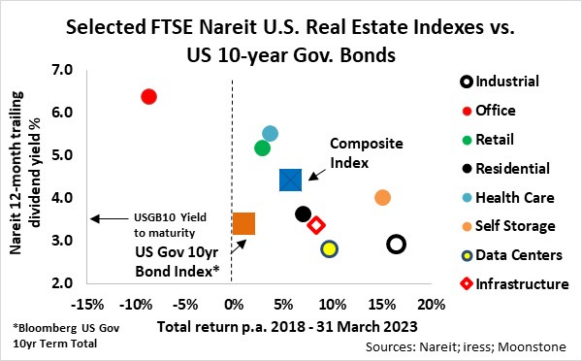

My analysis indicates that, in the past, the office, retail and healthcare sub-sectors were the most vulnerable to credit crunches (when banks increasingly upped their lending standards). The said sub-sectors were also the worst-performing sub-sectors based on dividend growth and total return over five years to March this year.

Even stalwart sub-sectors such as industrial that recorded positive year-on-year dividend growth each quarter over the past 10 years are likely to see growth slowing to 10% and lower.

In my opinion, dividend growth of the Composite US REITs Index could slow to near 0% or below over the next 12 months.

Many commentators will suggest that the 27.5% drawdown in the FTSE Nareit Composite US Real Estate Index since December 2021 fully compensates for the rise in US interest rates, as well as the weakening outlook for dividend growth and commercial real estate in general.

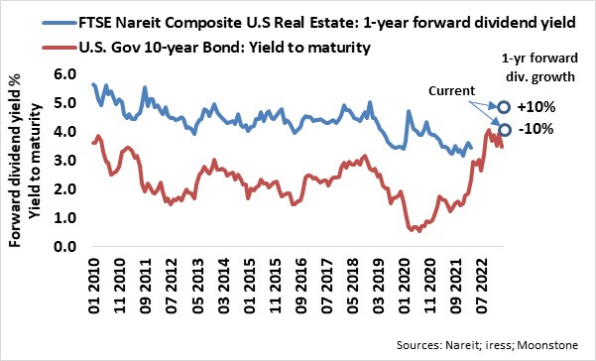

REITs tend to behave like interest-bearing bonds, mainly as a result of the valuation of properties where the capitalisation rates used in the valuation of properties are directly or indirectly linked to long-term bond rates. The gap between the one-year forward dividend yield of the FTSE Nareit Composite US Real Estate Index and the yield to maturity of the US 10-year government bond index gives me an indication of the risk of investing in REITs compared to bonds.

The average forward yield gap since end-2009 was 2.2% and 1.6% since 1987. Before the US Real Estate Index bubble burst in March last year, the gap closed to 1%, matching the lowest level since April 2011. If I assume unchanged dividend growth of 10% over the next year, current levels of the FTSE Nareit Composite US Real Estate Index and the US 10-year government bond yield suggest a forward yield gap of about 1.4% – a significant premium compared to the averages since end-2009 and 1987 respectively. Therefore, the FTSE Nareit Composite US Real Estate Index is not trading at bargain levels and is, at best, priced to perfection.

It is even worse if dividend growth of the Composite US REITs Index slows to near 0% over the next 12 months. It will mean that the forward yield gap will narrow to about 1%, matching the lows of April 2011 and March 2022. Granted, some sub-sectors, such as data centres and self-storage, may prove to be resilient. More economic cyclical sub-sectors are very vulnerable to the credit crunch and imminent recession.

The current forward yield gap is nowhere near the bargain levels of 2.8% plus in 2010, 2011/12, 2015 and 2020. The widening of the gap could be a result of bond yields declining or a sell-off in REITs. REITs are highly geared to changes in bond yields. A 100-basis point (1%) change in the 10-year bond index yield results in a change of approximately 6% in the clean price of the bond, while a 100-basis point (1%) change in the yield of real estate will result in 10% change in the capital value (price) of real estate.

REITs outside the US will not escape the negative market sentiment towards US REITs, as it will rub off on REITs globally and specifically on global REITs indexes, as US REITs comprise more than 70% of some of the indexes. From a risk/return point of view, I prefer longer-term bonds above REITs at current yield levels.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The views in this article do not constitute financial advice.

Skitterende stuk werk

Baie dankie, Nic.