The Association for Savings and Investment South Africa (Asisa) has expressed its concern about the high number of policy lapses and surrenders in the first half of this year.

Close to 5 million new recurring-premium risk policies (life, funeral, credit life, disability, severe illness, and income protection policies) were sold between January and June 2023. At the same time, 4.3 million risk policies were lapsed, according to Asisa’s statistics for the first six months of 2023.

A lapse occurs when the policyholder stops paying premiums for a risk policy with no accumulated fund value. A surrender occurs when the policyholder stops paying premiums and withdraws the fund value before maturity.

The lapse rate is concerning because 4.3 million policyholders and their beneficiaries are now either without risk cover or have reduced cover, said Gareth Friedlander, a member of Asisa’s Life and Risk Board Committee.

He said the high lapse rate was a result of the severe financial strain facing many consumers on the back of rising interest rates and the higher cost of living.

Friedlander said surrenders of recurring savings policies (endowments and retirement annuities) exceeded the sales of these policies in the first half of 2023. While 284 647 policies were sold, 313 318 were surrendered. This was unsurprising because consumers are more likely to surrender their savings policies during tough times to cope with financial hardship.

At the end of June 2023, there were 34.2 million recurring-premium risk policies in force and 203 578 single-premium risk policies. Recurring-premium savings policies amounted to 5.3 million, and there were 2.4 million single-premium savings policies.

Discuss the options with a financial adviser

Without the buffer provided by risk cover, death or disability can plunge a household already struggling financially into complete ruin. Friedlander urged consumers to consider all other options before giving up their risk cover.

“The Covid pandemic highlighted the importance of having risk cover in place like few other events in the history of South Africa. Many life insurers paid a record number of claims, and while these payouts cannot replace loved ones, they can prevent further trauma caused by the financial impact of the loss of a breadwinner.”

According to Asisa’s 2022 Life and Disability Insurance Gap Study, the average income-earner had a life insurance shortfall of at least R1 million and a disability cover gap of about R1.4m at the end of 2021.

The study, conducted every three years, shows that South Africa’s 14.3 million income-earners had life and disability insurance to cover only 45% of the total insurance needs of their households. The average household supported by at least one income-earner would, therefore, be forced to cut living expenses if the earner died or became disabled and no other source of income could be found.

Friedlander encouraged policyholders who are struggling to make ends meet to discuss their options with their financial advisers before letting go of their risk cover.

“A financial adviser can help you by taking a holistic view of your financial situation and helping you find sustainable solutions that are not driven by emotions.”

Life insurers remain well capitalised

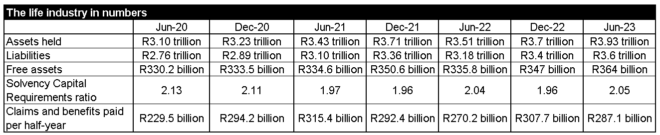

Asisa’s statistics show that beneficiaries and policyholders received R287.1 billion in claims and benefits from life insurers in the first half of 2023.

Despite the significant pay-outs, life insurers remain well capitalised and in a solid position to honour the long-term contractual promises made to customers.

Friedlander said the life insurance industry held assets of R3.93 trillion at the end of June 2023, while liabilities amounted to R3.6 trillion. This left the industry with free assets of R364bn, more than double the reserve buffer required by the Solvency Capital Requirements.

Healthy reserves are a critical indicator of the health of the long-term insurance industry, providing policyholders with the peace of mind that claims and policy benefits can be paid even in times of extreme market turmoil or unusually high claims.

“Life insurers displayed significant resilience over the past three years in an unprecedented operating environment marked by the effects of a global pandemic, a struggling economy and consumers under severe financial pressure,” Friedlander said.

The assets held by South African life insurers have shown steady growth over the past three years, from R3.10 trillion at the end of June 2020 to R3.93 trillion at the end of June 2023.