The FAIS Ombud did not issue any determinations in its 2022/23 financial year, with disputes between financial services providers (FSPs) and their customers resolved by interaction and discussion with the parties.

The Ombud, Advocate John Simpson (pictured), expressed his appreciation to FSPs for their “commendable” co-operation in resolving the disputes.

“The Office’s aim is to resolve disputes in the most expedient and conciliatory way possible, as this approach benefits both consumers and the FSPs. Determinations are regarded as a last-resort option, which should only be used if all other efforts to resolve the matter have failed,” Simpson wrote in his first annual report since his appointment as Ombud in November 2022.

Simpson told Moonstone that he aims to avoid issuing determinations because they can lead to appeals to the Financial Services Tribunal or the courts that can drag on for years before a matter is resolved. Litigation is also expensive.

Although a settlement, as opposed to a determination, may result in a complainant receiving less compensation than he or she had hoped, the complaint was resolved expeditiously.

Simpson added that his role is not to be a consumer advocate but an independent ombud who facilitates the resolution of disputes.

Simpson stated in his report that the past financial year had been “challenging” because “many issues within the Office required urgent attention. Numerous key staff vacancies made it especially difficult for the Office to deliver on its mandate. Progress was made in filling the deputy ombud position, which has been vacant for many years, and the human resources manager and assistant ombud positions.”

He referred to the Office’s decision to close its files on more than 1 000 property syndication-related complaints opened between 2009 and 2014 without resolving them.

Read: Why the FAIS Ombud is closing its files on property syndication complaints

After summarising his previously disclosed reasons for closing the files, he wrote: “The Office is in the process of withdrawing from the various property syndicate-related High Court litigation matters in which it was involved. The Office sincerely sympathises with the mostly elderly consumers who were affected by the failure of these property syndicate investments, but the ombud process is not appropriate, due to the nature of these disputes.”

Simpson told Moonstone that although his Office has decided to close all these complaints, he is required to send each complainant a letter in which he summarises the matter, states the Office’s reasons for closing the case, and informs the complainant of his or her right to appeal to the Tribunal.

About 680 files are in the process of being closed.

He said one of the other challenges over the past year was addressing the backlog “a few hundred” non-property syndication complaints that were two to three years old. The Office has closed 95% of these complaints.

Take-outs from the complaint statistics

The overall settlement value for the 2022/23 financial year was R39 133 121, which was 44% lower than the R69 979 324 in 2021/22, when the Office recorded the highest settlement value in its history.

Simpson said the main reason for the reduction seems to be that the Office stopped issuing determinations on property syndication matters. “The property syndicate determination awards were often for large amounts and were reflected as part of the statistics. The amounts would be reflected in our system and our reports but would not necessarily be amended if the determinations were successfully appealed to the Tribunal or ultimately set aside by a court.”

“There has also been a steady increase in funeral policy-related complaints. The amounts recommended are relatively small per case but are, of course, substantial for the individual complainant.”

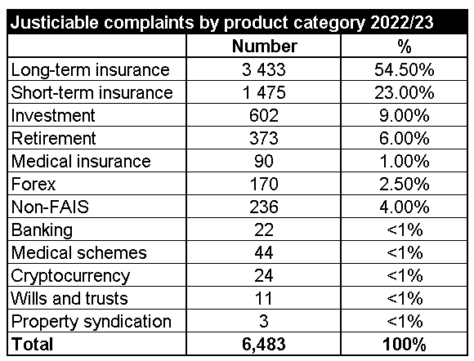

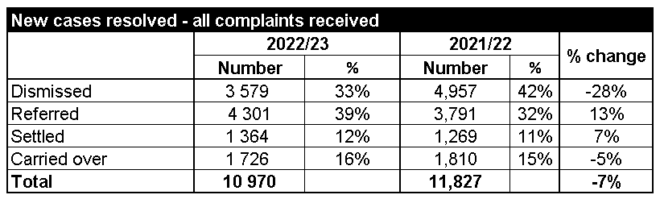

In 2022/23, the Office received 10 970 new complaints, a 7.25% decrease in the number of complaints received in 2021/22. Of the complaints received, 59% fell within the Office’s mandate, which resulted in 6 483 complaints being referred to the Case Management department for investigation.

Simpson told Moonstone the decline in the overall number of complaints represented a return to historical trends following the Covid-19 pandemic.

In 2021/22, the Office received many complaints from financially hard-pressed consumers who wanted to withdraw lump sums from their statutorily fixed investments, such as life annuities. After the pandemic, these complaints reduced, and were largely replaced by complaints relating to funeral policies – disputed and unpaid claims, Simpson said.

“This is a testament to the efforts made and commitment to the conciliatory resolution of complaints by this Office and FSPs alike to ensure that complainants continue to be treated fairly,” the annual report said.

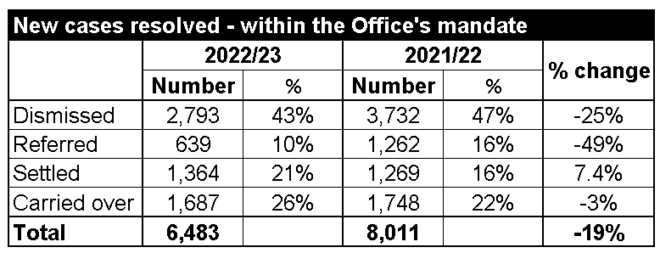

The number of complaints settled, 1 364, increased by 7% compared to 2021/11.

Of the 6 483 new complaints that fell within the Office’s mandate, 4 796, or 74%, were resolved and 1 687 were carried over to the 2023/24 financial year.

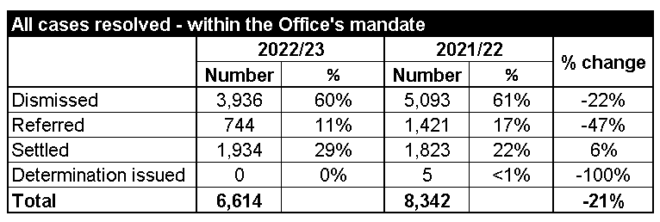

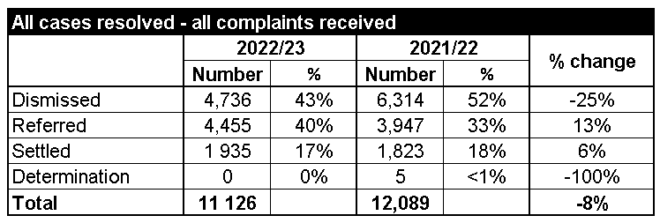

The Office resolved 6 614 complaints that fell within its mandate, including complaints received in 2023 and those carried over from previous financial years. ,# settled in the complainants’ favour increased by 6%. As a result of this, the Office increased its settlement ratio from 27.59% in 2021/22 to 29.24%.

On average, 84.04% of all complaints received by the Office were resolved within three months, 91.05% within six months, and 96.47% within nine months.

Complaint statistics in detail

The Office reports on complaints received and resolved during a financial year in two ways. First, it reports on the resolution of the complaints received within the period – in this case, 1 April 2022 to 31 March 2023 – and then it reports on the overall number of complaints resolved, which includes complaints carried over from previous financial years.

The statistics do not include the “historical” (2009 and 2014) property syndication complaints.

Complaints within the Office’s mandate

The following three tables speak to complaints that fell within the Office’s mandate. In other words, justiciable complaints that were sent to Case Management for further investigation.

The table below records how justiciable complaints received from 1 April 2022 to 31 March 2023 were dealt with.

The table below records how the Office resolved all justiciable complaints – complaints received during the 2022/23 financial year and complaints from previous financial years.

The following table provides a breakdown of justiciable complaints received from 1 April 2022 to 31 March 2023 by product category.

Non-justiciable and justiciable complaints

The following two tables report on all complaints received – complaints dispensed with by the Office’s Client Care Centre (non-justiciable complaints) and complaints referred to Case Management (justiciable complaints).

The table below records how all complaints received from 1 April 2022 to 31 March 2023 and were dealt with.

The table below records how the Office resolved all complaints – complaints received during the 2022/23 financial year and complaints from previous financial years.

Referrals to the Tribunal

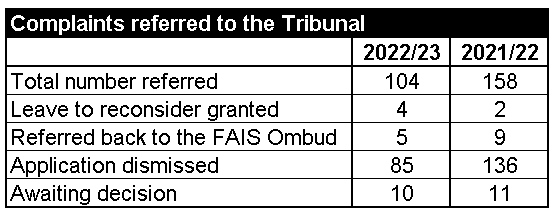

Any party to a complaint that feels aggrieved by the decisions taken by the Office can approach the FST for the matter to be reconsidered.

During the 2022/23 financial year, 104 applications for reconsideration were made to the Tribunal. This was lower than the 158 made during the previous year, which the Office ascribed to improved quality control measures implemented within the Case Management department.

Of the 95 matters decided on as of 31 March 2023, 85 applications were dismissed and five were referred to the Office for further investigation.

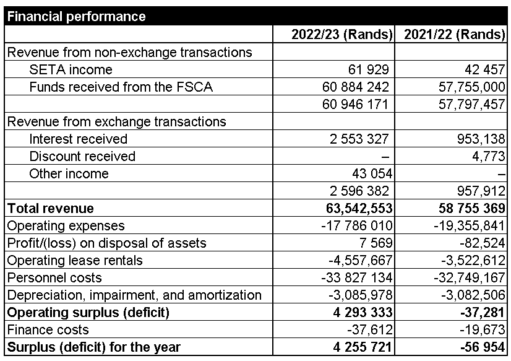

Financial performance

The Office swung from a net deficit of R56 954 in 2021/22 to a surplus of R4.2 million in 2022/23. It received a clean audit opinion from the Auditor General.