The local collective investment schemes (CIS) industry attracted net new investments of R9 billion in the third quarter of 2023, while existing investors reinvested income declarations (dividends and interest) of R30bn. The industry, therefore, concluded the third quarter of 2023 with net quarterly inflows of R39bn, according to the Association for Savings and Investment South Africa (Asisa).

The CIS industry statistics for the quarter and the year to the end of September 2023 show that despite the net inflows, the industry’s assets under management (AUM) dropped marginally to R3.34 trillion from R3.36 trillion at the end of the second quarter 2023.

Sunette Mulder, senior policy adviser at Asisa, said the decline in AUM could be attributed to market volatility in the third quarter, which resulted in a drop of 3.5% in the FTSE/JSE All Share Index.

Mulder pointed out, however, that over the 12 months to 30 September 2023, AUM grew by 11% from R3.01 trillion at the end of the third quarter of 2022.

At the end of September 2023, half of the AUM in local portfolios were invested in South African multi-asset portfolios and 31% in South African interest-bearing portfolios. South African equity portfolios held 18% of assets, and South African real estate portfolios only 1%.

South African investors had a choice of 1 824 local CIS portfolios at the end of September 2023, an increase of 19 portfolios from the second quarter of this year.

SA multi-asset portfolios attracted R60.5bn in net inflows (including reinvestments) over the 12 months to the end of September 2023, the second highest year-on-year since September 2016.

The most popular multi-asset categories were income portfolios, with net inflows of R29.7bn in the 12 months to the end of September 2023, and high-equity portfolios, with net inflows of R20.4bn.

Mulder said the SA interest-bearing portfolios (money market, short term, and variable term) were also popular with investors, attracting net inflows of R56.2bn in the third quarter of 2023.

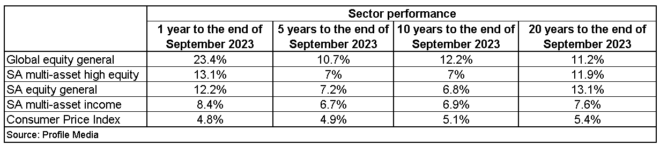

Global equity general portfolios, on average, reported net outflows of R3bn over the 12 months to the end of September 2023 despite outperforming the most popular portfolio categories over the one-year, five-year, and 10-year periods.

But SA equity general portfolios outperformed over 20 years, delivering, on average, 13.1% a year.

Locally registered foreign portfolios held AUM of R765bn at the end of September 2023, compared to R810bn at the end of June 2023. These portfolios recorded net outflows of R7.12bn for the quarter ended September 2023. Following the net outflows of R16.5bn in the second quarter ended June 2023, net outflows for the year totalled R24.6bn.

There are 661 foreign-currency-denominated portfolios on sale in South Africa.