A drop in fuel prices in January, a deceleration in food inflation and an interest rate cut in the second quarter of this year are some of the forecasts made for 2024 in Momentum Investments’ “In the Moment” report.

Prepared by the Momentum Investments Macro Research team, the report’s findings are based on inflation spike reverses in November 2023.

Following three consecutive increases in the headline inflation rate since hitting a recent low of 4.7% y/y in July 2023, Stats SA reported a decline in the Consumer Price Index (CPI) from 5.9% y/y in October to 5.5% y/y in November. This figure was unexpectedly lower than the Reuters median consensus expectation of 5.6% y/y.

According to Momentum Investments, this was largely due to the notable drop in fuel prices.

Drop in fuel prices eases inflationary strain

Momentum’s report shares that transport inflation moderated to 4.3% y/y in November and contributed 0.7 of a percentage point to the headline inflation rate.

“This was lower than 7.4% y/y (1.1 percentage point contribution) in October largely owing to lower fuel prices,” the report says.

Private transport inflation (mostly fuel) decelerated sharply from 10.2% y/y in October to 2.4% y/y in November. On the other hand, public transport inflation rose by 0.8% y/y from negative 0.3% y/y over the same period. As announced by the Central Energy Fund (CEF), the price of petrol (both grades) dropped by R1.78/l in November and diesel (0.05%) dropped by R0.85/l.

The fuel price decreases in turn led to a drop in transport inflation.

“We can expect further moderation in transport inflation during December 2023 and January 2024 on the back of a R2.35/l drop in the price of diesel (0.05%) and a R0.65/l drop in both grades of petrol during December and additional price decreases in January,” the report says.

Stating that early data from the CEF (12 December) suggests a R1.4/l cut in the price of diesel (0.05%) and a R0.78/l cut in the price of petrol (95), the report also adds that the recent rand weakness to an average of R18.89/US$ between 1 and 11 December 2023 could reduce the size of the estimated fuel price cuts in January 2024.

Anticipated slowdown in food inflation for 2024

The South African Reserve Bank (SARB) puts food inflation in 2023 at 10.6%. The estimate for this year, however, comes in significantly lower at 5.5%.

According to the report, the deceleration of food inflation in 2024 will likely be supported by high base effects and easing international food prices.

“There are upside risks to food inflation namely, geopolitical tensions, El Niño and loadshedding. Agricultural Economics Today reports that the likelihood of dry weather conditions has been pushed out from the first quarter of 2024 to the second quarter.

“This, along with good soil moisture in most parts of SA as well as farmers’ intentions to plant more crops than in the previous season as detailed in our November inflation note, is expected to yield good summer crops in the 2023/24 season,” the report reads.

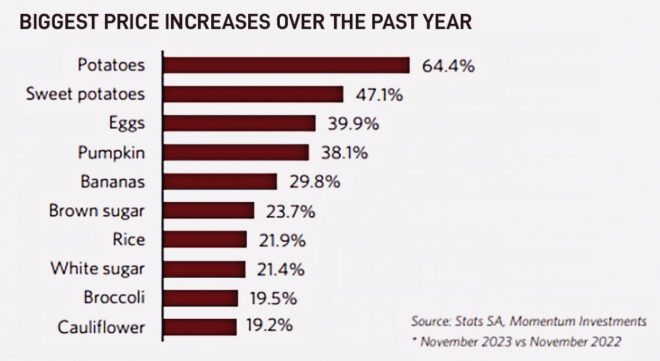

Looking at November’s food inflation (9% y/y), a deceleration is sure to be welcomed by cash-strapped consumers trying to make ends meet in the current fragile economic environment.

The report notes that in November, higher food prices were recorded in five of the nine food categories.

Meat inflation inched higher to 3.5% y/y in November (3.4% y/y in October), milk, eggs and cheese inflation accelerated to 13.9% y/y (12.4% y/y) and fruits inflation rose to 11.5% y/y (8.5% y/y).

These higher food prices, the report states, are reflective of the Avian flu outbreak.

Several poultry farms in South Africa experienced outbreaks of avian influenza last year caused by two different strains: influenza A(H5N1) and influenza A(H7N6).

According to the Department of Agriculture, Land Reform and Rural Development (DALRD), the influenza A(H5N1) outbreaks began in April last year. By October, 10 outbreaks in poultry (Western Cape and KwaZulu-Natal) and 39 outbreaks in non-poultry birds (Western Cape, KwaZulu-Natal, Eastern Cape, Gauteng, Mpumalanga and North West provinces) had been reported.

The influenza A(H7N6) outbreaks started in June 2023. Four months later, the total number of outbreaks reported in poultry farms (Free State, Gauteng, Mpumalanga, Limpopo, North West and KwaZulu-Natal provinces) and nonpoultry birds in Gauteng stood at 50.

Statistics shared by the department in September last year showed that the total reported number of chickens that either died or were culled because of the two strains was 2 680 758.

In November last year, the Minister of Agriculture, Land Reform, and Rural Development Thoko Didiza said that the avian influenza outbreak was finally under control in South Africa and that the replenishment of eggs was underway.

Momentum Investments says that supply constraints are expected to normalise early this year.

“We should consequently see a moderation in egg inflation,” the report says.

Hurry up and wait – interest rate cuts on the cards

Given the positive surprise in the November inflation rate and the anticipated deceleration in December, Momentum Investments expects headline inflation to average 5.9% in 2023 (broadly in line with the SARB’s projection and Reuters median consensus of 5.8%).

“Despite risks to the inflation outlook (weak exchange rate, high international oil prices, geopolitical tension, El Niño and administered prices) we expect inflation to retreat in 2024 to 4.9% (one percentage point lower than the SARB’s estimate) and stabilise at 4.5% in 2025,” the report reads.

Against the backdrop of elevated inflation risks, the report states, it is expected that SARB will keep the repo rate constant at 8.25% in the January 2024 interest rate-setting meeting.

Inflation expectations according to the Bureau for Economic Research’s December survey stood at 6.1% for 2023, 5.7% for 2024 and 5.6% in 2025 (up from 5.5% and 5.3% in the third quarter).

According to Momentum, keeping rates elevated in January and talking tough on inflation will signal to market participants that the SARB is serious about guiding inflation back to the midpoint of the inflation target range, “particularly given the dangers of high inflation to lower-income households”.

“A softening in core inflation signals contained demand inflation and the low likelihood of a wage-price spiral suggests limited second-round effects,” the report adds.

In the absence of these highlighted risks materialising, Momentum Investments predicts that the SARB is likely to reduce its interest rates by 75 basis points by the end of 2024, with the first cut expected in the second quarter. However, the SARB’s own model suggests a less aggressive cut of 50 basis points for the year.

To view the full report, click here.

The huge price increases in foodstuffs since 1 January at certain retailers seems to indicate that they are blissfully unaware of the Momentum report.