“The quest stands upon the edge of a knife.” Considering the geopolitical tensions experienced across the globe at this very moment, this famous line uttered by Galadriel in the blockbuster movie saga Lord of the Rings may well apply to 2024’s economic global outlook.

As Momentum Investments’ Market and Economic Outlook – January 2024, prepared by the Momentum Macro Research Team, points out, elections in 2024 for over half of the world’s population will further contribute to an uncertain geopolitical landscape.

Here at home, the ruling party faces challenges ahead as the country approaches the 2024 SA elections, escalating logistical challenges are affecting rail and port efficiency and dampening growth prospects and SA’s interest burden and social demands remain high, hindering a swift stabilisation in the country’s debt ratio.

Unpacking these issues in Momentum’s most recent Market and Economic Outlook, Sanisha Packirisamy, economist at Momentum Investments, says unforeseen geopolitical events will continue to act as unpredictable variables shaping the political, economic, and financial scenarios in 2024.

Stormier geopolitical waters

Packirisamy says that geopolitical tensions pose additional risks to the global economy, especially when major growth engines are already under strain.

“Investors were already navigating a complex global landscape before the tragic events unfolded in the Middle East. However, the conflict between Hamas and Israel has introduced a new layer of uncertainty for the global economy, particularly if the war escalates into a broader Middle Eastern conflict which could compromise the Strait of Hormuz, through which a fifth of the world’s total oil consumption passes.”

With a significant number of elections scheduled to be held worldwide this year, global political tensions are expected to remain heightened,

The Economist suggests that over half of the global population (76 countries) is set to undergo elections in 2024. The Democracy Index from The Economist Intelligence Unit anticipates that, out of the 71 countries it covers, only 43 will witness entirely free and fair voting processes.

As per Bloomberg, 40 of the 76 countries holding elections have a national scope, accounting for 41% of the world’s population and 42% of GDP.

Packirisamy says, the risk of China pursuing Taiwanese unification, the US election outcome, and the situation in Ukraine and Russia are particularly noteworthy.

“Despite the need to focus on slower domestic growth, we still believe the risk of China pursuing the unification of Taiwan more strongly is higher in the next five years than it has been in the last decade, given the increase in Chinese military movements around Taiwan,” she says.

Read: Taiwan – a country preparing for a possible war

This year, US voters will face a closely contested presidential election, with Democratic incumbent Joe Biden experiencing a decline in popularity to below 40% in early December, as indicated by an average of polls collected by FiveThirtyEight, an American website that focuses on opinion poll analysis.

The Republican frontrunner and former president Donald Trump has garnered a substantial lead over Biden in several swing states where polls have been conducted, suggesting the potential for a second presidential term for Trump.

“In this scenario, we anticipate an increase in economic nationalism with a rise in trade barriers. The US would likely withdraw from an active role in global affairs, given the diminishing support for such engagement, which has reached its lowest level since 2014,” says Packirisamy.

Additionally, she adds, under a second Trump term, there may be a rollback of regulations, heightened scrutiny on fiscal sustainability, and increased attention to central bank independence.

“Due to the diversion of military resources toward the conflict in Gaza, Ukraine, which relies heavily on military aid from the US and Germany, is likely to experience a reduction in the frequency and scale of military assistance packages in the foreseeable future.”

SA’s political path ahead

In recent months, the political landscape in SA has seen a decline in voter participation and significant gains for fringe political entities at both extremes. Packirisamy says this may be indicative of SA’s evolving democracy or it could signify a more fractured society.

“The ruling African National Congress (ANC) continues with a reduced majority but confronts challenges in the foreseeable future.”

The energy crisis, logistical breakdowns, and insufficient progress in tackling corruption (see chart 1) have seen support for the ANC wane.

Packirisamy says the National Prosecuting Authority’s inability to prosecute influential figures linked to state capture further hampers SA’s chances of being removed from the grey list by 2025.

Read: Prosecution challenges threaten South Africa’s exit from FATF grey list

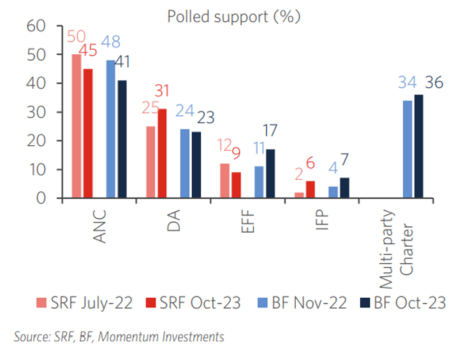

According to data shared in Momentum’s Outlook, opposition to the ANC is gaining traction, with growing support for the opposition alliance, the Multiparty Charter, and the emergence of new political movements leading up to the scheduled national elections in May 2024.

Polls conducted by the Social Research Foundation (SRF) and the Brenthurst Foundation (BF) in October indicate ANC support levels polling significantly below 50%, nationally.

“On a provincial level, the potential for a coalition-led government looms larger, especially in Gauteng and KwaZulu-Natal, which collectively constitute 44% of SA’s population and 49% of GDP,” she says.

Packirisamy says potential scenarios for national election outcomes range from an ANC-led coalition or a marginal ANC majority, suggesting a less stable political environment, to a retained ANC majority with a firmer mandate.

“In the latter case, a more stable policy environment could emerge if the ANC and the incumbent president pursue their agenda assertively,” she says.

Additionally, voter turnout, amid declining global democratic participation, could impact election outcomes. According to the Daily Maverick, increased voter turnouts are likely to benefit the ANC, Economic Freedom Fighters (EFF) and Inkatha Freedom Party (IFP). Conversely, lower voter participation in the national election could favour the main opposition party, the Democratic Alliance (DA) and the Freedom Front Plus.

Chart 1: Support for the ruling party has dropped

SA’s logistical challenges outlast loadshedding

While loadshedding is expected to detract from SA’s economic growth, improvements in Eskom’s generation plan and increased private sector investment in renewable energy suggest a potential easing of the energy crisis, says Packirisamy.

The SARB estimates that loadshedding will detract up to two percent points from gross domestic product (GDP) growth for 2023 based on an expected 250 days of loadshedding, up from a calculated loss of 0.7 percentage points in 2022. Lower anticipated levels of loadshedding could translate into a smaller 0.8 percentage point detraction from GDP growth in 2024, according to the SARB.

“However, logistical challenges, particularly in rail and port inefficiencies, persist. Rail inefficiencies alone are estimated to cost around 5.5% of the GDP in 2023. Despite government initiatives to address logistics issues, including the implementation of the Freight Logistics Roadmap, growth projections for 2024 and 2025 are likely to be constrained to 1% this year and 1.7% next year,” she says.

SA’s debt burden

Momentum’s Outlook foresees worsening fiscal conditions for SA, with last year’s October’s budget forecasts indicating a strain on revenues.

Packirisamy says the ratio of the country’s government debt relative to GDP has risen significantly since 2008, presenting challenges for fiscal sustainability.

“SA’s interest burden has surged, with warnings from the International Monetary Fund (IMF) that it could reach 27% of fiscal revenues by 2028. Balancing spending reductions, tax increases and managing state-owned entity challenges will be critical for fiscal consolidation.”

She adds that although the government proposed to plug the financing gap in the current fiscal year without raising government bond issuance by much, pressure on SA’s local bond market will likely escalate in the coming quarters as SA’s redemption profile ramps up.

Central bank caution likely to prevail

As these challenges take their toll, South Africans are desperately holding out for interest rate cuts this year.

Packirisamy says major central banks pressed pause in late 2023, cautioning against premature celebrations and expressing readiness to counteract any resurgent disinflation threats.

“Despite keeping SA interest rates stable at 8.25% (repo rate) at the last three monetary policy meetings, following 11 hikes since November 2021, the SARB remains vigilant.”

She says while there has been a positive shift in inflation drivers, concerns linger about the impact of loadshedding and drier El Niño weather conditions on food prices, especially affecting lower-income households.

Read: Impending climate phenomena could derail next year’s prospect of lower interest rates

Packirisamy states that the SARB is expected to uphold a hawkish stance, emphasising the need for a gradual return to the inflation target midpoint to mitigate economic costs and facilitate future interest rate reductions.

“We expect the SARB to remain on hold at 8.25%, with the first interest rate cut of 25 basis points projected for the second quarter of 2024. We have pencilled in three interest rate cuts of 25 basis points each for 2024, which is more than the 50 basis points easing suggested by SARB’s Quarterly Projection model for the same period,” she says.

Read the full Outlook here.