“Rocketing” medical specialists’ fees are causing a rapid increase in the average values of gap insurance claims.

Martin Rimmer, the chief executive of Sirago Underwriting Managers, says a recent analysis of gap insurance claims paid by Sirago in 2023 highlights the financially devastating nature of the shortfalls for in-hospital treatment.

“And secondly, how specialist fees have rocketed in the absence of any price regulation in healthcare provisioning, meaning providers charge any rate they wish, often many more times the medical scheme rates,” says Rimmer.

Gap insurance covers the difference that arises from the rates charged by healthcare specialists for in-hospital procedures versus what a medical scheme pays. Policyholders who do not have gap insurance must pay the difference out of their own pockets.

Of the thousands of gap cover claims processed in 2023, Sirago paid more than 100 mega claims – internally classified as upwards of R40 000 per claim – in shortfalls not covered by medical scheme benefits.

The total cost of gap insurance claims paid between January and November 2023 by Sirago was more than R106 million.

Rimmer says that average gap-claim values continue to rise exponentially, and mega gap claims are increasing in frequency, with massive shortfalls ranging between R50 000 and R191 000 (the regulated overall annual limit for 2023 per beneficiary per annum that gap insurers cover) for in-hospital treatments not paid by medical schemes.

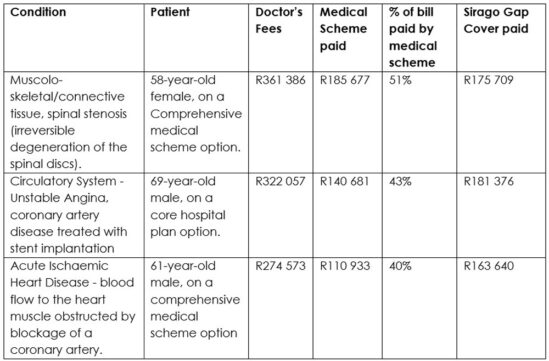

The three biggest gap insurance claims Sirago paid in 2023

Rimmers says an analysis of three massive gap insurance claims – amounting to R440 000 – are indicative of the erosion of medical scheme benefits and out-of-control specialist fees.

Here is a breakdown of the three biggest gap insurance claims paid by Sirago during 2023:

He says of the R958 000 in specialist charges for these three claims alone, medical schemes paid out 46% of the total specialist bills, while gap cover stepped in to pick up the 54% shortfall.

“The standout for anyone analysing these stats is that being on a comprehensive medical scheme option is no guarantee that your bills for in-hospital treatment will be paid for in full by your medical scheme.”

In these three case studies, two members were on the top-end comprehensive medical scheme options, but less than half of the bills from their specialists were paid by the medical scheme.

Rimmer says Sirago is seeing more frequently that gap cover is paying more than what the medical schemes are paying to doctors for in-hospital treatment.

“It’s a perverse situation where specialist doctor and hospital fees are now running at levels that are many times more than the rate at which medical schemes reimburse.

“The reality is that even if you’re on a medical scheme benefit option that pays at 200% of tariff, it may very well not be enough given that health care providers are free to charge whatever they want in the absence of any pricing regulation,” he adds.

The main drivers behind escalating costs in private healthcare

According to Rimmer, high demand for scarce specialist services, emigration, and insufficient medical graduates are the main factors contributing to the spiralling cost of private health care.

He says “gaming” of the system by unscrupulous healthcare providers is also a contributing factor, “but one that medical schemes are clamping down heavily on, investigating and prosecuting”.

“In the absence of any legislative overhaul to better protect users and funders (medical schemes) and balance this against proper price regulation for service providers, consumers are left between a rock and a hard place, as any alternatives in the public healthcare space all but collapse,” he says.

To manage the massive increase and risks related to healthcare costs, Rimmer says medical schemes are left without many alternatives, other than to continue to remove, reduce, or limit benefits related to certain procedures, leaving this burden on members and gap cover providers.

“The erosion of medical scheme benefits is very real and accelerating, with many of the drivers entirely outside of the control of healthcare funders and their members,” he says.

Rimmer says that when gap cover was introduced as a financial solution to medical scheme shortfalls, gap claims averaged between R6 000 and R12 000. In the past three years or so, large claims of R50 000 plus are almost a daily occurrence.

“Consider at an average of just over R50 000 per mega claim and measured against an average premium of R498 per month per policy on an individual basis, or R566 per month for a family (Sirago Ultimate Gap, 2023 rates), it means policyholders have claimed approximately eight years’ worth of premiums paid or still to be collected.”

Rimmer says this demonstrates the crucial role that gap insurance plays in healthcare financial planning, protecting consumers from large and unexpected costs that they would have to self-fund if they did not have gap cover.

“Very few people, if any, have that sort of money available unless they go into serious debt,” he says.

Protect yourself from unexpected costs and unethical practices

Sirago provides the following advice to consumers to protect themselves when it comes to unexpected costs and unethical billing practices:

- Always negotiate the pricing of any planned surgery with healthcare providers before and ask for a formal quote from all the medical roleplayers, from the surgeon to the anaesthetist. That way there are no surprises or unexpected costs creeping in after the fact, unless there were specific complications during the procedure.

- Your gap cover should be of no interest to your doctor. Be wary of doctors asking you upfront whether you have gap cover. Overbilling based on a client’s insurance portfolio is a growing practice by some unscrupulous medical specialists looking to capitalise on the patient’s insurance cover by overcharging, and in some of the worst cases, scheduling unnecessary procedures, knowing that the patient has the insurance to cover the inflated price. You are not obliged to tell your specialist that you have gap cover, and it should be of no consequence whatsoever to your doctor whether you have gap cover.

The bottom line, says Rimmer, is that gap cover is a critical part of an individual’s health care-funding strategy, and medical scheme membership, whether on a comprehensive or a core benefit, is not sufficient.