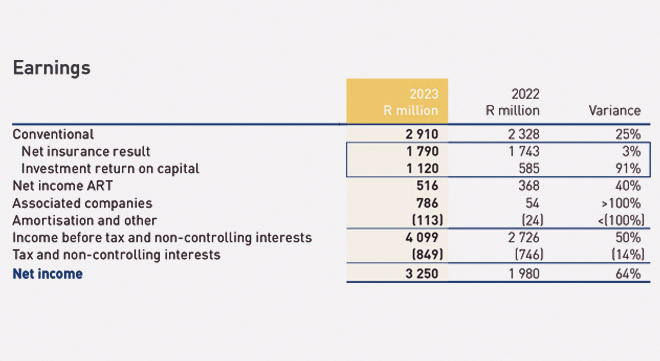

Despite a 26% decline in underwriting profit and paying out R29.9 billion in claims in 2023, along with risk management actions that had a negative impact of R579 million, Santam achieve net income of R3.25bn for the year, marking a significant 64% increase from the R1.98bn earned in 2022.

Santam’s overall “resilient performance” for the 2023 financial year, as set out in its audited annual financial statements released last week, is an impressive feat considering the challenging operating conditions faced by the insurance industry in the past few years: Covid-19, persistent weak economic growth, the 2021 KwaZulu-Natal riots, and the 2022 KZN floods.

According to Santam, its strong performance was the combination of 33% growth in operating earnings to R443m (2022: R332m) and 103% growth in investment returns to R73m (2022: R36m).

South Africa’s largest general insurer added that the resilient earnings performance was further supported by the Santam Partner Solutions’ Alternative Risk Transfer (ART) businesses, which reported strong results of R516m (2022: R368m).

Investment return on capital increased from R585m in 2022 to R1.1bn in 2023, and headline earning per share increased to 2 310c (2022: 1 817c), a 27% surge.

New operating model

Santam said it faced several challenges in 2022 that placed pressure on its growth prospects and underwriting results. “We recognised that most of these conditions would persist into 2023, which eventually turned out even more challenging than we anticipated.”.

To navigate this challenging environment, Santam said it introduced a number of strategic and operational interventions, including the launch of FutureFit2030, a “’refreshed strategy” that included the launch of a multi-channel operating model targeting particular client segments.

The new operating model went live on 1 January last year. The Commercial and Personal multi-channel business was restructured into three business units: Client Solutions, Broker Solutions, and Partner Solutions.

Client Solutions is the Santam-branded direct-to-client business that offers products through a multi-channel distribution channel. Broker Solutions covers various classes of general insurance.

Partnership Solutions is a new business unit focused on building partnerships across retailers, mobile network operators, and banks.

The group’s other client-facing businesses – MiWay, Specialist Solutions, and Santam Re – remained part of conventional insurance (for segmental reporting purposes).

MiWay is a direct general insurer that underwrites predominantly personal lines general insurance business through direct selling. It also underwrites commercial lines insurance.

Santam Specialist insures large and complex risks in niche market segments. Products are client-driven and supported by specialist underwriting and claims assessment.

Santam Re is a wholesale reinsurance service provider for the Santam group general insurance businesses and independent general insurers in Africa, India, the Middle East, Eastern Europe, China, South Korea, and Southeast Asia.

All these subsidiaries are listed under “Conventional insurance” in Santam’s business portfolio.

Underwriting actions

In addition to restructuring, interventions included the implementation of several underwriting actions – such as enhanced risk assessments, segmented premium increases, changes to excess amounts, and increased security requirements for high-risk vehicles.

Santam said this led to a turnaround in the profitability of the motor book (claims inflation and high-value vehicle theft successfully managed) and the mitigation of power surge losses.

Read: Claims reflect surge in theft and hijackings of high-value vehicles

Read: Santam introduces power surge excesses and exclusions as claims jump

Decline in underwriting profit

According to Santam’s 2023 financial statements, its underwriting profit declined by 26% at a margin of 3.5% for 2023 compared to 5.1% in 2022.

The insurer said several “large items” impacted the comparability of the results.

By business unit, Broker Solutions and Client Solutions were most significantly impacted by the weather-related losses in the first quarter of 2023, flooding in the Western Cape, and the increase in the frequency and severity of fire claims.

In addition, Santam Re’s performance was severely impacted by exposure (R150m) to the earthquakes in Türkiye in February last year.

In the property class of business, losses, predominantly related to fire claims, amounted to R422m in 2023 compared to R388m in 2022.

Santam increased property rates as part of the management actions to date.

“However, the weather and fire-related claims experience in 2023 indicate that premiums, risk mitigation, and surveying are not yet appropriate due to continued poor experience in this class of business,” it said.

Santam said this will be a particular area of focus in 2024.

“We remain focused on the implementation of underwriting actions in response to the increase in frequency and severity of natural and fire-related losses. These include segmented premium and excess increases, more stringent limits on concentration risk, enhanced surveying, utilisation of reinsurance and coinsurance, and accelerated roll-out of the geocoding initiative.”

Santam’s geocoding initiative creates a comprehensive risk-based view of property locations in South Africa. To date, geocoding covers about 86% of Santam’s core property book.

“We have seen the benefits with several losses avoided during the Western Cape floods through risk-mitigating actions we took in response to the geocoding initiative.”

You win some, you lose some

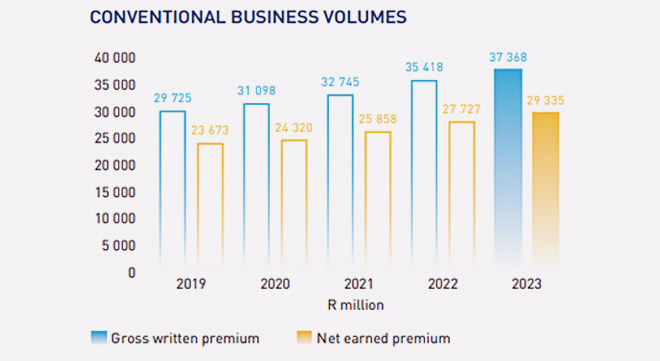

Gross written premium (GWP) and net earned premium (NEP) are two key performance measures used to track an insurer’s overall viability.

Risk management actions in 2023 had a negative impact of R579m on the growth in Santam’s NEP. These actions included pruning underperforming business at Santam Re and Broker Solutions, limiting concentration risk in selected portfolios and the non-renewal of business at Emerald “that were inappropriately priced by the market”.

Emerald, a provider of corporate property and associated engineering insurance products, is a wholly owned subsidiary of the Santam group.

Excluding the impact of these actions, Santam’s NEP grew by 8% while GWP increased by 5.5%.

Santam said the risk management actions aligned with its strategic focus on enhancing shareholder value through profitable growth. “We are prepared to lose premium volumes if we believe the business is unlikely to meet our return hurdles.”

The big earners

MiWay and the newly acquired MTN partnership stood out as the stars of the financial year.

The numbers showed that MiWay’s monthly growth almost doubled towards the end of the year compared to the first-half 2023 results, ending at an increase of 5% for the full year. MiWay recorded a loss ratio of 59% (2022: 60%) and an underwriting profit of R168m (2022: R254m).

Santam said commercial and value-added services continue to perform well, supported by an acceleration in personal lines sales.

“MiWay’s focus on addressing all of the key pressure points, namely rejected debit orders, quote volumes, conversions, and average premiums, are yielding positive results. The new strategic initiatives (tied agency for commercial business and inbound marketing strategy) contributed to the growth.”

The launch of new business through the MTN partnership resulted in a substantial increase in Partner Solutions’ contribution from a low base. A total of 151 339 policies have been sold since the launch in April 2023 “at attractive underwriting margins”.

Santam received Competition Tribunal approval early in 2023 to acquire the MTN device insurance book in South Africa. The transaction is part of the broader strategic alliance between Sanlam and MTN through aYo Holdings Limited, the MTN Group’s insurtech platform.

“Initial sales volumes are very promising. The transfer of the in-force book of business received regulatory approval in December 2023. This part of the transaction is unconditional with an effective transfer date of 1 January 2024,” the insurer said.

This will add 340 000 policies to the Santam licence and an annualised GWP of R390m on the transition date.