Are dark clouds gathering on the horizon for the Magnificent Seven stocks?

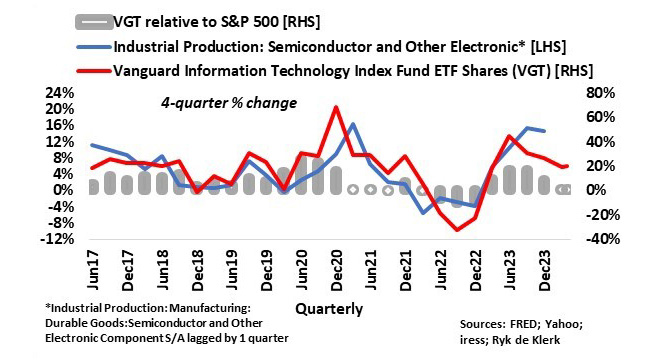

The Vanguard Information Technology Index Fund ETF (VGT), which tracks the return of stocks in the United States information technology sector, at Wednesday’s close fell by 7% from its all-time high in March this year. That followed a surge of more than 78% from its low in October 2022, driven by a 16% year-on-year growth in the production of semiconductors and other electronic components in the US by the end of the fourth quarter of last year. The VGT is, however, still up by about 4% for the year to date.

The index’s performance masks the divergent performance of individual stocks, specifically the Magnificent Seven. Since the VGT’s March highs, Nvidia is down by about 12%, Meta Platforms -14%; Microsoft -8%; Apple -2%; Amazon unchanged. Tesla and Alphabet (Class C) are up by 5% and 9% respectively.

For the year to date, some of the Magnificent Seven’s performances are still outstanding despite the recent drawdowns: Nvidia is up by a massive 72%, Meta by 27%, Amazon and Alphabet by 19%, and Microsoft by 7%. Tesla (-28%) and Apple (-9%) went the other way.

The broader US market excluding the IT sector has started to outperform the IT sector. Since the VGT peaked in March, the ProShares S&P 500 ex-Technology ETF (SPXT) declined by about 2% and matches VGT’s return for the year to date.

It is apparent that IT stocks as measured by the VGT price started to lose momentum (year-on-year) since the third quarter of last year, and because they tend to lead the sector’s production by between one and two quarters, this does not auger well for company profits and earnings in the sector in coming quarters. The VGT’s performance relative to the broader stock market (S&P 500) is losing momentum, with the VGT’s growth over the past 12 months currently on par with the broader market.

The relative weakness of information and communications technology compared to other industries is not limited to the US. The latest S&P Global Sector Purchasing Managers’ Index (PMI) data indicated that in respect to output, Technology is ranked fifth after Financials, Consumer Services, Industrials and Consumer Goods. Telecommunication Services are ranked the lowest on the Output Index but are still in expansion territory.

It seems the outperformance of the US IT sector relative to the rest of the S&P 500 Index has ended, and the sector’s performance is likely to match that of the market in coming quarters. It is, however, likely that there will be losers and winners among the Magnificent Seven.

But whereto from here?

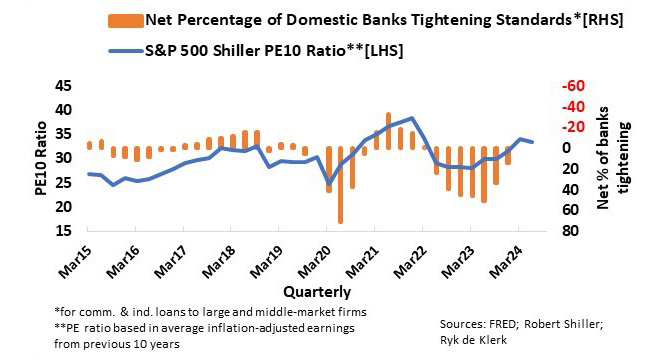

It is evident that the re-rating of the S&P 500 Index (broader market) in terms of Robert Shiller’s PE10 (price-to-earnings ratio is based on average inflation-adjusted earnings from the previous 10 years) since the second quarter of last year was driven by easier money as measured by the net percentage of US banks tightening their lending standards for commercial and industrial loans to large and middle-market firms, according to the Federal Reserve’s quarterly Senior Loan Officer Survey (SLOS).

The soon-to-be released SLOS will probably indicate that US banks are not tightening the said lending standards and will therefore underscore the rating of the S&P 500 Index, as well as the ratings of other developed market equities.

The way forward for the US and developed equity markets is, however, highly dependent on how the Fed and other central banks act in the coming quarters. CPI inflation in the US is stickier than anticipated, but according to S&P Global, their recent PMI survey pointed to the US economic upturn losing momentum in the second quarter because of lower demand and a cooling labour market.

It is evident that the broader US equity market is significantly undervalued compared to December 2020 – December 2021 and priced in line with 2018. Based on Federal Reserve chairperson Jerome Powell’s comments last week, it is evident that US monetary policy is skewed towards easing and therefore the banks are more likely to be more lenient in their lending policies and standards.

A bumpy road lies ahead, though, as imponderables are lurking.

Geopolitical risks remain high. The Ukraine/Russia war continues, while the Israel/Hamas war is threatening to become a wider conflict, which would not only dampen demand but also threaten supply chains. In addition, about 60% of the world’s population faces major elections in 2024, and policy changes may have a major impact on asset class returns and therefore investor preferences.

The easy leg of the equity bull market is something of the past. The second and final leg tends to be more volatile than the first, and this time around will probably be no different. I continue to remain an equity bull but selectively so and keeping within my risk budget. Yes, I buy the dips and sell the excesses, such as opportunities arising from divergent performance in the US IT sector, specifically among the Magnificent Seven.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.