The threat that inflation poses to investors’ real wealth and purchasing power is growing because inflation is expected to be structurally higher over the next few decades than it was in the first decades of this century.

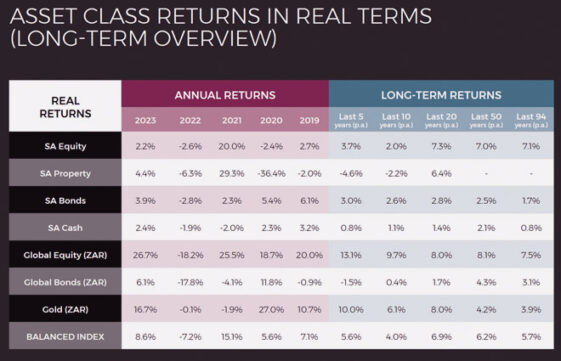

This is according to Old Mutual Investment Group (OMIG), which last month launched the 2024 issue of Long-term Perspectives. The publication, an annual study based on 94 years of data, looks at the returns from various asset classes and changes in inflation over this period to draw insights and derive investment lessons that are considered in the company’s investment process and made available to financial advisers and planners.

The key takeaway is that investors need to plan carefully and ensure they are investing in assets that can deliver inflation-beating returns in the long run.

OMIG portfolio manager Graham Tucker said that in an environment of structurally higher inflation, interest rates are likely to be higher than they have been in the past two decades as central banks focus on bringing inflation under control. He cited demographics, deglobalisation, and decarbonisation as three broad, long-term themes that will drive inflation higher over the coming decades.

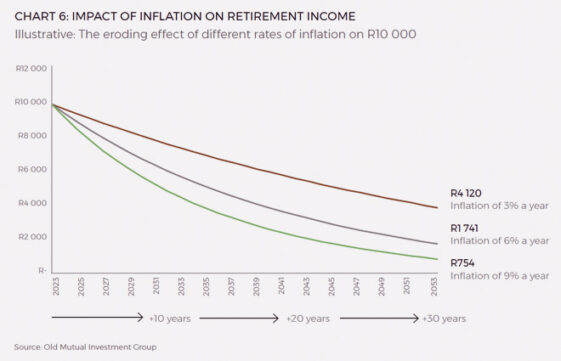

Tucker emphasised the material impact inflation has on investors and savers: “In a higher-inflation world, your wealth is being eroded faster every year.”

Long-term Perspectives contains some stark illustrations of the erosive impact of inflation on a “cash under the mattress” savings strategy over 30 years. At the South African Reserve Bank’s lower inflation target of just 3%, R10 000 at the start of 2024 will buy R4 000 worth of goods in 2054; and at the higher inflation target level of 6%, one would be able to purchase less than R2 000 worth of goods 30 years from today.

Although equities have delivered strong inflation-beating returns in the long run, being invested in the right equities has been a crucial decision for investors over the past decade, with global equities outperforming South African equities by a significant margin.

“The variation in returns from different asset classes and different regions creates an opportunity to add value through active asset allocation decisions. This is especially true as some developed market bonds are offering positive real yields for the first time in many years, providing a real alternative to equities,” said Tucker.

One of the best defences in terms of managing the shorter-term risk in the form of volatility is diversification.

“Building a balanced portfolio of assets lets you have a smoother ride, as the negative performance of one asset is counterbalanced by the positive performance of others.”

Investors who take care to diversify their investment portfolios and remain invested through periods of uncertainty typically weather the storm of market downturns better than those who disinvest for fear of suffering short-term losses.

‘Time is your friend’

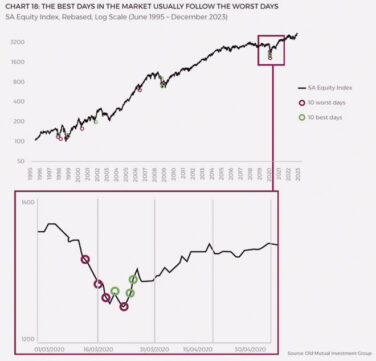

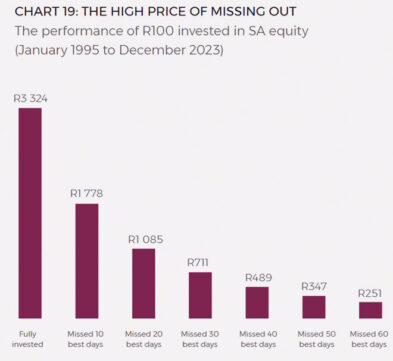

Time in the market, rather than timing the market, emerged as another impactful investment principle highlighted in Long-term Perspectives. There are countless statistics to support the “time is your friend” promise, not least of which are charts included in the publication that compare the returns of investors who remain in equity markets over the long term with those who miss out on the best return days.

OMIG investment analyst Sehrish Khan said many investors are adopting a wait-and-see approach to the uncertainty posed by the upcoming general election. She said the market reaction could be significant and swift, and even without a strong sense of which way the result could go, missing out on a positive market reaction could adversely impact an investor’s portfolio.

History shows that, particularly during periods of high uncertainty, the worst days on the market are usually followed by the best days on the market. In fact, it is rare that the best days in the equity market occur when the seas are calm.

“If you leave the market during the downturn, not only will you lock in those losses, but you will likely lose out on any potential recovery.”

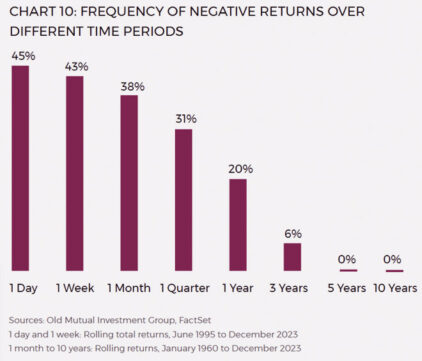

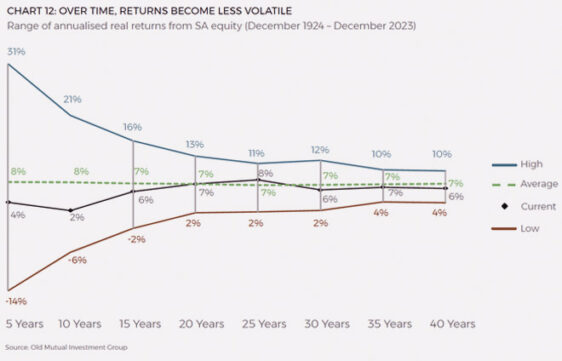

The data compiled in the publication clearly shows the return variances of short-term versus long-term-focused investors.

“Investors are often overcome by the fear of losing money in the short term, which is why they stay on the sidelines or decide to disinvest. But once you extend your investment horizon, that range of outcomes substantially narrows, softening the impact of market volatility,” said Khan.

The high price of missing out

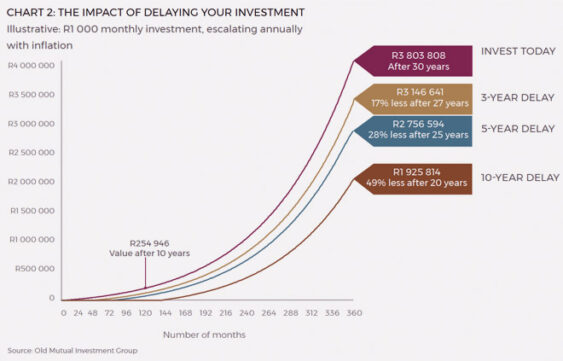

The time in the market effect is demonstrated by considering the impact of a delayed savings plan.

Investors who invest R1 000 a month, earn a real return of 5%, and increase their investment by inflation of 5.5% each year will accumulate R3.8 million in 30 years. If they delay the start date by five years, after 25 years, their portfolio will be worth R2.7m – that is 28% or R1.1m less than an investment started today. And if they delay the start date by 10 years, they will accumulate less than R2m by the same end date.

Investors who have not yet started saving for your financial goals can make up the shortfall. They could increase their monthly contribution or invest additional lump sums when they benefit from substantial salary increases or a bonus.

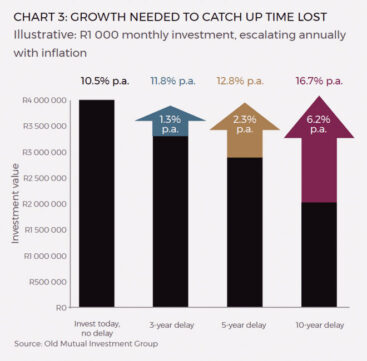

Using the previous example, to catch up after a five-year delay, you could increase your starting contribution by 38% to achieve the same investment value as if you had started saving immediately. If you have delayed your investment journey by a decade, your monthly contributions would need to increase by 98% to overcome the time delay and achieve the same outcome.

With rising financial commitments in your younger years, it may not be easy or possible to sacrifice current earnings for future retirement needs. An alternative way to make up the shortfall is to seek higher-yielding investments. Bear in mind that these higher returns are usually driven by exposure to elevated investment risk.

The chart below shows how, if you delayed saving for 10 years, your required return needs to increase by 6.2% a year (that is, a total return of 16.7% a year) to match the investment growth earned if had you started saving today.

Achieving a return in excess of 16% a year is challenging if you not fully invested in risky assets such as equities − and even then, such returns are never guaranteed.