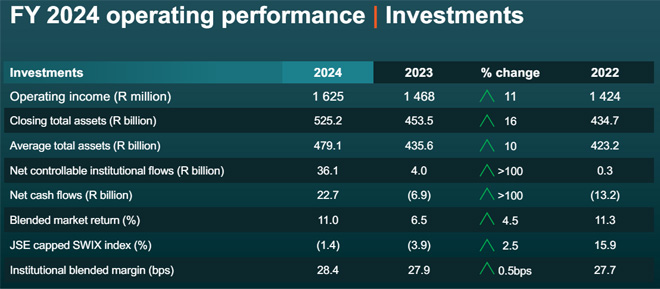

Alexforbes has solidified its position as a major player in the asset management arena, with its annual results for the 12 months to the end of March 2024 showing a 16% year-on-year increase in total closing assets, soaring to R525 billion.

Celebrating its 90th anniversary next year, the financial services company specialises in short-term and long-term insurance, health, retirement, and multi-manager investment solutions. As of 31 March 2024, the closing assets under management of Alexforbes’s flagship portfolio, Performer, surged by 12% year-on-year to reach R232bn.

Total assets include assets under administration and assets under management.

Chief executive Dawie de Villiers attributes the growth in the company’s asset management business to the strategic repositioning of the company’s brand.

“We’ve worked on making it more accessible to individuals out there. A lot of our 1.1 million members in the past didn’t even know that they can retire with Forbes, but that has all changed. Now people want to have their investments with Forbes. It’s a trusted brand with great returns.”

De Villiers adds that Alexforbes achieved net positive flows of nearly R23bn into its asset management business, despite operating in a market that typically experiences natural outflows of around R60bn annually.

“It is good business that we are writing, and it really shows that clients are starting to appreciate us as an investment business and starting to see us as a serious contender in the investment space.”

Explaining the company’s substantial inflows in a challenging market, he credits the success to the trusted Alexforbes brand, the dedication and expertise of its employees, robust research, competitive offerings, and a strong offshore partnership.

He highlights the integrated nature of the business.

“We can talk retirements, investments, health, retail, wholesale – all in the same language with the same people at the coalface, and that makes it a lot easier for clients to do business with us and obviously makes it much easier for investments to prosper.”

Solid financial performance

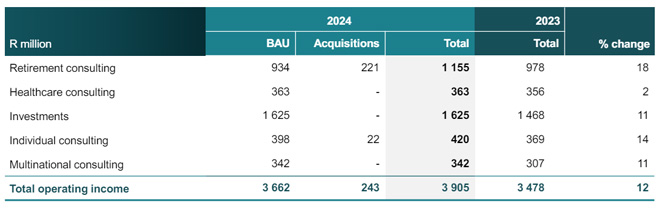

Overall, Alexforbes reported a 12% increase in operating income to R3.905bn for the 12 months to the end of March, with a 2% year-on-year increase in profit from operations (before non-trading and capital items) to R801 million.

The company says the growth in revenue is a result of the deliberate execution of its strategy, new business wins, and the implementation of acquisitions.

“We are pleased with the integration and performance of the six businesses acquired over the past three years, most recently OUTvest and TSA Administration. In the current year, these businesses added R243m to operating income and contributed R67m to profit from operations (before non-trading and capital items), notwithstanding an impairment of goodwill and associated intangible assets relating to EBS International.”

Cash generated from continuing operations stood at R1.073bn.

Headline earnings per share from total operations increased by 29% to 61.5 cents per share.

Operating expenses of R3.183bn increased by 16% year on year, with the cost-to-income ratio coming in at 79.5%.

Alexforbes says the increase in business-as-usual expenses is in line with its plan to invest in capacity.

“The increase in operating expenses also includes the effect of the one-off [IRFS 16] lease adjustment from the prior year, reduced cost recovery from discontinued operations and an increase in expense from acquisitions,” the company states.

All eyes on individual consulting

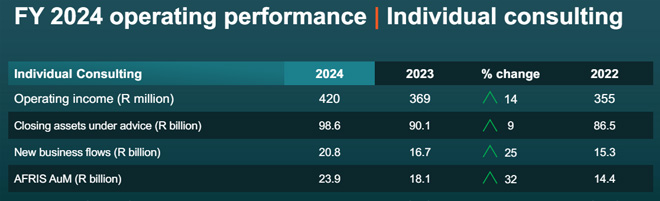

De Villiers shares that individual consulting is the main area of growth that Alexforbes is currently prioritising among its various business lines.

In the past year, the company added 26 advisers, with its total adviser force now standing at 250. The business line saw in-fund asset flows of R3.5bn for the year (up 40% year on year).

According to De Villiers, Alexforbes is engaging with members, streamlining lead processes, and making it easier for members to stay invested with the company upon exiting. He says the goal is to encourage members to purchase annuities, whether within the fund or outside, seek advice, and rely on Alexforbes for assistance.

“This whole ecosystem that we’re building here is starting to work nicely as you can see – 25% of new business year on year, and it is just the start.”

Regarding the impending implementation of the two-pot retirement system, De Villiers mentions that it has a benefit for Alexforbes.

“Two pot forces us to talk to every individual that is in our ecosystem, all of our 1.1 million members that are under administration, plus all the other clients that are potential clients and want help from us. So, we are geared towards talking to them, to advising them and, hopefully, building a trust relationship so that they will save with us into the future,” he says.

Why a special dividend?

De Villiers says the 29% increase in headline earnings per share from total operations has enabled Alexforbes to pay a gross final cash dividend of 30 cents per share, up 11%, distributing a total of R389m to shareholders. This brings the total annual dividend to 50 cents per share, up 19% year on year.

In addition, the board declared a gross special dividend of 60 cents per share, distributing a further R778m in available cash to shareholders and reducing the surplus capital position of the group.

He explains that further to the normal dividend, Alexforbes reduced the risk in the business “by selling some of the insurance businesses, by cleaning up the structure of the businesses, by reducing physical risk so that the regulatory capital that we have to hold behind this business has been reduced”.

He says that further reduction in that capital has allowed the company to pay an extra special dividend of 60 cents “which is around about R800m, which is most of the free cash that we’ve had on the balance sheet”.

But why opt for a special dividend instead of acquisitions?

De Villiers explains that part of the company’s strategy in recent years has been to remain capital-light, aiming “to be able to pay all the cash out or utilise the cash”.

He outlines three options for cash allocation: paying a special dividend, buying back shares, or pursuing acquisitions. Concerning share buybacks, he notes that Alexforbes’s shares are highly liquid, making it impractical to purchase such a large amount on the market.

As to acquisitions, De Villiers states that the company has demonstrated the ability to make acquisitions without significantly tapping into cash reserves.

“We’ve got lots of leverage left on the balance sheet. We are highly cash generative and can use some of the future cash as well.”

He adds that Alexfobes has “very supportive shareholders” that want the company to grow in the South African market.

“So, we are certainly continuing to look at acquisitions and this is by no means an indication of the country,” says De Villiers.

The special dividend is subject to approval by the Financial Surveillance Department of the South African Reserve Bank (SARB). A finalisation announcement confirming receipt of SARB approval will be released on SENS by no later than 9 July 2024.

Both dividends have been declared from income reserves.