Sanlam, Africa’s largest non-bank financial services group, said on Monday it paid out a total of R10.7 billion in claims in 2023.

Of the total amount, Sanlam Risk and Savings paid out R6.06bn, with the balance of R4.64bn from Sanlam Group Risk.

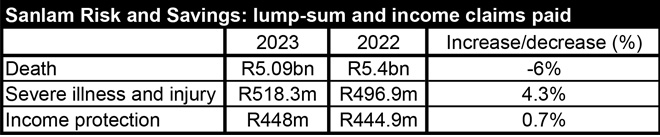

The R6.06bn (21 896 benefits) paid out by Sanlam Risk and Savings was 5% lower than the R6.38bn (23 952 benefits) in 2022, and 23% lower than the R8.3bn (28 322) in 2021. However, these pay-outs were higher than the R4.8bn (19 521) in 2020 and the R4.4bn (17 501) in 2019.

Across all Sanlam benefits, cardiovascular incidents were the biggest cause of claims at 18%, followed by cancer (15%), respiratory illnesses (12%), and accidents, violence, and injury (12%). These four accounted for 57% of all claims paid.

Dr Marion Morkel, Sanlam’s chief medical officer, said the rise in cardiovascular incidents over the past two decades is clearly linked to lifestyle diseases and was magnified by the extra mortality burden of the Covid-19 pandemic.

“We continue to fail to address the key causes of diseases of lifestyle, so, sadly, we’re likely to see cardiovascular incidents exponentially increase in the future. Obesity remains a major challenge in our country, with Type II diabetes linked to this.”

Cardiovascular severe illness claims are accelerating trend among men but remained relatively constant among women. The Heart and Stroke Foundation of South Africa says one in three men will have a cardiac event before they die; for women, this is one in four. Younger women have marginal protection because of their hormones, which decreases when they reach menopause.

Men also experienced an increasing trend of severe illness claims for cancer, primarily for prostate cancer, which is highly treatable with an early diagnosis, and for melanomas.

Prevalence of risk incidents among younger clients

Sanlam said a notable trend in the 2023 claim statistics is the prevalence of claims among younger clients, particularly in the areas of sickness and income protection.

Sixty-two percent of disability claims came from people younger than 55, in their prime working years. This figure was higher among women, at 70%.

Two-thirds of sickness and disability income claims came from individuals younger than 45. Additionally, more than half of all severe illness claims (57%) were for clients younger than 55 – for women, this was 70%.

Marion said, among young people, the biggest claim events are cancer, cardiovascular disease, and trauma and injuries.

People are living longer, which means by the time an individual reaches old age, he or she is likely to have experienced two or three life-changing events.

“Young people, especially, often think they are invincible, but our statistics show a significant number of claims come from clients under 45. It’s crucial for younger individuals to have appropriate cover, such as income protection and severe illness insurance, to safeguard their financial futures,” said Petrie Marx, product actuary at Sanlam Risk and Savings.

Increase in claims linked to pregnancy complications

The 2023 claim statistics also highlight the specific risk cover needs of women, emphasising the importance of tailored insurance solutions to address their challenges and circumstances.

Sanlam identified some of the key trends as follows:

- Cancer remained a significant cause of severe illness claims among women, with breast cancer the most prevalent. This underscores the critical need for women to have cancer cover to ensure financial support during treatment and recovery. Colon and cervical cancer are also common cancers among women.

- A marked increase in sickness income claims for accidents and injuries from female clients – a significant number of which came from individuals aged 26 to 45. Sanlam said it will be watching this closely to see whether it is an anomaly or a sustained trend.

- In 2023, Sanlam paid R5.5 million for caesarean sections as part of its cover for pregnancy complications under the sickness income benefit. Payment for pregnancy complications under its sickness income benefit have been increasing annually.

Globally and in South Africa, C-sections are increasing because pregnancy complications are on the rise, linked primarily to diseases of lifestyle.

“Obesity, hypertension, and Type II diabetes are starting earlier. These conditions are magnified by pregnancy. We’re also seeing women have first pregnancies later in life, which can bring more complications and cause obstetricians to opt for caesarean sections,” Morkel said.

Decrease in claims linked to Covid deaths

Morkel said claims for Covid-19-linked deaths have decreased significantly, now only impacting individuals who are elderly or immunocompromised.

However, there has been a rise in pneumonias linked to influenza and respiratory syncytial virus (RSV). This has caused an increase in hospitalisation claims, which mirrors global trends.

“Covid-19 is still here but competing with influenza and RSV. So, we’re seeing the effect of these combined,” Morkel said.