The gold price surprised me on the upside.

The decoupling of gold and TIPS yields

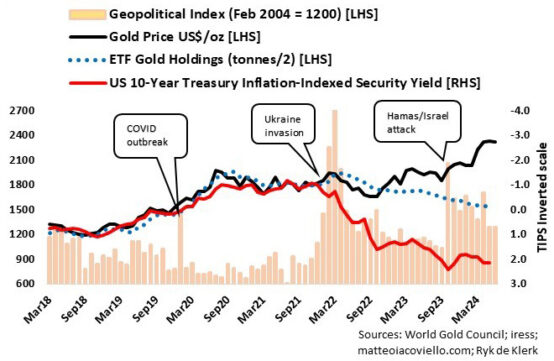

After tracking the 10-year US Treasury Inflation-linked Bond, also known as TIPS, for 16 years, gold’s correlation with the bond broke down in the latter half of 2022.

Russia’s invasion of Ukraine in early 2022 led to a global energy and food crisis, forcing central banks to hike lending rates. The quantitative tightening hit TIPS hard as yields jumped, leading to significant capital losses on investments in inflation-linked bonds.

The decoupling of gold and TIPS yields was expected because Russia’s invasion tripled the Geopolitical Risk Index, resulting in significant flows into gold-backed exchange traded funds (ETFs). This was short-lived, though, because ETFs experienced net outflows soon after the event. This was because of the high correlation between gold and total ETF gold holdings. An increase in total ETF gold holdings was associated with a rise in the gold price, and vice versa, a decrease in gold holdings was associated with lower gold prices.

The decoupling of gold and ETF flows

From the accompanying graph, it is evident that the correlation between ETF gold holdings and the gold price broke down since the end of 2022. The gold price commenced a new upward trend, while ETF gold holdings continued to decline. The outflows continued despite the Hamas attack on Israel and the ongoing war.

In an article published in March last year (Is gold an accident waiting to happen?), I wondered whether gold was an accident waiting to happen or whether Russian aggression was the new normal that would buoy the gold price.

At this stage, geopolitical risk remains high and could get worse. The Russia/Ukraine war is ongoing, and there are indications that the superpower may extend its aggression towards the Baltic states. The Hamas/Israel war also continues and threatens to spill over to Israel’s neighbouring states.

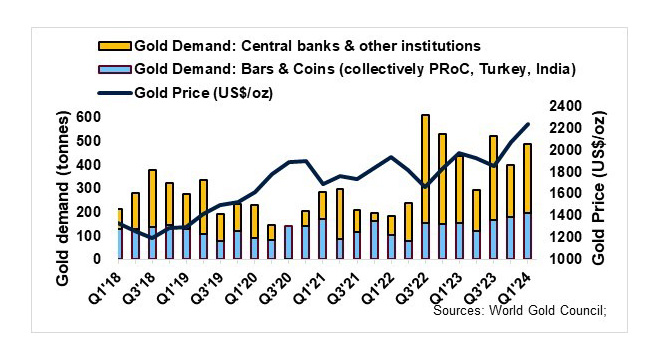

Central banks starve investors

According to World Gold Council data, central banks and other official institutions purchased more than 300 tonnes of gold over the past seven quarters compared to a quarterly average of about 100 tonnes from 2019 to 2021. It effectively means that over the past seven quarters, the amount of gold available for investment was on average 200 tonnes less per quarter than over the 2019/2021 period.

Shift in investment demand

One of the most bullish factors in the gold supply/demand balance is the gold investment boom in India, China (mainland), and Turkey. Demand for gold bars and coins, collectively, in these three countries in the first quarter of this year was 150% higher than in the second quarter of 2022.

More importantly, the decline in total ETF gold holdings of 739 tonnes since the second quarter of 2022 was more than offset by the growth in investment demand in India, China, and Turkey, which amounted to 1 187 tonnes.

Where to from here?

According to the recent 2024 Central Bank Gold Reserves survey conducted the World Gold Council, the percentage of central bank respondents intending to increase their gold reserves in the next 12 months is at the highest level since the survey began in 2018. Yes, central bank demand is likely to underscore the gold price.

It is apparent that central banks – together with investment demand in China, India, and Turkey – have become less price sensitive than previously. In addition, there are indications that gold ETF flows are gaining momentum.

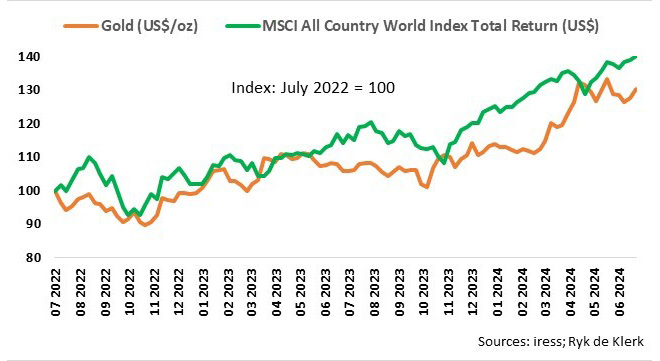

Over the past two years, gold has displayed the characteristics of a defensive stock – outperforming when stock markets are under pressure, specifically during major sell-offs, and underperforming when stock markets are strong.

Most importantly, owning gold reduces the volatility in my total investment portfolio. Yes, I am bullish on gold.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.