An exclusion in the policy’s terms and conditions topped the reasons for disputes between non-life insurers and policyholders in 2023, according to the annual report of the Ombudsman for Short-term Insurance (OSTI), released yesterday.

The report cites “exclusion applies” as the reason for most complaints by consumers to the OSTI across all its dispute categories: motor vehicle insurance, homeowner’s insurance, household contents, commercial insurance, and other types of insurance and non-claim-related disputes.

In line with previous years, most complaints to the OSTI in 2023 were about motor vehicle claims. In this category of complaints, claims were most often rejected based on the insured’s alleged failure to prevent the loss or exercise due care. However, complaints of this nature decreased slightly in 2023, from 364 to 308.

The other common exclusions invoked by insurers in this category were “contravention of the National Road Traffic Act” and “gradual deterioration, lack of maintenance, or wear and tear”. The OSTI noted a decrease in complaints related to the latter, as well as in complaints where the exclusion was “driving under the influence”.

The second most common reason for motor vehicle insurance complaints were disputes over the amount claimed, although these complaints decreased by 22.4%, from 711 in 2022 to 552 in 2023.

Disputes related to non-disclosure or misrepresentation at the inception of the policy was the third-biggest reason for motor vehicle complaints, followed by “non-payment of premiums”.

The “gradual deterioration, lack of maintenance, or wear and tear” exclusion gave rise to most of the disputes involving household contents insurance, homeowner’s insurance, and commercial insurance.

The OSTI called attention to the increase in disputes related to this exclusion in the household contents category. Disputes involving “gradual deterioration, lack of maintenance, or wear and tear” jumped by 48.8%, from 84 in 2022 to 125 in 2023.

The household contents category also saw a marked increase in disputes related to whether the peril was covered, by 22.4%, from 76 to 93.

Under the homeowner’s insurance category, disputes relating to lack of maintenance/wear and tear ticked up from 905 to 911.

The second main issue in complaints about homeowner’s insurance was “defective design and construction”, which was followed by disputes over whether the peril was covered.

There was also a slight increase in the number of complaints related to the lack of maintenance/wear and tear exclusion in the commercial insurance category, from 195 to 200.

The second main reason for complaints in this category were disputes over the claim amount. This was followed by disputes related to whether the criteria for the insured event had been met and disputes over whether the peril was covered by the policy.

The “other insurance” category includes complaints about personal accident insurance, water loss, travel, all risks, mobile devices, legal expenses, hospital, and medical gap cover.

In this category, the exclusion was based on the insured’s alleged failure to prevent the loss or exercise due care.

The secondary reason for disputes in this category related to the criteria for the insured event not being met.

A notable change in the “other insurance” category compared to 2022 was that “non-payment of premium” appeared among the top three reasons for disputes in 2023.

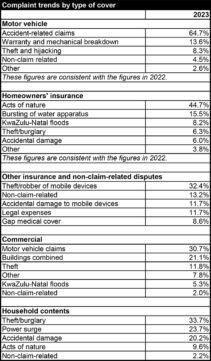

Complaint trends in relation to types of cover

The OSTI highlighted the following complaint trends by type of insurance cover:

Household contents

In 2022, theft/burglary claims were at 40%, while they decreased to 33.7% in 2023. Power surge complaints rose from 20% in 2022 to 23.7% in 2023. Complaints related to accidental damage rose from 16.6% in 2022 to 20.2% in 2023.

Other insurance

There was an increase in complaints related to the theft/robbery of mobile devices and legal expenses compared to 2022. The former increased by 27.9% to 32.4%, while complaints about legal expenses rose from 8.7% to 11.7%.

Increase in registered complaints

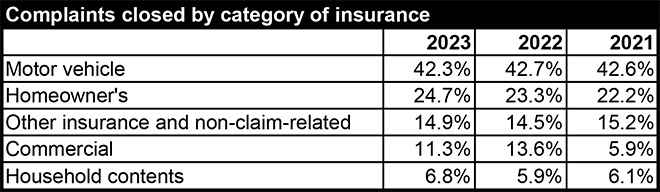

The OSTI recorded a 5.6% increase in the number of registered complaints in 2023 compared to 2022. This was down on the 17.8% increase between 2022 and 2021.

The ombud scheme registered 12 188 complaints in 2023, compared with 11 542 in 2022 and 9 797 in 2021. The office closed 10 534 complaints last year, compared to 10 411 in 2022 and 10 879 in 2021, according to the OSTI’s annual report.

Of the 12 188 complaints registered, the overwhelming majority related to motor vehicle accidents (2 887), followed by acts of nature (1 161), warranty and mechanical breakdown (606), and theft and robbery (478).

By comparison, the OST said it received 220 complaints related to power surges and 167 related to the KwaZulu-Natal floods of April 2022. The earthquake in June on the East Rand generated 97 complaints, and 96 complaints related to storms and floods in Gauteng during December.

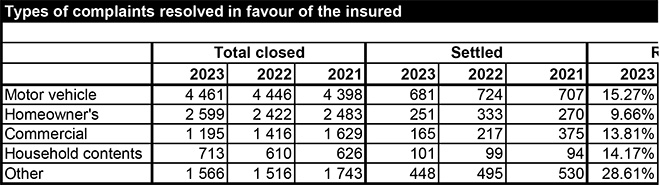

The OSTI recorded a resolved ratio, also known as an overturn ratio, of 16%, a decline of 2% compared to the 18% recorded in 2020, 2021, and 2022. The resolved/overturn ratio is an indicator of complaints where the insurer’s decision or approach was changed by the office with some additional benefit to the insured.

The OSTI settled all disputes between policyholders and insurers via conciliation, except for two cases where the ombud had to issue formal ruling against the same insurer (not named).

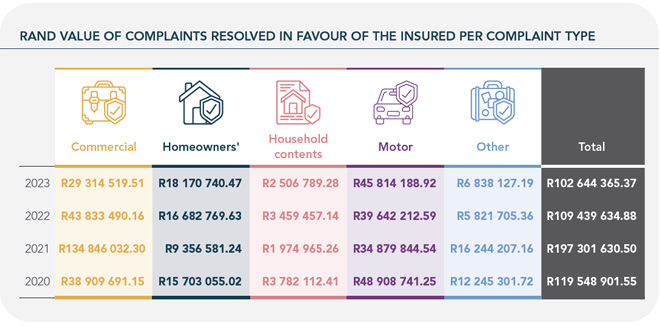

The recorded monetary benefit and value for consumers who approached the office for assistance was R102 644 365.37 in 2023, compared to R109 439 635 in 2022 and R197 301 630 in 2021.

Slower complaint turnaround time

Complaints took an average of 142 days to resolve, compared to 122 days in 2022 and 138 days in 2021. The OSTI aims for a maximum turnaround time (TAT) of 120 days. Without weekends and public holidays, the average TAT for last year was about 97 days.

The OSTI aims not to have more 10% of open complaints on its “six-month list”, which is a list of complaints outstanding for six months and longer. The office ended the year with 1 305 complaints on the list, which represents 22.8% of the open complaints compared to 10.7% at the end of 2022. At the end of December, there were 5 732 open cases compared to 4 131 open cases in December 2022 and 3 052 in December 2021.

The OSTI’s chief executive, Edite Teixeira-Mckinon, said the higher-than-normal resignation rate in 2023 had a negative impact on the scheme’s operational performance.

The higher number of resignations was attributed to staff re-evaluating their life/work priorities in the wake of the Covid-19 pandemic, the pressure to make quality decisions amid set timelines, and the increase in the workload in 2023.

A persistent problem facing the OSTI is that it invests a significant amount of time and effort in training its staff, only for them to pursue more financially lucrative careers in the insurance industry, Teixeira-Mckinon said.

Over the past two years, the OSTI has experienced an increase of about 24% in new registered complaints while maintaining the same adjudicative staff complement. The main reason for keeping the staff complement the same was the risk of potential job redundancies going into the National Financial Ombud Scheme (NFO) and the risk that complaint volumes may again decline, as happened in 2021. The OSTI’s funding is based on a standard case fee charged for each complaint registered against a member insurer.

More complaints result in higher revenue

The OSTI extended its financial reporting period by two months from 31 December 2023 to 29 February 2024 because of the amalgamation with the Ombudsman for Long-term Insurance, the Credit Ombudsman, and the Ombudsman for Banking Services to create the NFO. The NFO officially launched on 1 March 2024.

The OSTI’s revenue increased by 21.6% in 2023 compared to 2021, from R50.8 million to R61.8m, which it attributed to additional invoicing in January 2024 and the 5.6% increase in the number of registered complaints.

The fee charged per complaint remained at R4 500 in 2022. A penalty fee of double the current fee is charged to insurers for delays in resolving complaints.

Fee income is recognised over time based on when a complaint is closed or based on a three-year average time that it takes to close complaints.

The OSTI’s operating expenditure was R56.5m compared to R45.7m in 2022. This is mainly due to the additional two months’ expenditure incurred in relation to ICT, salaries, other staff-related costs, and moving to new premises.

The OSTI ended the year with a surplus of R9.2m (2022: R7.3m).