The FSCA will lodge a claim against the estate of the late Markus Jooste to recover the half-a-billion rand in penalties the Authority imposed on him, says Gerhard van Deventer, the head of the Authority’s Enforcement division.

Van Deventer told a media briefing on Friday that the fines have not been paid.

A day before Jooste reportedly committed suicide on 21 March, the FSCA imposed a penalty of R475 million on him for making or publishing false, misleading, or deceptive statements about Steinhoff International Holdings Limited and Steinhoff International Holdings.

The penalty was in addition to the reduced fine of R20m, plus interest, imposed on Jooste in December 2022 for insider trading. The original fine of R162m, also for contraventions of the Financial Markets Act, was set aside by the Financial Services Tribunal (FST) in December 2021.

Van Deventer said the administrative penalties imposed by the FSCA have a similar status to a court judgment in a civil matter, and the Authority is required to take all reasonable steps, including sequestration and liquidation, to obtain the money.

In the case of licensed entities that fail to pay fines, the FSCA can suspend and ultimately withdraw their licences.

The FSCA briefed the media on the regulatory action it took from 1 April 2023 to 31 March 2024. This is the second year the Authority has a published a regulatory action report.

Deputy Commissioner Katherine Gibson said the Authority will be placing more emphasis on warning and educating the public. Enforcement action comes “at the end of the chain”, and interventions are required so that consumers will avoid dodgy and high-risk schemes.

As much as the FSCA seeks to protect consumers, it does not have the resources to investigate every complaint it receives. It therefore takes a risk-based approach, focusing on those areas that pose the biggest risk to consumers or where enforcement will have the greatest impact, Gibson said.

Regarding ethics in the financial sector, she said a minority of people will always do the right thing or always do the wrong thing; most people are on a spectrum between these two extremes. An organisation’s internal culture will determine the type of behaviour that becomes normative.

Gibson said the FSCA sees its role as “nudging” financial institutions towards adopting behaviour that results in positive outcomes for the industry and consumers. Where there is was blatant wrongdoing, it will impose the strictest sanctions. But in the main, it aims to work with the sector to achieve a positive outcome.

In this regard, Gibson highlighted the increased use of enforceable undertakings.

The Authority prefers to use enforceable undertakings where the outcome of a matter is predictable or where it receives a high level of co-operation from an entity. They eliminate the need for formal regulatory or enforcement actions.

The FSCA entered 41 enforceable undertakings in 2023/24 compared with two in 2022/23. It said the main reason for the increase is that these undertakings have proved to be an appropriate remedy in funeral parlour business investigations.

Nine-fold increase in the value of fines

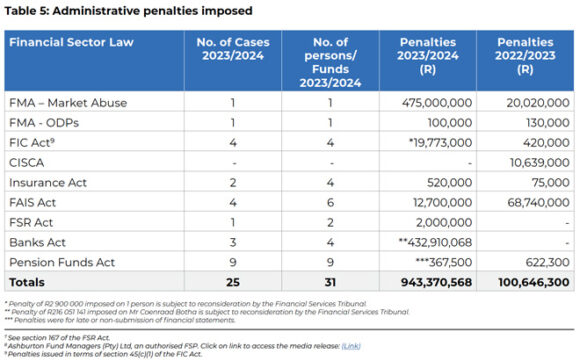

The FSCA imposed administrative penalties totalling about R943m on 31 people, marking a substantial increase on the R100m imposed on 44 people in 2022/23.

Apart from the R475m imposed on Jooste, significant penalties were the R216m imposed on CBI director Coenraad Botha and the R143m on Classic Financial Services’ Jacobus Geldenhuis.

Read: CBI director fined R216 million and debarred for 10 years

Read: FSCA imposes R143m penalty on Classic Financial Services director, creditors unaffected

There has also been a significant increase in the value of penalties imposed for contraventions of the Financial Intelligence Centre Act, as illustrated by the R16m penalty on Ashburton Fund Managers.

Read: FSCA fines asset manager R16m for FICA non-compliance

The FSCA said the substantial increase in the value of administrative penalties is mainly because of its approach to enhance effective deterrence. “As such, a penalty must reflect the nature, seriousness, and extent of the misconduct, the harm caused to financial customers, and the extent of financial benefit to the investigated party.”

Other material factors that are considered in determining a fine are the extent to which the conduct was deliberate or reckless, and the co-operation or lack thereof by the investigated party with the investigation team.

During the briefing, the FSCA emphasised it does not keep the money it receives from fines; it is paid over to the National Revenue Fund. The only income for the FSCA from enforcement action is possible investigation and litigation cost recoveries.

Increase in FSP debarments

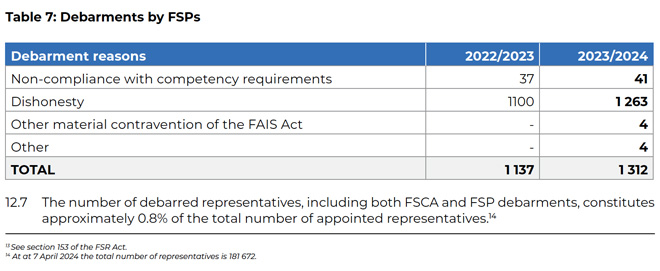

FSPs debarred 1 312 representatives, an increase of 15% compared to 2022/23. In about 95% (1 100) of cases, the reason was dishonesty.

The FSCA debarred 156 people from providing financial services, a decrease from the 210 in the previous period. As in 2022/23, a significant number of debarments resulted from representatives submitting false policies. The FSCA highlighted this type of conduct as a concern in its inaugural report, “and it will continue to be an area of focus”.

The number of debarred representatives, including FSCA and FSP debarments, constituted about 0.8% of the 181 672 appointed representatives on 7 April 2024.

Licence suspensions and withdrawals

In 2023/24, the FSCA suspended the licences of 1 061 FSPs, which constituted about 9% of the 11 826 authorised FSPs on 7 April 2024. In the previous 12-month reporting period, the Authority suspended the licences of 984 FSPs (8% of the 11 826 authorised FSPs at the end of March 2023).

Of the total number of suspensions, 1 035 (97%) related to the non-submission of statutory returns and/or the non-payment of levies. The suspensions were lifted in 624 (58%) cases after the FSPs rectified their non-compliance.

The FSCA withdrew the licences of 75 FSPs, which was a substantial reduction from the 420 withdrawn in 2022/23. (The numbers exclude cases where the withdrawals were set aside by the FST.) The decrease was primarily because the cycle for suspensions and withdrawals related to the non-submission of statutory returns spans two reporting periods. The initial part of this process occurred in the current reporting period, while the latter part will take place in the next reporting period.

Uptick in complex investigations

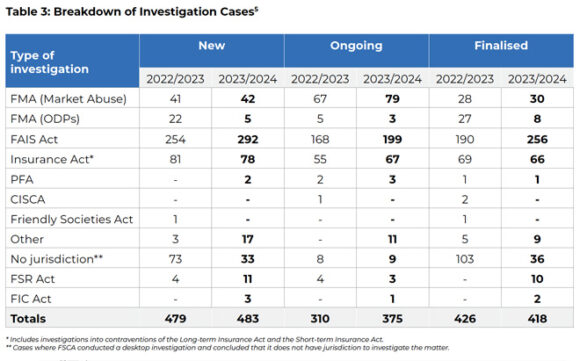

The FSCA opened 483 (2022/23: 479) investigation cases and finalised 416 (426), while 375 (310) cases are ongoing.

The Authority said the 21% increase in the number of ongoing cases was because of the “noticeable uptick” in the number of complex investigations. “These cases are inherently more resource intensive, requiring extensive time, effort, and specialised expertise.”

In addition, there has been an increase in legal challenges against the investigations and the sanctions imposed. “These legal battles necessitate additional resources, further contributing to the overall workload. The combined effect of these factors has placed a substantial demand on available resources,” the FSCA said.

Most of the investigations involve alleged contraventions of the FAIS Act and the Insurance Act – predominately conducting unauthorised business. Of the new cases, unauthorised FAIS business constitutes 61% of the FAIS Act investigations, while most of the Insurance Act investigations involve unregistered insurance business in respect of funeral policies.

Eight percent of the new FAIS cases relate to fraud involving the regulatory examinations – an issue the Authority highlighted in its previous report.

“We expect financial institutions to apply proper due diligence processes when appointing individuals to regulated roles, rather than merely relying on certificates without verifying their validity. Institutions must ensure rigorous vetting to prevent access to the financial sector by perpetrators of this type of fraud,” the FSCA said.

The increase in Financial Sector Regulation Act investigations stems mainly from cases involving people unlawfully impersonating the FSCA, its leadership and staff. Similarly, there has been an increase in the impersonation of authorised FSPs by people unlawfully soliciting investments from the public.

Note: The number of new, ongoing, and finalised cases the table will not reconcile because finalised cases were not necessarily received during the reporting period and new cases were not necessarily finalised in the same period. Additionally, although the overall totals of new, ongoing, and finalised cases can be used for year-on-year comparison, the subtotals for each type of investigation may not reconcile with the following period’s totals. This is because contraventions suspected at the commencement of the investigation may change depending on what is found during the investigation. Therefore, the categorisation of a finalised case may differ from its categorisation when it was new or ongoing.

Reconsideration applications

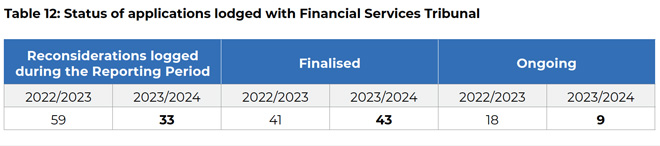

The FSCA took 1 323 administrative actions in 2023/24, and 33 new applications for the reconsideration of the Authority’s decisions were lodged with the Tribunal during the same period.

The table below provides a breakdown of the outcome of the 44 cases finalised in 2023/24. It includes new cases lodged during this period and ongoing cases rolled over from the previous reporting period. Of these cases, the FSCA’s decisions were upheld in 16 cases. In the 11 cases where the applications were withdrawn, the FSCA’ decisions remained in force. The FSCA’s decisions were set aside in five cases, and in the remaining 11 cases, the FSCA agreed, by way of consent order, to have its decisions set aside and referred for further consideration.

In several cases, the FSCA agreed to set aside its decisions when the reasons for its decisions involved non-payment of levies or failure to submit statutory returns, provided the respondents subsequently paid the levies, submitted returns, or made satisfactory arrangements in this regard.

FSCA news