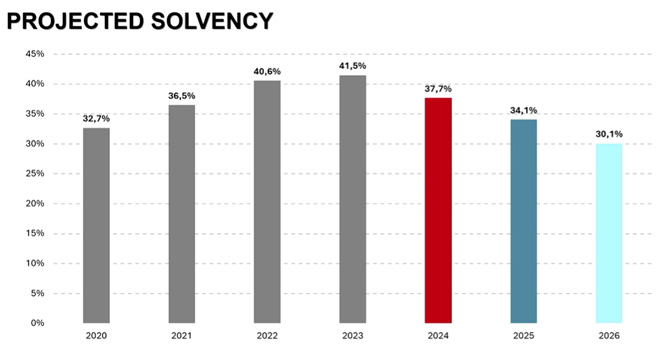

Over the next two years, Bonitas Medical Fund plans to erode its solvency by about 3% to 4%, to channel some R600 million to R700 million in reserves back to members annually.

South Africa’s second-largest open scheme yesterday announced its 2023 financial results. The scheme’s solvency levels hit a record high of 41.5%, surpassing the legislated 25% requirement by 16.5 percentage points. The results also showed the scheme has reserves totalling R8.9 billion and a robust surplus of R265.3m.

Medical schemes received a boost during the Covid-19 pandemic because members avoided hospitals, leading to increased solvency levels for many schemes.

In recent years, Bonitas focused on building up its reserves, concerned that during Covid, members were not accessing healthcare, undergoing screenings, or engaging in preventative measures. The worry was that post-Covid the scheme would need sufficient funding to cover the surge in healthcare costs when members resumed screenings.

Luke Woodhouse, the scheme’s chief financial officer, said Bonitas stabilised its solvency in 2023.

“So, a very small increase in [solvency in] 2023. But the strategic ambition for the board and the scheme now is to start releasing some of those reserves in a very slow, disciplined, and prudent fashion, ultimately reducing down to a solvency of 30.1% in 2026.”

He said because Bonitas has significantly higher solvency compared to some of its peers, it will be able to manage contribution increases at a low level, ideally below healthcare inflation. Additionally, this strong solvency position may allow for increased benefits and a reduction in co-payments.

“That is a big focus area in terms of our pricing and benefits strategy for next year and enhancing some of our benefits. So we are, in a sustainable fashion, going to start reducing our reserves over the next few years, which is good news for members over the medium term,” said Woodhouse.

Financial performance and results

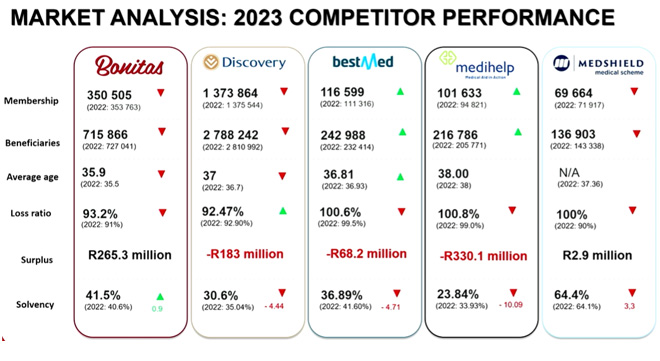

A market analysis comparing Bonitas with four competitors – Discovery, BestMed, Medihelp, and Medshield – based on financial performance and results from their reports, integrated reports, and annual financial statements, shows that Bonitas is the only scheme that was able to increase its solvency in 2023. Medihelp saw its solvency ratio decrease by 10 percentage points, falling 2% below the prescribed level.

Read: Medihelp’s solvency ratio drops below threshold amid high claims and rising costs

The market analysis reveals mixed membership trends.

BestMed saw its membership rise from 111 316 in 2022 to 116 599 in 2023, while Medihelp’s membership grew from 94 821 to 101 633. Conversely, other schemes, including Bonitas, experienced a decline. Bonitas’s membership decreased from 353 763 in 2022 to 350 729 in 2023, reflecting a net decrease of 0.9%. According to Bonitas’s 2023 integrated report, there were 50 729 new memberships and 53 987 terminations in 2023.

Woodhouse said the reduction in membership was a symptom of the struggle to grow in the corporate segment.

“We have seen rapid growth coming through in 2024, a very accelerated growth; probably the most rapid growth that I’ve seen on the scheme for a number of years. That’s very exciting. That tells us that a lot of the strategies that we’ve implemented over the past two or three years are bearing fruit in terms of growing our membership base.”

He said Bonitas’s partnership with Agile will help the scheme to develop a nuanced corporate strategy to boost corporate membership.

Bonitas is partnering with Agile, a company that provides digital solutions and technology services. This partnership is focused on improving healthcare accessibility and efficiency.

Bonitas’s pensioner ratio has picked up slightly, along with its chronic profile. But Woodhouse said these are well within industry standards.

Among the five schemes compared, Bonitas has the lowest average beneficiary age, which rose marginally from 35.5 to 35.9 years. Woodhouse said medical scheme membership typically ages by one year annually. Hence, attracting younger members is crucial, because they generally present a healthier profile, contributing to the scheme’s long-term sustainability.

“On average, medical schemes would go between 0.4 and, say, 0.8 years, and we’re at the very bottom of the of that, so that helps tremendously in terms of maintaining sustainability for the scheme,” he said.

The scheme’s 2023 claims data shows that the largest claim categories were hospital (R7.2bn), medical specialists (R2.3bn), day-to-day benefits (R1bn), auxiliary (R973.9m), GPs (R915.3m), and pathology (R811.1m).

The top 10 individual claims for 2023 ranged from R4 852 143 to R2 368 694.

“Although we’ve built reserves and increased our solvency over the last year, we will never shy away from paying large claims … Bonitas has the reserves, it has the working capital and the cash flow in place to sustain and pay for these types of claims,” Woodhouse said.

Investment income

The scheme increased its investment risk appetite in 2022, with a slight increase in equities, which it maintained in 2023. It reported R830m in investment income, which includes R147m in fair value gains. This translated into a gross composite return on its investment portfolio of 7.7% (2022: 7.2%).

The market value of its investment portfolio, excluding cash and cash equivalents, breached R10m and was R10.21bn on 31 December 2023 (2022: R9.97bn).

Medical schemes, unlike retirement funds, may not invest up to 45% offshore, which gives funds consistently higher returns. Despite these investment restrictions, Bonitas delivered returns above inflation.

“Over the past three years, we met our strategic return target, which was CPI plus 3.5%. With the highly regulated restrictions in place for medical schemes around investing, it’s very difficult to deliver the types of returns that pension funds do because we are not permitted to invest in foreign equities, for example,” he said.

Private healthcare affordability

With the National Health Insurance sword hanging over the private healthcare industry, prioritising affordability has become essential to retain existing members and attract new ones.

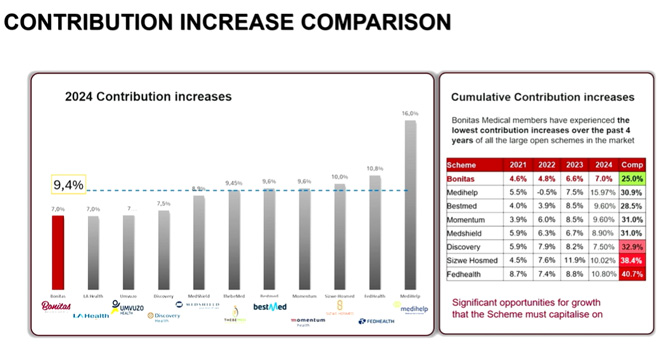

Woodhouse said the scheme has tried to limit its contribution increases year-on-year compared to the industry and CPI.

“And you’ll note that 65% of our Bonitas members experienced an increase below healthcare inflation, which is very difficult to do. And that’s an average increase of 6% across nine plans and a 7% average increase [for 2024]. Now, historically, medical schemes would normally have contribution increases of double digits and beyond.”

Read: Clash of the titans: medical scheme heavyweights announce 2024 contributions

He said Bonitas provided R1.4bn in relief to members by applying those low contribution increases, and R1.5bn passed back to members in 2022 and 2023.

About R300m of that was in the form of a contribution increase freeze in the first quarter of 2023, he said.

Of the scheme’s 12 options, seven were surplus-generating in 2023.

Woodhouse said it is important that at least half the scheme’s options register surpluses, so they can cross-subsidise other options that are producing deficits.

“A medical scheme will never have all of its options producing surpluses unless maybe in isolated circumstances with a closed medical scheme. But for open medical schemes, you are going to have cross-subsidisation taking place, which is why it’s important that you want at least half of your options producing surpluses.”

Comparing contribution increases among 11 major open schemes shows that Bonitas has recorded the smallest increases in medical contributions over the past four years.

Bonitas applied a cumulative increase of 25% during this period, the lowest among its peers.

Well done with exceptional results. Proud to be associated with Bonitas over the years. Best with the new marketing journey.