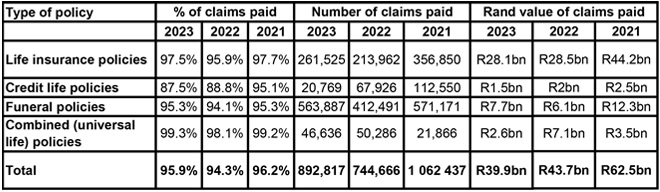

South African life insurers paid death and funeral benefits worth R39.9 billion last year to the beneficiaries of 892 817 policies, according to statistics released this week by the Association for Savings and Investment South Africa (ASISA).

The payout rate last year was 95.9%, compared to 94.3% in 2022 and 96.2% in 2021.

The death claims statistics for 2023 show that life insurers processed 931 025 claims against individual life, credit life, funeral, and universal life policies.

While 892 817 claims were paid, 38 208 claims (4.1%) were declined for reasons that included dishonesty, fraud, or contractual exclusions such as suicide within the first two years from when the policy was taken out.

Gareth Friedlander, a member of the ASISA Life and Risk Board Committee, says the 95.9% payout rate for death claims should provide consumers with the peace of mind that life companies will pay valid claims if the terms and conditions were met and the policyholder was honest during the application process.

As the table below shows, the number of claims was higher in 2023 than in 2022, but the value of claims paid was lower. ASISA said this was most probably because the benefit amounts were lower for the claims last year.

Reasons claims are declined

Friedlander says death claims are most commonly declined for the following reasons:

- Material non-disclosure. The policyholder did not disclose material information about a medical condition or lifestyle when applying for the policy to secure cover and/or lower premiums.

- Fraud. A fraudulent claim is submitted, or the beneficiary was involved in a crime that resulted in the death of the policyholder. All policies, whether life or funeral, come with an exclusion that states that no benefit will be paid to a beneficiary who committed a crime resulting in a policyholder’s death.

- Suicide. The policyholder committed suicide, generally within the first two years of taking out the policy.

- Exclusion. The policyholder died from an excluded health condition or dangerous lifestyle activity. The policyholder would have been informed of this exclusion when entering the contract.

- Waiting periods. Funeral cover generally imposes a waiting period of six months for deaths because of natural causes.

According to Friedlander, the reasons that will most likely apply when a claim is declined depend on the type of policy being claimed against.

Life insurance policies (including universal policies)

When a claim against a life insurance or universal life policy is declined, it is most often because of material non-disclosure.

Friedlander says life insurance policies can offer life cover worth millions of rands and, therefore, generally require some form of risk underwriting and assessment, which can range from medical and lifestyle questions to blood tests and medical examinations.

Since it is generally accepted that the person applying for insurance knows more about the risk to be insured than the insurer, the law compels life cover applicants honestly to disclose all information likely to influence the insurer’s judgment when determining appropriate policy terms and premiums. This ensures that every person pays a fair premium without unduly subsidising someone less healthy.

Withholding material information from a life insurer during the underwriting process is dishonest, and a life insurance company is, therefore, fully within its rights not to pay out a claim and declare your policy void if it comes to light that you were dishonest or that you failed to disclose important details when you took out your policy. This could have devastating financial consequences for your beneficiaries.

Funeral insurance policies

The main reasons for declining claims against funeral policies are waiting periods, fraud, and unpaid premiums.

Funeral insurance policies are designed to pay out quickly and without hassle when an insured family member dies. They typically do not require blood tests and medical examinations, and their payout is limited.

Since there are no underwriting requirements for funeral insurance, it is often tempting for people to buy funeral cover only once they have developed a serious illness and are expecting to die as a result. To prevent this, funeral cover usually imposes a waiting period of six months for deaths from natural causes.

Credit life policies

Claims against credit life policies are most commonly declined because the cover lapsed because of the non-payment of premiums, or the outstanding loan balance has been settled.

The payout by a credit life insurance policy decreases as the outstanding loan amount decreases. Once your debt has been repaid, your cover ends. When you default on your loan repayments, no premiums are paid to the life insurer and your cover lapses. It is important, therefore, that you have stand-alone life and disability cover, which is not linked to debt.