The most important financial decision people face as they enter retirement is choosing an appropriate annuity, so they will receive an income that will sustain their standard of living for the rest of their life.

The biggest threat to retirees’ income is inflation. The risk with choosing the “wrong” annuity option is that the income will not keep pace with or beat inflation. Determining whether the inflation rate will remain relatively constant throughout a person’s retirement or will rise suddenly makes the choice of the appropriate annuity more difficult.

The two other risks that must be considered are:

- Sequence-of-return risk, which is the risk that the order and timing of investment returns can negatively impact the overall performance of a portfolio. The sequence of returns is important in retirement because if you receive poor returns early in retirement, your portfolio may be significantly depleted, making it difficult to recover even if subsequent returns are strong.

- Longevity risk, which is the risk that retirees will outlive their savings and financial resources. As life expectancy increases, this risk becomes more significant because retirees may need to fund a longer period of retirement than they initially anticipated.

At retirement, investors have two options from which to draw their retirement income:

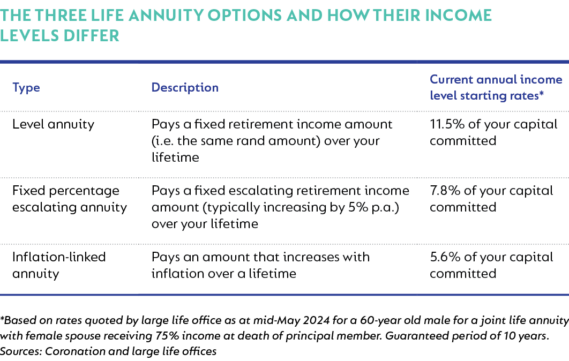

- A life annuity, which is an insurance policy that guarantees a pension income for the rest of your life. There are three types of life annuities, each offering a different guaranteed income drawdown rate: a level annuity, a fixed percentage escalating annuity, and an inflation-linked annuity.

- A living annuity, which is an investment-linked account. The income drawdown rate is flexible within the legislated limits, so it can be adjusted in response to the underlying performance of the chosen investment portfolio.

An analysis by Coronation Fund Managers provides more grist to the mill in the debate over whether a life annuity or a living annuity is the more appropriate option.

The analysis, published in the latest edition of Corospondent, examines the issue from the perspective of which annuity will best protect the value of a retiree’s income in a high-inflation scenario.

Coronation’s analysis is reproduced here to make investors aware of some of the factors to consider when choosing an annuity and should not be interpreted as an endorsement of Coronation’s findings.

Swing to life annuities

Living annuities have been the most popular retirement income option in South Africa for much of the past two decades. Life annuities have become more popular recently, taking the split closer to 60% in favour of living annuity purchases and 40% in favour of life annuities, according to Coronation.

The asset manager attributes the growth in the popularity of life annuities to their higher initial income rates, which are the result of the elevated yields on long bonds. Life insurers (which issue life annuities) typically buy government and other high-quality bonds to back the guaranteed obligations towards their annuitants (a retirement income for life). On the other hand, living annuities have not always met annuitants’ expectations over the past decade, following a period of disappointing returns from South African assets in general and high-risk assets specifically.

According to Coronation, nearly all life annuity purchases last year were fixed escalating annuities, while few retirees chose an inflation-linked annuity. This preference is understandable, given the materially higher initial income from a fixed escalating annuity.

Can annuitants bank on low inflation?

The implicit assumption that buyers of fixed escalating annuities make is that inflation will remain about 5% a year for the next 20 to 25 years, Coronation said.

“We think this is a mistake and akin to insuring your car against a fender bender (mild inflationary outcome), but not a total write-off scenario (double-digit inflation).”

Coronation said its base case is that monetary policy will remain sound, and inflation should stay close to the target range of 3% to 6%. However, the risk of a period of much higher inflation over the next two decades has increased. This is because the government requires additional funding as its expenditure outstrips its revenue.

Although National Treasury has done well in containing spending in the 2023/24 fiscal year, looking ahead, decisions about large allocations (such as the future of the Social Relief of Distress grant, funding for National Health Insurance, and additional investment in critical infrastructure) have yet to be made, Coronation said.

Annuity options in different inflation scenarios

Coronation provided three simple models to illustrate the importance of selecting the right retirement income strategy within the context of potentially higher inflation in future.

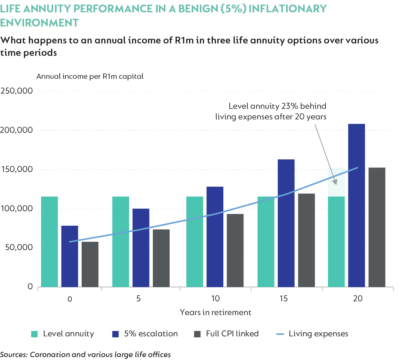

Benign inflationary scenario

The graph below represents the retirement income level for an investment of R1 million given certain assumptions. The starting income for the level life annuity is defined by the mint bar, for the escalating annuity in blue, and the inflation-linked annuity in grey.

The first model assumes the lowest starting income amount to be equal to your current living expenses (as represented by the blue line) coupled with a benign inflationary environment (5% inflation over 20 years).

In this scenario, only the level annuity’s income falls behind in purchasing power after 15 years. After 20 years, selecting this annuity option would leave you 23% behind in living expenses.

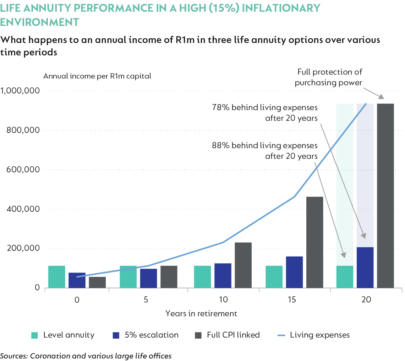

‘Blow-out’ inflationary scenario

The next model looks at what happens in a “blow-out” scenario, with high inflation of 15% a year over 20 years. In this case, the retirement incomes paid out by a level and an escalating annuity will fall behind your living expenses by around Year 5. In contrast, the income from an inflation-linked annuity continues to offer protection for 20 years.

Although the 15% inflation scenario is purely hypothetical, it is not entirely inconceivable if we remember the inflation rate in South Africa in the 1970s to the early 1990s.

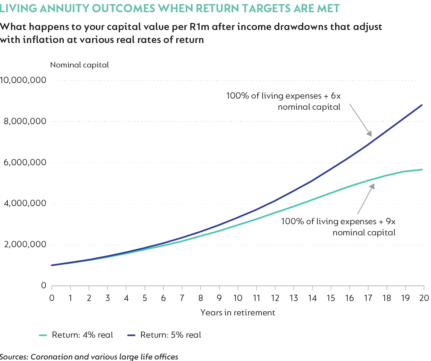

Living annuity

The third model looks at a living annuity where the underlying investment portfolio consists of an actively managed multi-asset portfolio with enough growth assets (60% to 70%) to achieve “meaningful real returns over time”.

The inclusion of growth assets in the portfolio funding your retirement income means you have a decent probability of protecting the purchasing power of your money in both the benign inflationary scenario and the blow-out inflationary scenario, Coronation says.

Present value of cash flows

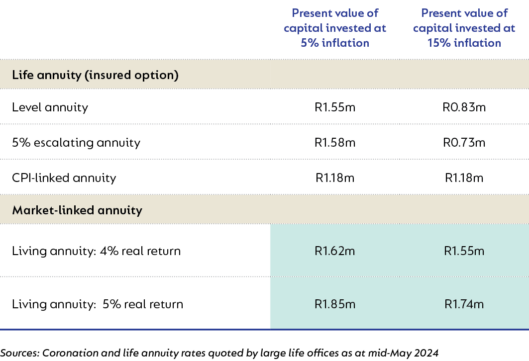

Coronation said the above scenarios can also be examined by calculating the present value of the cash flows of the respective life and living annuity options.

The table below, which uses the same assumptions as above, shows how well the chosen annuity option protects the purchasing power of R1m over 20 years given the two inflationary scenarios (5% benign or 15% blow-out). A present value of less than R1m means the purchasing power has not been protected over this period.

Coronation deduced the following from the above models:

- Of the three life annuity options, the 5% escalating annuity offers the best value in a benign (5%) inflationary scenario, whereas the inflation-linked annuity delivers the best outcome in a high-inflation (15%) scenario. This demonstrates that the preferred life annuity option depends on the inflation outcome (an unknown variable), effectively requiring investors who purchase life annuities to bet on the rate of inflation over the coming decades.

- The living annuity option (assuming the target rate of real returns are achieved from its underlying portfolio) delivered good value in both the benign inflationary scenario and the blow-out inflationary scenario, potentially delivering much more valuable outcomes in a blow-out inflationary scenario. This is mainly because of the flexibility of a living annuity, which allows investors to choose an underlying portfolio that can deliver inflation-beating returns through exposure to growth assets.

Navigating the options is complex

Life annuities are often perceived to be lower risk than living annuities because they remove the sequence-of-return and longevity risks. However, they force retirees into making a difficult trade-off between maximising either their initial income rate or their long-term inflation protection, Coronation said.

“The flexibility inherent in living annuities, primarily through enabling the inclusion of growth assets in your retirement portfolio, improves the probability of achieving good outcomes regardless of the inflation scenario that plays out. This removes the need to take a view on the future path of inflation at the point of retirement.”

As Coronation concludes, its analysis shows that navigating your income options in retirement is complex and requires careful consideration. This is why investors will benefit from the assistance of their financial adviser when making life-defining decisions at retirement.

Disclaimer: The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

I think you’re missing a graph – the first table is repeated later in the article and the text is non-sensical without the first graph.

Thank you for pointing this out. The graph has been inserted.

The question should not be whether to go for a life annuity or a living annuity, but rather the questions should be:

1. What percentage should go into a life annuity (with the balance into the living annuity)?

2. Should the portion for the life annuity be delayed [because current annuity rates are too low, due to low long term interest rates and or because the annuitant is still fairly young (or young and female, since females are expected to have a longer life expectancy)] and the portion earmarked for a life annuity temporarily also put into a living annuity?

3. What type of life annuity should be chosen? In most cases where the annuity is the sole or primary source of income, a level annuity should not even be considered and the choice should be between a fixed % escalating annuity (preferably at least 6%), a CPI linked annuity or a “with profits” annuity. The “with profits” life annuity is not even mentioned in the article, but it allows the pensioner to take on investment risk, (which might possibly be less than the inflation risk of a fixed % escalating annuity), but unlike a living annuity it also provides protection against longevity risk and also has the protection that the annuity can never decrease even if investment returns are negative.

Finally, it should be borne in mind that if only half of the income is coming from a life annuity and the other half from a living annuity, then for a joint life annuity it might be ok for the spouse to receive only 50% instead of 75% of the income on the death of the principal member (since the spouse will still be receiving 100% of the income from the living annuity), so hat would increase the initial income from the life annuity.