The Council for Medical Schemes (CMS) has urged schemes to cap their tariff hikes for 2025 at 4.4%, plus “reasonable” utilisation estimates, but it remains to be seen whether they will adhere to this guidance considering last year’s experience.

On 1 August, the CMS released Circular 35 of 2024: “Guidance on contribution increases and benefits changes for 2025”. The circular discusses the factors the regulator will consider when assessing schemes’ contribution increases and benefit changes for 2025.

In a circular distributed in August last year, the CMS advised schemes to limit their contribution increases for 2024 to 5% – in line with headline inflation as measured by the Consumer Price Index (CPI) – plus “reasonable” utilisation estimates.

Read: CMS releases guidelines on medical scheme increases for 2024

The CMS projected these estimates at 3.2% to 3.8% based on its analysis of cost increase assumptions for 2023. In other words, a recommended increase of just over 8%, give or take a percentage point or two.

This year’s circular did not include a projected estimate.

Despite the CMS’s recommendation, most open medical schemes set their 2024 contribution adjustments above the advised 8%, with few exceptions. Among South Africa’s top five medical schemes, Discovery Health Medical Scheme (DHMS) announced a weighted average increase of 7.5%, Bonitas set theirs at 6.9%, and Momentum at 9.6%. Bestmed and Medihelp reported average increases of 9.6% and 15.96%, respectively.

Alexforbes, an adviser/broker for multiple schemes, disclosed the following increases: Fedhealth, 10.8%; Genesis, 5%; Medshield, 8.9%; Sizwe Hosmed, 10.02%; and Thebemed, 9.67%. These figures place Medshield, Momentum, Bestmed, Thebemed, Sizwe Hosmed, and Fedhealth above the 8% guideline. Medihelp, with its 15.96% increase, led the chart, although it noted that most of its options were priced the lowest in the market, justifying the higher adjustment.

Read: Medihelp’s solvency ratio drops below threshold amid high claims and rising costs

Once you moved away from schemes’ “weighted average contributions” and considered the range of increases across various benefit options, many exceeded the 8% mark. Bonitas’s BonComprehensive increased by 9.6%; Bestmed, Thebemed, and Medshield’s increases topped out at 9.9%; DHMS’s Executive plan saw a 12.9% rise; Sizwe Hosmed’s highest increase was 13%; Fedhealth’s was 14.4%; and Medihelp’s MedAd savings plan saw a 19.9% increase.

Read: Medical scheme contribution increases largely surpass recommended 8% hike

All signs thus far suggest that history is set to repeat itself.

Speaking at Momentum Health Solutions’ virtual Healthcare Insights Summit on 30 July, Momentum Health marketing officer Damian McHugh highlighted the rising demands on medical funds. Efforts to contain contribution increases are causing medical schemes to incur additional costs, leading to reduced or tightened benefits to keep increases lower than necessary – an issue that may continue into 2025, BusinessTech reported.

Despite these measures, 2024 medical scheme contributions still exceeded inflation, a trend McHugh predicts will continue in 2025. He warned that members should brace for hefty above-inflation price hikes next year.

Wants versus needs

South Africa lacks an official medical price index, and while private medical inflation typically outpaces CPI by 2% to 3%, the CMS advocates that industry price increases should closely mirror CPI.

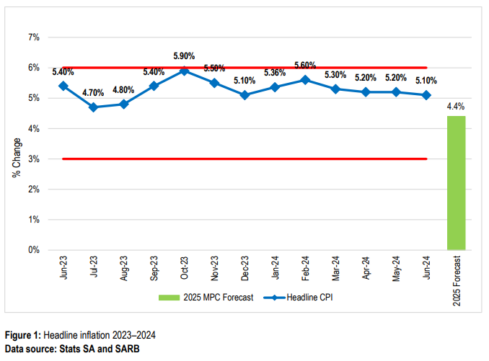

The CMS relies on the CPI, along with salary inflation, to gauge the affordability of annual contribution rate increases. Figure 1 below presents historical CPI data up to June 2024, including the South African Reserve Bank’s inflation target range and its CPI forecast for 2025. Year-on-year headline inflation, measured by CPI, held steady at 5.2% in April and May before slightly decreasing to 5.1% in June 2024. Overall, inflation is projected to average 4.9% in 2024, with the Reserve Bank’s forecast indicating an average of 4.4% for 2025 and 4.5% for 2026.

Despite a notable dip during the Covid-19 pandemic, the average increase in industry contributions has consistently surpassed CPI. For instance, the average contribution increase rate of 6.8% for 2023 was 0.7% higher than the average CPI of 6.1%. This trend reflects a return to pre-pandemic patterns where contribution increases regularly outpaced inflation.

“The CMS remains concerned about this trend, which has significant ramifications for the industry’s long-term sustainability. The higher price differential between annual medical scheme contribution rate increases and average CPI poses a serious affordability challenge for cash-strapped consumers.

“In the current challenging economic climate, raising contributions above the inflation rate is simply above the budget line for most cash-strapped consumers. High medical scheme contribution rates also create a barrier for new entrants looking to join the private healthcare industry, posing a threat to the industry’s long-term sustainability.”

In the circular, the Registrar of Medical Schemes acknowledges that some schemes may need higher increases than the CMS’s CPI-linked recommendations. In such cases, trustees must submit a comprehensive actuarial business plan justifying the proposed above-inflation increases.

“The Registrar’s decisions to approve any proposed contribution increases will continue to be data-dependent and sensitive to each medical scheme’s financial and demographic risk profile.”

The Registrar states it will approve increases higher than CPI only if there is a clear financial and actuarial justification.

In addition, to “contain spiralling costs and maintain a sustainable risk pool”, the CMS recommends that non-healthcare expenditures (NHE) for the 2025 benefit year be adjusted in line with CPI.

“In the current adverse macro-economic climate, there is no economic rationale for increases in NHE above CPI, as this cost is ultimately passed down to members through higher monthly premiums.”

The CMS expects schemes with sufficient economies of scale to use strategic purchasing when contracting with providers to ensure value-based contracting.

“Trustees must also strive to incorporate efficiency and performance metrics into managed care contracts to improve operational efficiencies and the overall quality and efficiency of patient care delivery.”

Medical schemes expenditure trends

However, tackling this challenge is easier said than done, particularly considering the current trends in medical scheme expenditures. The increased use of healthcare services directly correlates with higher costs for medical schemes. When beneficiaries use more healthcare services, scheme expenditures tend to rise even faster than contributions. Conversely, reduced service utilization leads to lower expenditures.

“This emphasises the critical nature of effectively managing healthcare service usage to control costs and ensure the efficient allocation of resources. In essence, monitoring and optimising the utilisation of healthcare services is crucial in maintaining the financial sustainability of medical schemes and the overall healthcare system,” the CMS noted.

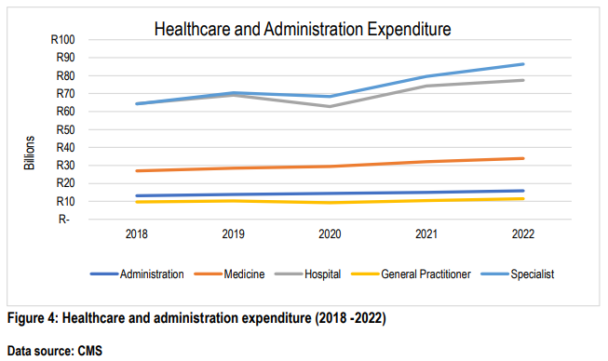

Figure 4 illustrates a progressive rise in spending across various healthcare categories and administrative services from 2018 to 2022. Notably, spending on specialist consultations and hospital admissions has seen the most significant increases compared to GP visits and medication expenses. The overall expenditure shows a marked dip in 2020 during the Covid-19 peak but surged again in 2021.

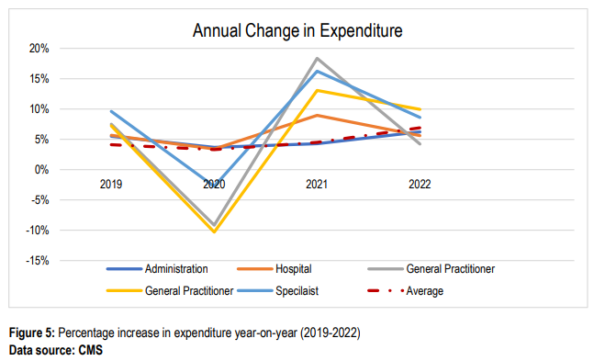

Figure 5 depicts year-on-year percentage increases in medical scheme expenditures across different categories. The inflation rate fluctuates annually between 3.2% and 4.6%, influencing cost trends for medical schemes. Variability in expenditure across different categories is driven by factors such as healthcare utilization patterns and economic conditions.

“Medical schemes must devise financial management strategies, robust cost containment measures, and effective resource allocation to navigate the unpredictable nature of expenditure trends,” the CMS stated.

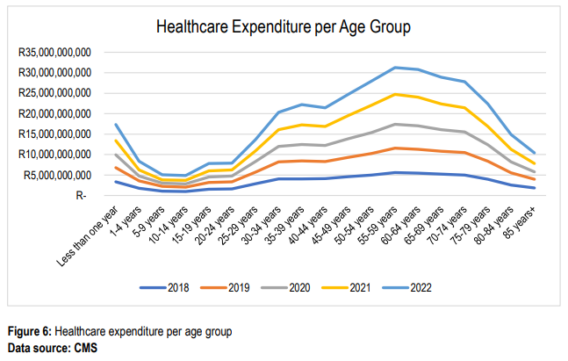

Figure 6 shows healthcare expenditure across different age bands from 2018 to 2022. It is evident that expenditure increases with age, peaking in the 55-to-59 age group and then gradually declining.

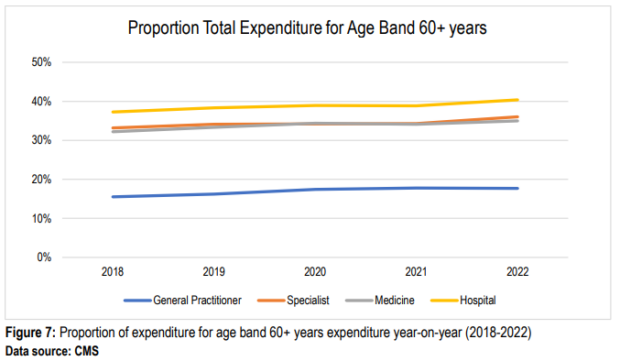

Figure 7 highlights year-on-year increases in healthcare expenditures for beneficiaries aged 60 and older. The proportion of total expenditure on specialists for this age group rose from 33.18% in 2018 to 36.02% in 2022. Similarly, spending on medicine and hospital costs also increased for this age band.

The CMS highlighted that healthcare expenditure in the industry continues to rise faster than inflation due to factors such as technological advancement, an ageing population, and the increasing prevalence of chronic diseases. “Managing spiralling healthcare costs remains a key priority for medical schemes to ensure affordability and sustainability,” the CMS stated.

The CMS recommends prioritising selective contracting with cost-efficient healthcare providers and pharmaceutical suppliers and using formularies to curb costs without compromising quality health outcomes.

Review benefit offerings

Like last year, CMS has called for fewer, not more benefit options.

Based on the findings of the Health Market Inquiry in 2019, the current high number of benefit options and complicated benefit structures have negative impacts on consumers and competition in the market.

As a result, the CMS states, the industry needs regularly to review its benefit offerings and eliminate options that are not financially viable or sustainable in terms of membership.

“However, the CMS will still consider applications for new benefit options. The main focus of the medical scheme’s business plan should prioritise enhancing risk pooling, cross-subsidisation, and affordability while providing members with high-quality healthcare services. This includes investing in preventative care programmes, building strong provider networks, and offering virtual care benefits.”

Remember the disclaimer

After last year’s mini showdown between the CMS and DHMS – when the CMS directed DHMS to retract its communication about 2024 contribution and benefit changes – medical schemes should pay close attention to section 5.7 in the latest circular.

Although the CMS eventually withdrew the directive, schemes must be aware of the guidelines outlined under “Communication of the 2025 benefits and contributions changes”.

According to section 31(2) of the Medical Schemes Act, any amendments, rescissions, or additions to a scheme’s rules are only valid once approved by the Registrar. Moreover, in compliance with section 29(1)(l), medical schemes must provide their members with advance written notice of any upcoming changes to their contributions and benefits. Importantly, communications must include a disclaimer stating that the amendments will only take effect once the Registrar’s approval is secured.

The deadlines for submitting applications are tight: new benefit options and efficiency-discounted sub-options must be submitted by 2 September, while changes to contributions and benefits are due by 1 October.

Medical schemes that need extra time to finalise their 2025 pricing decisions can request an extension from the Registrar, detailing their specific circumstances.