A recent study by Schroders and Ad Lucem found that only 34% of women plan to stay with their family adviser after a spouse’s death or divorce – a significant challenge for some financial advisers but also an opportunity for those who can effectively address the evolving needs of female clients.

Previous research suggests that by 2025, women will control 60% of the UK’s wealth. This will largely be because of the wealth transfer within the Baby Boomer generation, typically from male spouses or partners to women.

Gillian Hepburn (pictured), commercial director at Schroders, notes that although this prediction remains unproved, data from 2020/21 provided by the UK’s version of SARS – His Majesty’s Revenue and Customs (HMRC) – shows that of the £15.7 billion of estates that transferred to a single partner, 73% went to women, lending credibility to the theory.

Although South Africa differs from the UK, it holds true across the globe that women on average live longer than men. In South Africa in 2022, the life expectancy of women at birth was 64.18 years versus 58.6 years for men.

Additionally, the latest divorce statistics in South Africa, released by Statistics South Africa in March 2024, show an uptick in divorce rates. The 2022 statistical release on divorce data, based on the processing of 20 196 completed divorce forms by Stats SA, marked a significant increase of 10.9% or 1 988 cases from the 18 208 divorces recorded in 2021. The crude divorce rate for 2022 was calculated at 33 divorces per 100 000 of the estimated resident population.

Schroders and Ad Lucem’s recent survey identified four disconnects between advisers and their female clients.

The first disconnect was retention. Although advisers expected 62% of these women to remain after the death of a spouse or on divorce, only 34% indicated they would stay with the family adviser.

Hepburn emphasises that for advisers planning to exit businesses and maximise valuations, losing wealth as it transfers could undermine their strategy.

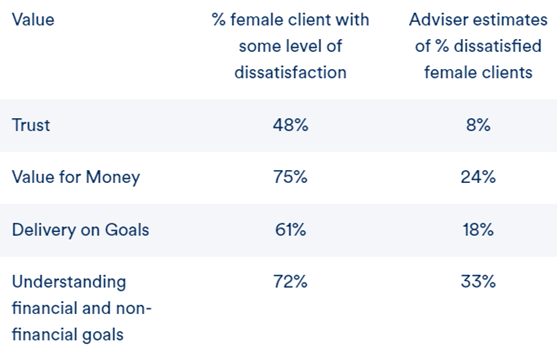

The second disconnect highlighted was satisfaction. Hepburn notes the importance for financial advisers to understand which services female clients value and assess their satisfaction levels.

“Unsurprisingly, women in the survey valued trust, peace of mind, goal delivery, and discussions about both financial and non-financial needs. These align with advisers’ views on what their female clients value. However, advisers’ perception of how dissatisfied their female clients are with each element of their service differs widely from what their female clients report,” she says.

Regarding trust, 48% of female clients reported some level of dissatisfaction, while advisers estimated it at just 8%. For value for money, 75% of women expressed dissatisfaction, contrasted with advisers’ 24% estimate. In terms of goal delivery, 61% of female clients were dissatisfied, whereas advisers thought only 18% would be. Concerning understanding financial and non-financial goals, 72% of female clients were dissatisfied, compared to advisers’ 33% estimation.

Hepburn suggests these gaps indicate significant challenges to overcome, and advisers should consider strategies to bridge these divides.

“It was also interesting to note that when women expressed their non-financial goals, these often related to financial capability: wanting to travel more, spend time with family, and engage in leisure activities,” she adds.

Involvement emerged as another disconnect. Past research indicated that women were disengaged and not involved in the financial planning process pre-widowhood.

“Interestingly, they blamed both their partners for excluding them and advisers for not engaging them. Our research suggests that they may be right to hold this view,” Hepburn says.

She highlights that 45% of advisers primarily communicated with the male partner, only 22% reported both partners always present at meetings, and less than half indicated an equal professional relationship with both partners. Additionally, 66% of advisers found it somewhat difficult to engage with both partners.

The final identified disconnect, financial requirements, may partially explain the difficulty in engaging both partners.

“Women have different financial needs,” Hepburn explains.

Regarding product requirements, only 46% of women felt adequately protected for sickness (primarily private health), while more than 60% of advisers believed their female clients were. This discrepancy also applied to critical illness coverage.

“Interestingly, 82% of women felt prepared for death, but only 57% of advisers agreed, suggesting a need for better engagement on this sensitive topic,” she says.

Hepburn suggests that advisers might consider engaging with partners individually, based on their unique planning requirements.

“For instance, women outnumber men in care homes by a ratio of 3:1 and typically stay more than four times as long. Anyone who has witnessed a family member moving into care knows it can be an emotionally challenging time, and navigating the financial implications can be equally daunting,” she says.

While many women are not staying with their financial advisers, survey participants offered advice on what could dissuade them from moving. They expressed a desire for advisers to “understand me more”, “deliver proactive communications” tailored to their needs, and “listen more”.

“For the 70% of advisers who are actively seeking more female clients or plan to do so, understanding these points could be beneficial. In conclusion, the potential loss of female clients poses a challenge for some advisers but also an opportunity for others,” Hepburn says.