The South African Revenue Service (SARS) has issued a communication to clarify the change to the tax deduction for retirement fund contributions.

The formula to determine the allowable deduction for retirement fund contributions is set out in section 11F of the Income Tax Act (ITA).

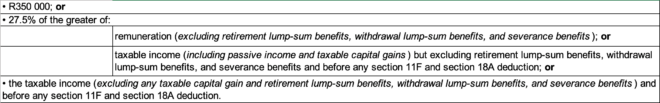

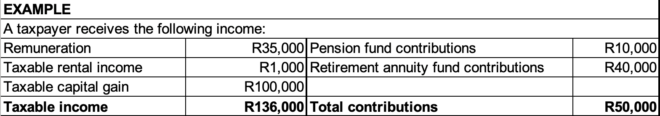

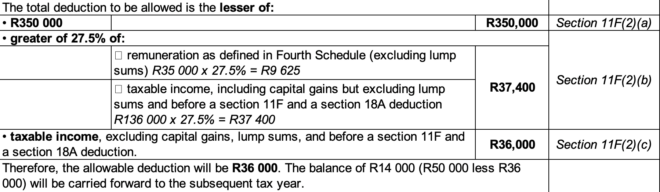

In summary, the allowable deduction is the lesser of:

Section 11F(2)(a) of the ITA was amended with effect from 1 March 2024 as follows: Where any person’s year of assessment is less than 12 months, the amount stipulated in section 11F(2)(a) of the Act used to calculate the allowable retirement contribution deduction (currently R350 000) shall be adjusted. The adjusted amount will bear the same ratio to R350 000 as the number of days in that year of assessment bears to 365 days.

Therefore, if a person’s year of assessment is less than 12 months, the allowable retirement contribution deduction (currently R350 000) will be applied pro rata.

SARS said that where a person’s year of assessment is less than 12 months, the maximum amount of the allowable retirement fund contribution deduction may not exceed the prescribed limit (currently R350 000) for all years of assessment within the 12-month period from 1 March of that calendar year to the last day of February in the following year.

SARS provided two examples, one involving insolvency and the other the ending of tax residency, to illustrate how the amendment works.

Example: insolvency

Mr Taxpayer was classified as insolvent on 31 October 2024. For the 2025 years of assessment, the allowable retirement fund contribution deduction in terms of section 11F(2)(a) will be applied as follows:

Period of assessment: 1 March 2024 to 31 October 2024

- This assessment applies to Tax Reference Number 1 – the original tax number coded as insolvent and applicable to assessments preceding the date of sequestration.

- The allowable retirement fund contribution deduction that was utilised for this assessment is R200 000.

Period of assessment: 1 November 2024 to 28 February 2025

- This assessment applies to Tax Reference Number 3 – Mr Taxpayer’s new tax number applicable to assessments from the date of sequestration.

- The retirement fund contribution deduction allowable is R150 000 – that is, R350 000 less R200 000 utilised in the first “period assessment” that falls within the same 12-month period from 1 March of that calendar year to the last day of February in the following year.

Note: Tax reference number 2 is an optional tax number registered for the insolvent estate and is managed by the court-appointed administrator or trustee. It is applicable to assessments from the date of sequestration until the estate is finalised. Section 11F does not apply to this tax number.

Example: ceasing tax residency

Mr Taxpayer ceased to be a tax resident on 31 July 2024. For the 2025 years of assessment, the allowable retirement fund contribution deduction in terms of section 11F(2)(a) will be applied as follows:

Period of assessment: 1 March 2024 to 31 July 2024

- This applies to Mr Taxpayer’s assessment as a South African tax resident.

- The allowable retirement fund contribution deduction that was utilised for this assessment is R350 000.

Period of assessment: 1 August 2024 to 28 February 2025

- This applies to Mr Taxpayer’s assessment as a non-tax resident.

- There will be no retirement fund contribution deduction for this assessment because the allowable amount in terms of section 11F(2)(a) was fully utilised in the first period assessment that also falls within the same 12-month period from 1 March of that calendar year to the last day of February in the following year.