Younger drivers are likely to choose higher excesses on their car insurance policies to reduce their monthly premiums, according to data from Naked Insurance.

Data from the digital insurance platform shows that customers aged below 28 are likely to choose a higher excess on their car insurance policies than those aged 29 to 55.

Ernest North, co-founder of Naked, says their data suggests that younger customers often opt for a large excess to lower their monthly premium because their cash flow is tighter.

“Many older customers, on the other hand, choose to reduce their excess because they have experience with owning assets, having insurance, and making claims. Among over-55s, excesses tend to be slightly higher because they usually have older, less valuable cars than those under 55,” he says.

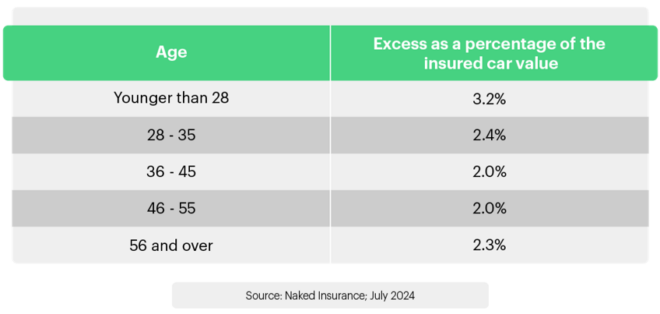

Data from Naked’s customer pool by age group and excess as a percentage of the insured car’s value is as follows:

North says excesses can be a source of frustration and confusion.

“But if you understand how the excess in your policy works, you can adjust the amount to hit a sweet spot between reducing your risks of a loss and saving money on your monthly premium.”

He adds there is no single right or wrong choice about whether to opt for a higher or lower excess.

“It’s important to pick what’s right for your budget and lifestyle.”

What is an excess?

The insurance excess is the amount of money an insured will contribute towards a claim. If the excess is R3 000 and an insured’s car is damaged in an accident, he or she will contribute R3 000 to repairs. North explains that it doesn’t matter whether the repairs cost R4 000 or R40 000 – the insured will pay the same excess. An excess will also apply if a claim is made for a stolen car.

“Paying an excess is a downer when you’re dealing with the stress of claiming for a damaged or stolen vehicle,” says North. “But excesses help to keep premiums lower for everyone and make insurance more affordable. They reduce the number of small claims insurers handle, which in turn reduces administrative expenses, the volume of fraudulent claims, and the costs of settling claims,” he says.

Different kinds of excess

According to North, one of the factors that makes excesses so contentious is that they can make it difficult to compare quotes across different providers, particularly because some providers do not allow much flexibility in adjusting their excess.

“Many traditional insurers also apply a range of additional excesses. For example, you might need to pay an additional excess if the accident happened after 10pm, the driver was younger than 25, or your policy is less than a couple of months old,” says North.

“A combination of excess charges could add up to tens of thousands of rands more in costs if you have an accident,” he says.

A few insurers make use of percentage-based excesses. If the excess is 10% of the claim, the insured will contribute R10 000 if the claim is R100 000. If the claim is R10 000, the insured may need to pay a minimum of R3 000.

“It’s important to read the fine print carefully,” says North. “Some policies are not as cheap as they seem when you factor in the extra excesses.”

On the flipside, some minor claims could have no excess, depending on the insurer. For example, glass or windscreen claims could have a zero excess if the repair or replacement cost is less than R2 000.

Deciding on the right excess

North says the maths of excesses is relatively straightforward. A higher excess amount will result in a lower monthly premium, while a lower excess amount will leave you with a higher monthly premium.

He suggests asking the following questions when trying to decide what level of excess to go for:

- How much money can I afford to pay towards an excess without borrowing?

- Do you have some money saved for a rainy day? If you can pay for small repairs out of pocket without derailing your financial plan, then a lower premium and higher excess might make sense for you.

- What monthly premium will not break the bank? A lower excess will mean a higher monthly premium, so be sure to balance the affordability of the monthly premium with your ability to pay your excess at the claims stage.

- What is my risk exposure? If you drive less, you might be more comfortable with a higher excess. Your chances of having a bumper bashing will be lower than the average driver.

“Whichever quotes you get, be sure you understand the basic and all the hidden excesses, so that you’re comparing premium costs on a like-for-like basis,” says North.