The main aim of the two-pot retirement system is to improve the preservation of retirement assets. However, the extent to which the new system improves or undermines preservation may depend on the type of fund to which a member belongs.

This is according to Allan Gray’s Shaun Duddy, who says fund member behaviour, not the system itself, will ultimately determine whether the two-pot system will result in members retiring financially better off.

Although Allan Gray believes the two-pot system is a positive step for South Africa’s retirement system, “whether they actually assist retirement fund members in achieving a better retirement will still come down to individuals making good decisions and avoiding the risks that exist within the framework of the new rules,” he said.

Duddy, who heads the asset manager’s product development team, looked at how the new system creates potential benefits and risks depending on whether one is a member of a pension, provident, preservation, or retirement annuity (RA) fund.

Enhancing preservation

He said the new system will enhance preservation in the case of pension and provident funds, as well as pension preservation and provident preservation funds. This is because, under the retirement system, members of pension and provident funds can take up to 100% of their assets as cash each time they change jobs or leave an employer. They can make one withdrawal from a preservation fund before their minimum retirement age.

Members who withdraw everything and do not invest it elsewhere effectively have to start saving over again but with fewer years to rebuild their investment before they reach retirement.

In contrast, under the two-pot system, the assets in the savings component will be accessible once per tax year and the assets in the vested component will still be accessible when you change employers or leave your employer. However, the assets in the retirement component cannot be accessed.

Automatically preserving the assets in the retirement component assists in ensuring that a minimum amount of assets remain invested until and for retirement.

In the case of people who join a retirement fund for the first time on or after 1 September, a minimum of two-thirds of their retirement fund assets will make it to retirement, which is a substantial improvement compared to what is happening under the current system.

Over time, allowing access to the savings component should also reduce (and ultimately remove) the often-counterproductive incentive to leave one’s job to access retirement fund assets, as well as the instinct to withdraw all of them when doing so, Duddy said.

Risk of undermining preservation

On the other side of the coin, he said the new system runs the risk of worsening preservation in RA funds.

Under the current rules, members of RA funds cannot access any of their retirement assets before age 55 (although there are exceptions). In other words, RAs have always had 100% preservation.

This will change with the introduction of the savings component under the two-pot system: a portion of the retirement fund assets will be accessible.

To the extent that this access is used as intended, to assist in case of financial emergencies, it is a positive. However, the risk is that this access introduces a temptation to access retirement fund assets, potentially reducing preservation and ultimately resulting in a lower and less sustainable income in retirement, Duddy said.

How this can play out

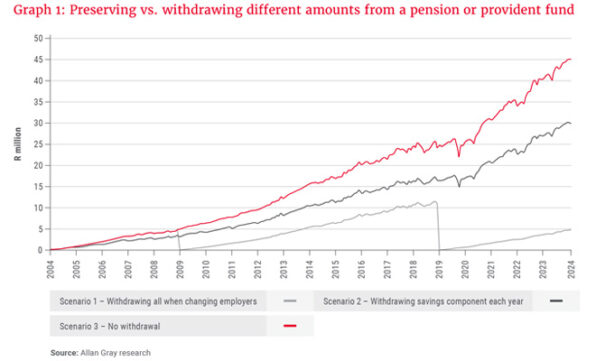

Duddy provided two graphs to illustrate his points.

Graph 1 shows the different outcomes for a pension or provident fund member contributing R6 000 a month over the past 20 years and investing in the Allan Gray Balanced Fund.

In Scenario 1 (the light grey line), the member takes all his retirement fund assets when he changes employers at the end of year 5, and again at the end of year 15, which is allowable under the current rules.

Scenario 2 (the dark grey line) assumes that the new rules apply: one-third of each contribution (R2 000) is allocated to the savings component, two-thirds of each contribution (R4 000) is allocated to the retirement component, and only the full savings component is taken each year.

Last, Scenario 3 (the red line) assumes that nothing is taken when changing employers.

Relative to Scenario 1, after 20 years, the member will have 6.3 times more in Scenario 2 and 9.5 times more in Scenario 3. This illustrates the power of preservation and how the two-pot system can improve preservation in pension and provident funds.

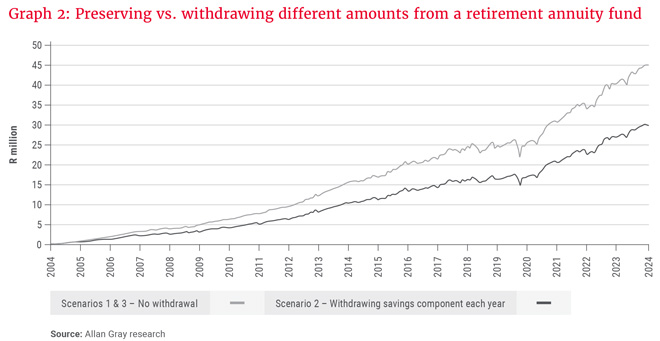

Graph 2 shows the same scenarios for a member of an RA. However, for Scenario 1 (the light grey line), no assets are accessible under the current rules when changing employers, therefore Scenarios 1 and 3 (as described in Graph 1) are equal.

This graph again shows the importance of preservation. However, it also shows that the ability to access the savings component under the two-pot system, as represented in Scenario 2 (the dark grey line), is a negative relative to the current rules for this type of retirement fund, Duddy said.

Good reasons not to withdraw

“Just because you can, doesn’t mean you should” is arguably the best saying to apply to your savings component under the two-pot system, Duddy said.

It is highly recommended that members do not make one withdrawal per tax year from their savings component, unless they find themselves in a real financial emergency and not withdrawing will lead to a worse financial outcome, he said.

The most important points to make are:

- Any assets that are withdrawn and not replaced before retirement will reduce your income in retirement.

- The longer you wait to replace the assets, the more you will have to invest to make up for lost time and investment returns.

Duddy said new retirement fund members who start to invest on or after 1 September also need to keep in mind that if they deplete their savings component before retirement, they will not only have one-third less assets to provide an income in retirement, but also no assets that can be taken as a cash lump sum at retirement to cover once-off expenses, such as settling a mortgage bond.

If members do not withdraw, their contributions will continue to accumulate and grow and will be available to withdraw at a later stage, if need be.

Members also need to remember that any withdrawal from their savings component will be taxed at their marginal tax rate, which is above their effective tax rate (that is, the tax rate applied to their salary) and can further be reduced if they owe outstanding taxes to the South African Revenue Service, Duddy said.

These taxes are also higher than those applied at retirement if members decide to take their savings component assets, or a portion thereof, as a cash lump sum at that point. This is another compelling reason not to dip in.

“Ultimately, the goal should be to keep as much as possible of your savings component invested until retirement. You lose nothing by not withdrawing every year, because all your savings component assets remain available for withdrawal in future years, and you benefit materially from avoiding the associated risks,” Duddy said.

Disclaimer: The information in this article does not constitute investment, financial planning, or tax advice that is appropriate for every individual’s needs and circumstances.

On the charts, the y axis title should probably be R100k’s not R millions. Under Scenario 1, for example, a member can’t expect to save R6000/month for 5 years (2019 – 2024) and have R5m in retirement savings. R500 000 is more realistic.