Despite the turbulent macro-economic environment, private equity (PE) fundraising activity surged to a 13-year high in southern Africa.

The 2024 Private Equity Industry Survey, conducted by the South African Venture Capital and Private Equity Association (SAVCA), reported a 43% increase in funds raised compared to the previous year, reaching a record R28.1 billion. Fifty-nine percent of these funds were raised from investors outside of South Africa – European and US investors made up 45% and 22%, respectively.

Exits proceeds increased to R21.3bn from R20.8bn – the highest level since 2011.

Based on responses from 46 PE firms operating in southern Africa, the survey covers key aspects of the industry, including strategic priorities, ESG (Environmental, Social and Governance) and impact investing, talent, broad-based black economic empowerment, fundraising, investment and divestment activities, and funds under management. The data reflects the calendar year to 31 December 2023 (wherever possible).

Tshepiso Kobile, the chief executive of SAVCA, says the survey findings indicate that the engines of the PE industry are gaining traction.

“On a global scale, PE is up against some serious odds, including economic uncertainty and political upheaval. Locally, the picture looks very much the same, although – true to its reputation for being resilient – PE has continued to push through and demand attention as an asset class, continuing to return capital back to investors and drive impact.”

Evidence of this can be seen in the marked optimism of local PE firms compared to their global counterparts. The survey found that PE firms in southern Africa are more optimistic about an increase in exit activity in the next six months than global PE firms. Currently, 41% of local firms expect an increase of 10% more as opposed to only 24% of global firms. Sixty-two percent of PE firms expect high (57%) or very high (5%) deal flow in 2025.

Funds under management insights

The survey shows a dramatic increase in the proportion of investments (by number) made by PE firms with funds under management (FUM) of more than R5bn, which stands at 58% in 2023 compared to 11% in 2022.

Fifty-one percent of respondents reported their expectation of seeing accelerated growth of their FUM, compared to just 38% in the previous year.

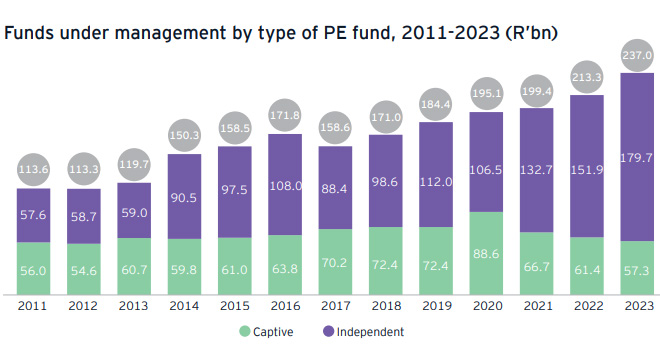

FUM continued to move in an upward trajectory and gained 11% from 2022 to reach R237bn in 2023. FUM of independent fund managers witnessed notable growth of 18% (R28bn).

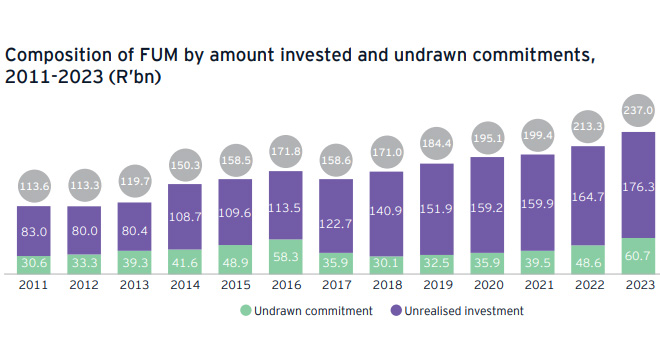

The cost of unrealised investments witnessed in 2023 grew by 7% (R12bn) in comparison to 2022, reaching more than R176bn, while undrawn commitments grew by 25% and accumulated to R61bn, the highest in more than a decade.

Undrawn commitments and unrealised investments are key terms in fund management. Undrawn commitments refer to capital that investors have pledged to a PE fund but has not been called by the fund manager. This capital stays with the investors until the manager identifies suitable investments and requests the funds, representing potential future investments.

Unrealised investments are those already made by the fund but not yet sold or exited. These refer to the assets or portfolio companies the fund still holds. Their value is typically based on current market conditions or projected future returns but remains unrealised until the assets are sold, at which point the gains or losses become realised.

According to the survey, this increased availability of “dry powder” – the capital that PE firms have raised from investors but have not yet invested – makes PE firms less susceptible to the higher interest rate environment and well poised to make investments in the near future.

“The growth can be attributed to the successful fundraising by independent fund managers,” the survey states.

The deterioration in the value of the rand in comparison to US dollar between 2022 and 2023 also contributed to the growth in FUM.

“When converted to US dollars – with respective rates at the end of each year – FUM growth comes out at 5% (2022: US$12.4bn; 2023: US$12.9bn).”

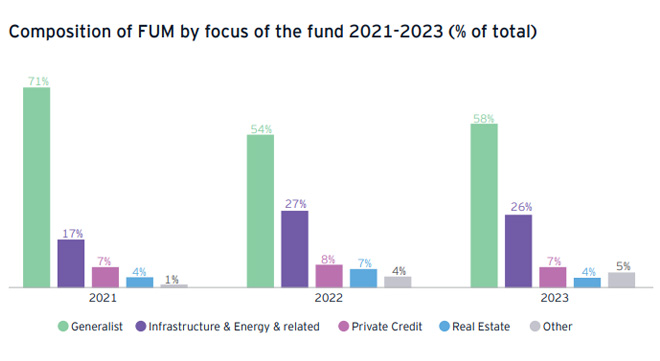

The composition of FUM by fund focus reveals a decline in generalist investments, dropping from 71% in 2021 to 58% in 2023. Meanwhile, infrastructure and energy-related investments grew from 17% to 26% over the same period. Investment in the “other” category also saw an increase, rising from 1% in 2021 to 5% in 2023.

ESG and impact front and centre

According to the survey, it’s full steam ahead for PE, and ESG and impact investing are leading the charge.

Per this year’s survey, 35% of local PE firms now have dedicated ESG professionals. In addition, 55% of respondents said their fund has a specific impact investing mandate.

When asked about the elements of ESG on which these investors are placing particular emphasis, 92% of respondents reported their investors require measurement of portfolio company performance against specific metrics. Increased reporting on ESG and the tailoring of investment strategy to meet ESG requirements ranked as the second and third most prevalent investor focus areas, respectively.

In tandem with this consistent push for a greater focus on sustainability in terms of the social and environmental aspects of PE investments, survey respondents also commented on the nature of their ESG policies.

Sixty-six percent of respondents said the top component that makes up their ESG policy is adhering to external global sustainability initiatives (for example, Principles for Responsible Investments), with the responsibility for setting ESG priorities placed at the highest level within the firm (board level).

According to Kobile, these findings are indicative of a PE industry in which “ESG concerns have now become embedded in decision-making and are seen as integral to operational success”.

“We should never underestimate the capacity that sits within PE to foster resilience in ventures. This is evidenced by the growth in revenues, employment and EBITDA that was reported by the PE portfolio companies for the 2021 to 2023 measurement period, in a battling economy. With more and more PE firms keeping this objective top of mind, we will undoubtedly continue to see great examples of the positive contribution the industry can make towards our broader national goals,” she adds.

PE driving transformation progress

One of the chief findings to emerge from the nationwide analysis of the role of PE and venture capital (VC) in supporting and delivering on national policy objectives was that PE is driving transformation. The #InvestingForGrowth analysis was commissioned by SAVCA and conducted by research firm Intellidex (now Krutham) in 2023.

Objectives such as job creation featured prominently in the final report, which found that while national employment growth found itself in the red at -4.2%, employment growth within PE investee companies stood at 4.2%. The report also found that PE and VC firms have thus far made an important contribution towards improving the BEE performance of the companies within their portfolios.

According to the report, investee companies reported significant improvements on several BEE scorecard components, namely ownership (up by 54%), management control (up by 38%), skills development (up by 68%), enterprise and supplier development (up by 71%) and socio-economic development (up by 63%). However, there was a slight drop in female representation of at least 30% within portfolio company boards (down from 19% to 14%).

Kobile says this coincides with the findings of this year’s PE survey, in which fund managers reported improving diversity both within their boards, as well as within their teams, with an increasing proportion of PE firms with more than 30% women promotees across all levels.

However, there was a slight drop in female representation of at least 30% within portfolio company boards (down from 19% to 14%). A further 62% of PE firms reported having more than 50% black management – up from 60% last year.

For more information, download the complete SAVCA PE Industry Survey 2024 here.