Discovery Group has achieved its goal of 1 million banking clients two years ahead of schedule.

After receiving its banking licence in 2017, Discovery Bank officially launched operations in 2019, setting a goal to reach its first million clients by 2026. However, earlier this week, the financial services provider announced it has already met this ambitious milestone.

Discovery Bank’s chief executive, Hylton Kallner, said: “While it’s only the beginning for us, we are incredibly proud because it reflects the impact of our unique shared-value model that creates value as clients manage their money well and engage with our products and rewards, the ease of use and scalability of our digital banking app and platforms, and ultimately the trust that people are placing in the bank.”

Strategy for growth

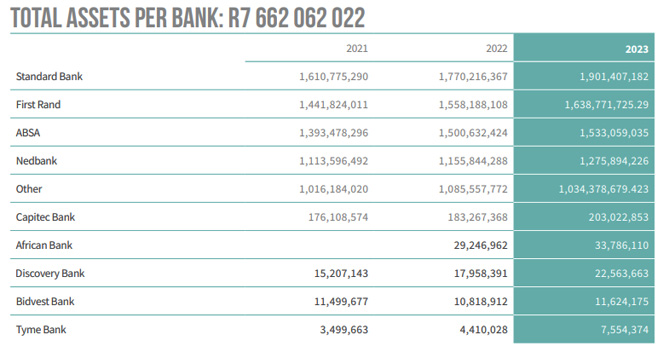

According to the Ombudsman for Banking Services (OBS) 2023 annual report, Discovery Bank ranks eighth (R22 563 663) in total assets per bank. Standard Bank (R1 901 ,407 182) is the largest followed by First Rand (R1 638 771 725.29) and Absa (R1 533 059 035).

When Discovery announced its entry into the banking sector, there was considerable debate about how it would differentiate itself in a market dominated by a few large players. At the time, Adrian Gore, founder and group chief executive of Discovery Limited, said the approach would follow their established business model.

“Our core purpose is ‘to make people healthier’,” Gore said, adding: “This has led us to understand that within the most complex matters of life, death, and money, there is a common strand – behaviour.”

Marketed as South Africa’s first “behavioural bank”, Discovery Bank applied this approach by using technology to incentivise positive lifestyle changes, integrating these incentives into financial services through a shared value model. Different to Discovery’s existing loyalty and reward structures, the bank’s Vitality Money programme focused on changing financial behaviour.

Back then Gore explained that banks generally compete on three key dimensions: fees, interest rates, and rewards. He said established banks tend to focus on fees and rewards, while newer entrants often emphasise fees and interest rates.

However, their research, which analysed more than 12 000 customers and 600 000 transactions, found that fees don’t necessarily reflect actual costs, and the concept of “free banking” is a myth. The study also showed that bank charges typically account for 0.3% to 0.6% of people’s salaries, but he said, managing the remaining 99.5% was even more critical.

Gore said Discovery believed that by changing customer behaviour, they could create economic value that funds incentives, allowing them to compete effectively across all three dimensions.

Now less than five years later, it appears Discovery’s strategy was spot on.

Released in March, the group’s unaudited interim results for the six months to the end of December 2023 showed that the group’s banking business delivered excellent results, achieving its stated target of monthly operational break-even before acquisition costs during the period, ahead of plan.

For the six months under review, Discovery Bank’s operating loss, before new business acquisition costs, improved by 40%. In the first half of 2024, the bank’s client and deposit growth was up 31% to R16.67 billion, with advances increasing by 20% to R5.75bn. Through the shared-value approach, the bank’s clients have also accumulated more than R90 million in interest rate boosts and discounts.

Leveraging the Vitality Money programme, Discovery Bank clients earned an additional R61m in interest on their savings deposits and reduced their repayments of interest by R28m in 2023.

Discovery Bank clients earned (and spent) over seven billion Discovery Miles in 2023 and saved more than R640m when booking more than 900 000 discounted local and international flights through Vitality Travel.

Discovery attributes the bank’s success not only to its unique shared-value banking model but also to ongoing product innovation as a key driver of growth.

Over the past year, the bank introduced a new-generation revolving credit facility and a home loan offering that cuts up to 1% off interest rate repayments.

Read: Discovery Bank launches ‘shared-value’ home loan product

“With these additions, the bank has, in under five years, grown to a completely digital, comprehensive retail bank offering that is attracting over 1 000 new clients a day,” Discovery states.

Winning hearts and minds

Discovery Bank was recently also ranked the top retail bank in South Africa for brand connection and emotional satisfaction in the new 2024 Ask Africa Banking Brand Index.

Research company Ask Africa announced the results of their new Ask Africa Banking Brand Index in July. The index included views from clients across 11 major South African banks.

Discovery Bank stood out as winning the hearts and minds of banking clients across all income groups, with 72% of clients, almost 20% higher than the industry average, experiencing “delight” with the bank and rating it at 9 and 10 out of 10.

Overall, Discovery Bank outperformed the industry to take the prime position as the top banking brand.

According to the index, generally, client satisfaction scores have increased across the banking industry.

Discovery Bank experienced the most significant increase and had the highest “delight” scores. With no clients in the sample feeling dissatisfied, the bank had the highest scores of “delight” and “satisfaction” from 72% and 70% of participants, respectively. The industry average was 54% and 47%, respectively.

Discovery Bank also received higher ratings than the industry average in other perceptions the index evaluated, which included:

- Disruptive banking – taking innovation a step further for clients (17.3% above the industry average);

- Excellent benefits and rewards (21.7% above the industry average);

- A company with my best interests at heart – not just about profits (20.3% above the industry average); and

- Company that recognises your family and your family’s banking needs (16.8% above the industry average).

Kallner said this recognition reaffirms clients’ high satisfaction levels with Discovery Bank’s offering.

“When we started building Discovery Bank, we envisioned a financial institution that would revolutionise banking by applying the shared-value model we pioneered in insurance and healthcare and placing a digital bank branch in every client’s hands.

“Our goal is to drive financial inclusion by democratising private banking services to provide all our clients, irrespective of their product type or income, with personalised, excellent digital service and access to dedicated bankers,” he said.