Sanlam has entered definitive agreements that will result in Sanlam Life acquiring a 25% interest in African Rainbow Capital Financial Services Holdings (Pty) Ltd (ARC FSH), subject to the fulfilment of certain suspensive conditions.

The news comes days after the Competition Tribunal approved Sanlam’s acquisition of Assupol for R6.5 billion.

In a SENS announcement on Monday, the financial services group said the proposed transaction entails:

- Sanlam Life subscribing for ordinary shares in ARC FSH for a cash consideration of R2.413bn; and

- Sanlam Life disposing of its 25% interest in ARC Financial Services Investments Proprietary Limited (ARC FSI), with a value of R1.492bn, to ARC FSH in exchange for the issue by ARC FSH of ordinary shares to the value of R1.492bn to Sanlam Life.

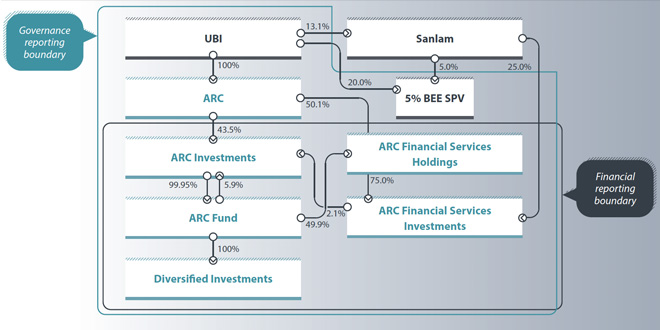

ARC FSH is the investment holding company for all the financial services investments of the Ubuntu-Botho Investments (Pty) Ltd group of companies, other than its shareholding in Sanlam, which is held directly by UBI.

Source: ARC Investments 2023 Integrated Annual Report

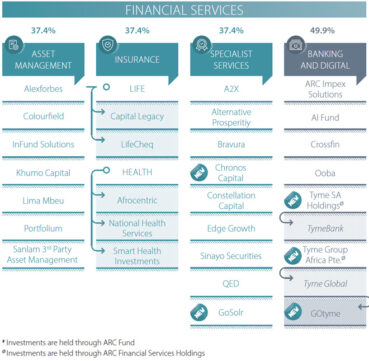

Source: ARC Investments 2023 Integrated Annual Report

Following the conclusion of the proposed transaction, ARC FSH will hold 100% of the shares in ARC FSI, together with its existing investments in Tyme Bank, AI Fund, CrossFin, and Ooba.

ARC FSH is currently owned 50.1% by African Rainbow Capital (Pty) Ltd and 49.9% by the ARC Fund, an en commandite partnership, with UBI General Partner (Pty) Ltd the general partner. ARC and UBI GP are wholly owned subsidiaries of UBI. UBI is, for the purposes of the JSE’s Listings Requirements, a material shareholder in Sanlam and, accordingly, is a related party of Sanlam.

Explaining the rationale for the transaction, Sanlam said UBI is Sanlam’s strategic empowerment partner and, in this context, ARC and Sanlam partner in certain specific strategic initiatives in the financial services sector towards delivering better customer propositions, increasing competition, and promoting financial inclusion. In furtherance of this objective, Sanlam acquired a 25% non-controlling minority stake in ARC FSI in 2021, which has allowed Sanlam to benefit from the growth of the ARC FSI portfolio, strengthen its market presence in South Africa, and expand on its financial inclusion imperative.

“The proposed transaction is a natural extension of Sanlam’s existing interest in ARC FSI. Sanlam will continue to explore ways to collaborate strategically with ARC FSH and its portfolio investments to enhance competition and to assist Sanlam in providing holistic and integrated product offerings to its clients.”

The effective date of the proposed transaction will depend on the fulfilment of the suspensive conditions, including that a new ARC FSH memorandum of incorporation must be filed at the Companies and Intellectual Property Commission. The longstop date is 31 October 2024.

Sanlam Life will also have to pay ARC an outperformance fee, capped at R70 million including VAT, if the value of ARC FSH’s investment in Tyme Asia as at 30 June 2028 exceeds an annual hurdle rate of 14.64%. The outperformance fee (inclusive of VAT) will be capped at R70 million.

ARC FSH’s after-tax profit for the six months to the end of December 2023 amounted to R1.81bn, while its net asset value was R11.99bn. ARC FSI’s profit after tax over the same timeframe was R610m and its net asset value was R5.1bn.

Assupol merger approved

The Competition Tribunal said on 27 August it has approved the Sanlam Life-Assupol merger subject to “an employment-related condition”, which it did not disclose.

Assupol becomes part of Sanlam’s retail mass cluster, together with Sanlam Sky, Safrican, and the Capitec joint venture, which will close at the end of October.

However, Assupol will continue to operate with its own brand and identity and separate management team.

Established in 1913 as a burial society for members of the then South African Police, Assupol has grown into a full-fledged life insurer, providing a range of financial products tailored for focused markets to “people from all walks of life”. These include funeral, life, savings, and retirement products and services.

Sanlam has previously said the acquisition will result in an enhanced product offering, including the ability to capitalise on the businesses’ respective routes to market and leverage cross-selling opportunities.

According to Sanlam Group chief executive Paul Hanratty, the proposed acquisition will place Sanlam in a strong competitive position in the retail mass segment of the South African market.

“Given the envisaged synergies, we are confident it will deliver accretive value for all our stakeholders,” Hanratty said.

For its financial year ending 30 June 2023, Assupol reported an embedded value of more than R7bn, gross insurance premium revenue of over R5bn, and a solvency cover ratio of 179%.

The conclusion of the transaction follows a notice sent to Assupol shareholders in April last year, advising them that Budvest (Pty) Ltd, which held 46.02% of Assupol’s securities, and the World Bank’s International Finance Corporation, which had a 19.41% stake in the company, expressed their intention to sell their holdings.