Last week, the People’s Bank of China (PBoC) unveiled what some commentators have called one of the biggest bazooka stimulus measures ever.

The measures include a war chest to pull China’s stock market out of a four-year slump by lending to asset managers, insurers, and brokers to buy stocks, and, according to Bloomberg, “to listed companies to buy back their stock”.

The monetary stimulus is huge. The PBoC cut bank reserve requirement ratios, benchmark interest rates, and mortgage rates, and lowered downpayment requirements. According to the Financial Times, this comes on top of measures announced previously that “would, in effect, reduce interest rates to buy up unsold housing”.

In addition, the Chinese government is about to issue more than $700 billion in long-term government bonds and special-purpose local government bonds, earmarked for investment in infrastructure or other projects.

The interest rate cut for existing mortgage holders is unquestionably a boon for households, and propping up the Chinese stock market will underscore consumer confidence.

Although some economists think the stimulus will not be enough to get domestic consumption back on a growth path again, China’s leaders have vowed to intensify fiscal support and prop up the Chinese real estate market.

The move by China is massive and promises to be as big as the stimulus in 2008/9 that sparked a boom, reverberating through the global economy and financial markets.

Markets will always doubt whether the PBoC will be successful in its attempt, but it does seem that the Chinese authorities, driven by the politburo, will leave no stone unturned to fast-track the economy.

The impact of this bazooka stimulus by the PBoC on the global economy and financial markets is significant because China tends to lead other economies at major turning points.

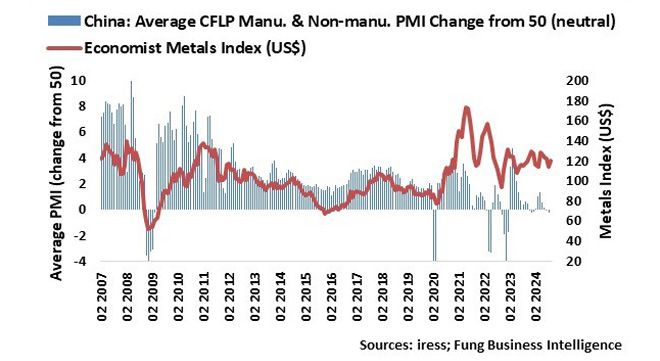

China’s economic activity, as measured by the average official manufacturing and non-manufacturing purchasing managers indexes (PMIs), turned positive as soon as the bazooka stimulus at the end of 2008 was implemented by the PBoC. The manufacturing sector’s PMI in the United States only breached the 50 (neutral level) on the upside four months later.

It means the global economy is entering a transitional phase, moving away from recessionary conditions to the initial stages of recovery. Yes, no hard landing. This transitional phase has a significant impact on one’s strategic investment positioning.

This stage is typically characterised by long-term government bond yields in developed economies bottoming and starting to rise despite key official rates continuing to decline. Yes, it marks the end of inverted yield curves, where shorter-term bond yields were higher than those of longer-dated bonds as higher inflation expectations are repriced in financial assets.

At the end of 2008, the bear market in metals (metal prices, measured by the Economist Metals Index (US$)) ended abruptly with the implementation of the PBoC’s then massive stimulus. It is not dissimilar now. Commodity prices, specifically metal prices, have bottomed, and are already gaining momentum as supply in cases such as platinum and palladium have shrunk because of cost-induced production curtailment. The PBoC’s new stimulus will undoubtedly lead to increased Chinese upstream raw material demand.

In this intermediary cycle, investors are also likely to start to reprice stocks for the recovery as they lean towards risk-on strategies. Commodity-based emerging market bonds, stocks, and currencies start to outperform, while economic cyclical stocks in developed countries are favoured ahead of non-cyclicals.

Yes, geopolitical risks are elevated, the US election is around the corner, and Black Swan events are lurking, but I’m inclined to up my risk budget in favour of risk assets benefiting from China’s melt up.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

Thank you.

Insightful.