Covering home or car expenses and settling short-term debt are the two main reasons for retirement fund members making withdrawals from their savings components, says Discovery Corporate and Employee Benefits.

Discovery’s employee benefits business represents more than 3 000 employer groups and just over one million employees.

It asked claimants why they have chosen to access their savings components, created in terms of the two-pot retirement system, which was implemented on 1 September.

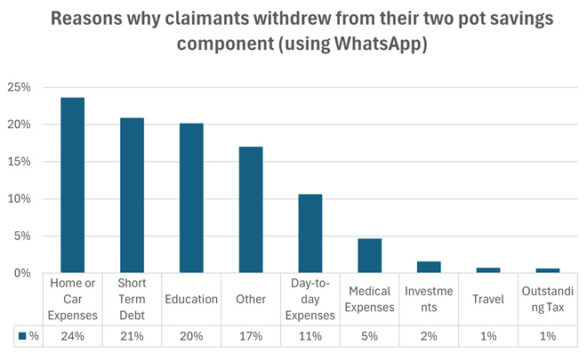

Guy Chennells, the chief commercial officer of Discovery Corporate and Employee Benefits, said the data was gathered from individuals who submitted withdrawal requests via the business’s WhatsApp channel.

“Responses showed that the main reason our claimants withdrew from their savings was to resolve home or car expenses (24%). This was closely followed by a need to pay off short-term debt (21%),” he said.

“We found it surprising that a big group of claimants (20%) was using the extra money for education, presumably in the majority of cases for children’s school fees, as well as for day-to-day expenses (11%). Sadly, these are all indications of the cost-of-living crisis faced by so many,” he said.

Source: Discovery Corporate and Employee Benefits (16 to 27 September 2024)

Chennells said that claimants who chose the “Other” category (17%) were asked to provide a written example of what “Other” meant for them. Most said the withdrawn money would be used for home improvements and renovations.

“This isn’t really recommended as a good use of two-pot savings because it does not truly classify as ‘emergency spending’. It’s still understandable, though, because South Africans who want to improve their lives are simply unable to create discretionary spending from their regular income at the moment,” Chennels said.

Lower than expected

Although the daily withdrawal volumes were much higher than usual from 1 September, only 22% of Discovery Corporate and Employee Benefits’ members who qualified to make a withdraw have done so, to date.

“So far, two-pot withdrawals have been lower than our team expected, and we hope that some of this is due to people changing their minds about dipping into their retirement savings,” Chennells said.

“Understanding other options for short-term capital, or how much more you will have to contribute to your fund later if you withdraw, or how much you will lose to tax, has proved critical in helping people make the right decisions.

“There might be another spike in withdrawals in November during Black Friday, possibly another at Christmas, and a third early next year as the new school year starts. However, the relatively low percentage of overall withdrawals shows that most people understand they must only draw on their savings pots in genuine financial emergencies. They realise that the more disciplined you are about not withdrawing, the more you will have available if one day you really do need it,” Chennells said.

Most claims by people between 35 and 45 years

If middle-aged claimants are split into two separate groups of 35 to 45 years and 45 to 55 years, withdrawals among individuals between 35 and 45 have been higher (27% of those eligible).

“This figure emphasises the pressures facing South Africa’s ‘sandwich generation’, who are battling to support young children while potentially being responsible for their older parents too,” Chennells said. “This is worsened by the recent high-inflation cycle, increased debt and electricity costs, and other cost-of-living pressures which have devastated household finances, especially for families.”

Of the 22% of total withdrawals recorded during September, Discovery’s Corporate and Employee Benefits’ data set highlights a range: from more than 40% for those who are middle-aged with a low- to medium-income (low: R0 to R125 000 a year; medium: R125 000 to R500 000 a year), to less than 1% for those individuals over 55 years old who also had very high income (more than R1 million a year).

“By age alone, withdrawal rates were similar for the young and middle-aged (around 25%), but about half that for the over 55 group (13%),” Chennells said.

Income was a much stronger driver of withdrawal rates, with low-income claimants at 38%, middle-income claimants at 29%, high-income at 12%, and very high-income claimants at only 4%.

Eligibility affects withdrawals

Chennells said the withdrawal rates during September should be understood within the context that many people did not qualify for a withdrawal for two key reasons:

- There was less than R2 000 (the minimum withdrawal amount) in their savings component after it was seeded with the savings accumulated in their vested component.

- Members of provident funds who were 55 years or older on 1 March 2021 and have remained a member of the same provident fund are automatically exempted from the two-pot retirement system. They must choose to opt in before the seeding will occur.

The data showed that claimants’ eligibility to make a withdrawal was different by age and income.

By age, 45% of those below 35 qualified in September, 71% of those between 35 and 55 qualified, and 61% of those over 55 were eligible. For those over 55, a further 20% would have enough savings to qualify if they opted in.

By income, the data is even more stark. Of those earning R125 000 a year or less (low income), only 34% were eligible.

“As this is the group with the highest claiming rate, withdrawals overall would have been much higher without the R2 000 minimum requirement,” Chennells said. “It also means that withdrawals are expected to rise by the end of the year as savings components grow with contributions and investment returns.”

Of the middle-income group (R125 000 to R500 000 a year), 67% qualified, while 83% of the high-income group (R500 000 to R1m a year), and 90% of the very high-income group (above R1m a year) qualified.