The FSCA imposed administrative penalties totalling some R943 million on 31 people in 2023/24, a substantial increase on the approximately R100m imposed on 44 people in the previous financial year.

This is according to the Authority’s 2023/24 integrated report, which was released last week.

The R943m includes the R475m fine imposed on the late Markus Jooste for market abuse contraventions. Two other substantial fines were R216m imposed on the director of CBI X SA, Coenraad Botha, and the R143m fine imposed on Classic Financial Services One’s Jacobus Geldenhuis.

Read: CBI director fined R216 million and debarred for 10 years

Read: FSCA imposes R143m penalty on Classic Financial Services director, creditors unaffected

The Authority also increased the penalties it imposed for non-compliance with the Financial Intelligence Centre Act, as illustrated by the R16m penalty on Ashburton Fund Managers.

Read: FSCA fines asset manager R16m for FICA non-compliance

The Authority debarred 156 people from providing financial services, a slight decrease from the previous period’s 210 debarments.

The FSCA’s 2023/24 Regulatory Actions Report states that most debarments were because of dishonest conduct. As in 2022/23, a significant number of debarments resulted from representatives submitting false policies.

By comparison, FSPs debarred 1 312 representatives in 2023/24, about 95% of which were for dishonest conduct. There was a 15% increase in debarments by FSPs compared to the previous reporting period.

The number of debarred representatives, including FSCA and FSP debarments, constituted only 0.8% of the total number of appointed representatives in 2023/24, according to the Regulatory Actions Report.

Licence approvals

The FSCA approved the licences of 668 FSPs, compared to 584 in the previous year. This resulted in the number of authorised FSPs increasing from 11 740 in 2022/23 to 11 890 in 2023/24.

A total of 38 over-the-counter derivative providers (ODPs), comprising 16 bank and 22 non-bank ODPs, were approved, compared to the 24 licences granted in 2023.

The FSCA concurred with the Prudential Authority (PA) to approve the registration of two co-operative financial institutions, one mutual bank, one local commercial bank, and one representative office of a foreign bank.

The Authority also concurred with the PA in approving the deregistration of one co-operative bank, one representative office of a foreign bank, and one branch of a foreign bank.

The total number of active benefit administrators during the reporting period was 114, a decrease from the 127 in the previous year. This is because 13 benefit administrators were considered for deregistration, thereby increasing the total number of inactive entities to 59.

The Authority concurred with the PA in approving one cell captive insurer and one microinsurer. It also concurred with the PA in withdrawing the licence of one microinsurer.

Four microinsurance licence applications were declined by the PA.

“The applicants failed to comply with the minimum requirements, and after multiple engagements to provide guidance, the applicants still failed to demonstrate that they have the capacity and resources to operate as microinsurers,” the FSCA said.

Suspensions and withdrawals

The FSCA suspended the licences of 1 061 FSPs (2022/23: 984) and withdrew 75 licences (420). Notably, 97% of the suspensions were because of the non-submission of statutory returns and/or non-payment of levies.

Of the 1 061 suspensions, 58% (621) were lifted after the financial institutions rectified their non-compliance, according to the Regulatory Actions Report.

Investigations and warnings

The Authority registered 483 new investigation cases and finalised 418 in 2023/24.

Most new cases related to potential misconduct in the FAIS and insurance sectors. Unauthorised FAIS business and fraud involving the FAIS regulatory examinations accounted for 61% and 8%, respectively, of the FAIS investigations. Additionally, most of the insurance investigations involved unregistered funeral policy businesses.

During the reporting period, the FSCA published 104 public warnings, which is was an increase of 121% compared to the previous period. These warnings mainly related to unregistered financial services, social media-based scams, and impersonations.

Financial performance

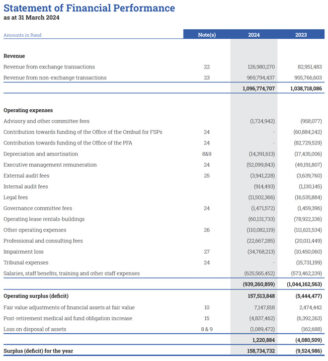

The Authority derives its revenue from “exchange” and “non-exchange” transactions. Exchange transactions include fees and service charges and income from investments, while non-exchange transactions mainly consist of levies and fines.

It should be noted that the FSCA is required to pay the money it receives from fines and penalties over to National Treasury, which transfers the money to the National Revenue Fund. The FSCA can claim the cost of conducting inspections and recovering fines.

Total revenue grew by 5.6% to R1.096 billion (2022/23: R1.038bn) against a budget of R977m.

Levy revenue increased by 22.6%, from R785 647 877 to R969 794 437.

The FAIS (31%), retirement (21%), insurance (18%), and banking (11%) sectors continued to be the major contributors to the FSCA’s levy income.

Total operating costs decreased by 10% to R939m (2022/23: R1.044bn). The Authority attributed the decrease to cost-containment measures that included a hybrid working model and a reduction in rent for office space.

The Authority ended the financial year with a surplus of R158.7m, compared with deficits of R9.5m in 2022/23 and R4.9m in 2021/22. It attributed the turnaround to an increase in levies, including the special levy, and savings in office rental and other operating costs.