As 2025 contribution increases loom, medical schemes are touting value-adds, digital health solutions, and wellness programmes in a bid to soften the blow. Yet, for members facing significant hikes next year, these enhancements offer little relief.

Among South Africa’s top medical schemes, Discovery Health Medical Scheme (DHMS) announced a weighted average increase of 9.3%, Bonitas of 10.2%, Momentum of 9.4%, and Medihelp of 10.8%. Medical scheme administrators argue these increases are essential to ensure the financial stability and sustainability of their offerings.

The Council for Medical Schemes (CMS) uses CPI and salary inflation to assess contribution affordability, but medical schemes argue that medical inflation is a more accurate metric.

In Circular 35 of 2024, issued on 1 August, the CMS urged medical schemes to limit their 2025 tariff increases to 4.4%, aligned with the South African Reserve Bank’s CPI forecast, plus “reasonable” utilisation estimates. Although the circular outlined the factors for evaluating contribution increases and benefit changes, it did not specify what would be considered “reasonable utilisation”.

Globally, healthcare inflation typically exceeds CPI, and in South Africa, healthcare costs usually rise by CPI + 2% to CPI + 4% annually.

Lee Callakoppen, principal officer of Bonitas, says over the past few years, the scheme has kept its contribution increases well below the industry average. In fact, Bonitas did have the lowest increase among the top five for 2024 – 6.9%. However, for 2025 the scheme comes in third, with DHMS now taking the pole position.

Read: Discovery announces 2025 contribution increases: average hike of 9.3%

Callakoppen says although Bonitas has seen a positive performance, they had to take measures to prevent instability in their environment in arriving at a weighted increase of 10.2% as of 1 January.

“The Bonitas board and executive’s input considered market trends, including international healthcare protocols, industry analysis, benchmarking reports, and benefit utilisation patterns. Integral to this process was independently commissioned research across core stakeholder groups including brokers, HR representatives, corporates, and local government,” he says.

Momentum Health Solutions states that medical inflation has increased above CPI once again. It was below CPI during the Covid-19 years.

“This, coupled with the increase in the utilisation of healthcare services, has resulted in increased claims costs. The industry is not growing, and the profile of the market is ageing. However, given all these challenges, the sector has shown remarkable resilience and adaptability.”

Koena Molekoa, Medihelp’s senior manager of business development, highlighted several factors influencing contribution increases.

“Firstly, you’ve got tariffs that are between 4.5% to about 4.9%, and then you’ve got the supply side inflation,” he explained. “But you’ve got the supply side and the demand side, and those are between 1.21% to 2% and 1.9% to 4% respectively. Then you’ve got the reserve building.”

In the circular, the CMS highlighted a worrying trend: contribution hikes have been outpacing inflation, even though there was a temporary dip during the Covid-19 pandemic. The regulator raised concerns about the long-term implications of this pattern, warning it has “significant ramifications for the industry’s long-term sustainability” and poses a serious affordability challenge for consumers.

In the current economic climate, contribution increases above inflation are, as the CMS puts it, “beyond the budget of most consumers”. The regulator also notes that high rates create barriers for new entrants to private healthcare, further threatening the industry’s sustainability.

For cash-strapped consumers, the impact is clear: many will be forced to shop around for the best value, with some likely downgrading their plans to make ends meet. The affordability crisis in healthcare is becoming more pronounced, leaving members with tough decisions in the year ahead.

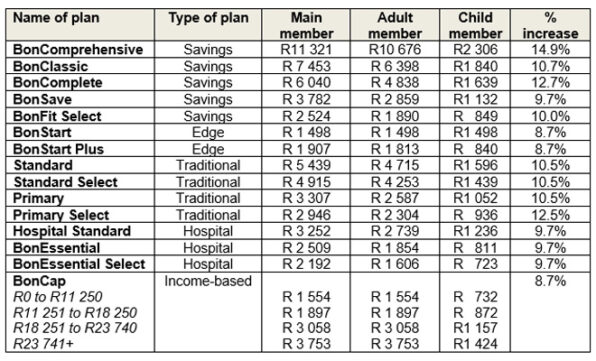

Bonitas

Bonitas’s contribution increases range from 8.7% to 14.9% per plan, with the latter impacting only 1% of members.

The scheme’s gross contribution increases for 2025 across its benefit plans are:

What’s new

For 2025, Bonitas has introduced several enhancements across its offerings:

- The GP network now includes a mental health component for integrated chronic care. In hearing loss management, free online hearing screenings are available for all South Africans, with selected plans covering hearing aids and audiology services through network providers.

- The Weight Management Programme, led by a biokineticist, provides access to a dietician and psychologist for comprehensive support on exercise, nutrition, and mental health.

- The Female Health Programme, part of the expanded Mother and Child Care Benefit, emphasises preventative care and the early detection of women’s health issues. The enhanced Maternity Programme includes high-risk pregnancy support, post-childbirth care, and health screenings for children under three.

- Bonitas Geriatric Care offers in-home wellness screenings, vaccines, cancer screenings, and chronic care management for seniors, all covered from Risk. The diabetic retinopathy screening, in partnership with PPN, uses AI to detect eye conditions linked to diabetes.

- The Benefit Booster now provides up to R5 000 for out-of-hospital expenses on seven plans, at no extra cost.

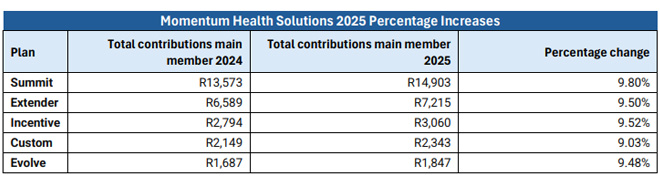

Momentum Medical Scheme

Momentum Health Solutions (MMS) members will see contribution increases varying by plan, with no increases reaching double digits. Additionally, for the 10th consecutive year, there will be no reductions in benefits.

MMS’s gross contribution increases for 2025 across its benefit plans are:

Momentum Health’s weighted average increase for 2024 was 9.6%.

Damian McHugh, the chief marketing officer of MMS, says this reflects the scheme’s commitment to balancing affordability with the need to provide high-quality healthcare cover.

“The scheme’s approach to contribution adjustments is guided by a thorough analysis of healthcare cost trends, member utilisation patterns, and economic factors. By taking a data-driven approach, Momentum Medical Scheme made informed decisions that benefit both members and the Scheme,” explains McHugh.

MMS states that when considering an option for the upcoming year, it is crucial to understand how these adjustments impact choices.

“Prioritising value over cost is essential; cheaper plans often come with limited benefits and higher out-of-pocket expenses. Investing in a comprehensive plan that meets healthcare needs ensures the best care and support. By understanding the full range of benefits, members can make informed decisions that maximise their health outcomes and financial well-being.”

What’s new

MMS will introduce benefit enhancements, which include:

- An updated low-income option;

- Easier and more accessible rewards, and the ability to use these rewards to pay medical scheme contributions.

- An easy digital process that demonstrates how much consumers can save monthly without having to buy down.

- Momentum Multiply will now offer the digital health and fitness assessment to all its members.

- Wysa, an emotional intelligent chatbot, is another feature that Momentum Multiply introduced for members to support mental wellness. The AI-powered “companion” provides 24/7 emotional support through mood trackers, journaling prompts, and guided exercises based on cognitive behaviour therapy and mindfulness.

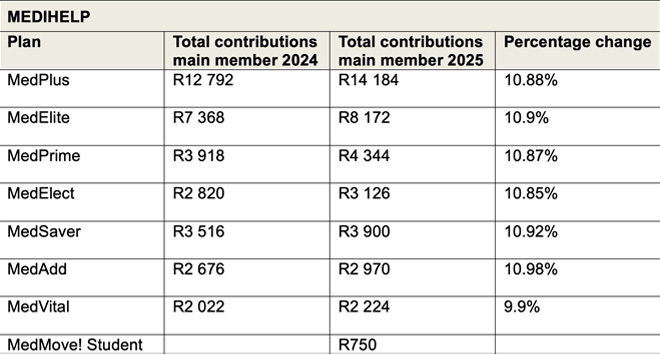

Medihelp

Varsha Vala, Medihelp’s principal officer, says the average weighted contribution increase of 10.8% on all its plans increase is sensitive to the pockets of members.

“Our rapid growth and previous price adjustments placed our solvency under pressure, but we are ahead of our budgeted solvency ratio, which we attribute to our profile of members and our risk management strategy,” says Vala.

Medihelp’s solvency ratio dropped by 10 percentage points in 2023, falling 2% below the required 25%. In its 2023 annual report, released on 20 June, chairperson Chris Klopper attributed the decline to increased hospital admissions, rising medical costs, and a claims ratio of 100.8%.

To address the shortfall, Medihelp’s trustees and executives submitted a three-year plan to the CMS ahead of the 2024 product launch, outlining necessary contribution increases to restore reserves to the statutory 25% level.

In 2021, Medihelp used reserves to ease economic pressure on members by reducing premiums by 0.45% for 2022, followed by a 7.5% increase in 2023. However, in 2024, it announced the highest contribution increase (15.96%) among the big schemes, citing membership growth straining reserves.

Read: Medihelp’s solvency ratio drops below threshold amid high claims and rising costs

Commenting on the 10.8% increase for 2025, Vala says: “It’s important that we realise that during Covid, we actually gave back to our members. Our advisers would remember that point. Subsequent to that, we adjusted for giving back during that Covid time, and now we can see a levelling out in terms of a competitive increase and becoming more competitive over time.”

Medihelp has seen a significant turnaround in its solvency, according to Vala, with a marked improvement over the past year. “We’ve seen a 3% improvement against our budgeted levels,” Vala explains.

“The big driving factor here, obviously, is rapid growth. And at Medihelp, we’ve actually experienced rapid growth over the last three years. So that is one of the key contributors to that solvency position.”

Vala expresses optimism about the future, noting that Medihelp’s strategic plans will support further improvements in its solvency over the next two to three years. “I think with regards to all the plans we have in place, you know, we are able to, with confidence, look forward to our solvency levels improving.”

MediHelp’s gross contribution increases for 2025 across its benefit plans are:

What’s new

Medihelp’s product enhancements for 2025 include:

- MedElect, tailored for employer groups, now extends child beneficiary coverage up to age 26, a significant increase from 21.

- Day-to-day limits per beneficiary are set to rise by 94%.

- MedSaver members will enjoy a boost, receiving R2 500 once their medical savings account is exhausted—a 110% increase for GP consultations, specialists, and medications. Annual day-to-day benefits per member are also up by 80%.

- Under MedMove!, students can access quality healthcare for R750 monthly.

- Limits will increase by 5%.

“All these changes still have to be approved by the Council for Medical Schemes,” says Vala.

In addition, Medihelp will implement personalised care initiatives. These include a parenting journey with access to a digital companion and a digital personal assistant to support new moms and dads during the first phase of parenthood.

A dedicated programme for members with depression that will support them in and out of hospital. Medihelp now also includes the services of a social worker in the benefit.

A post-hospital care innovation. “This offering has been introduced several months ago and already we’ve already reduced preventable hospital re-admissions by 15%,” Medihelp states.

The 2025 contribution increases are set to take effect on 1 January, pending approval by the CMS.

Why not reflect Discovery Contributions Increase as well?

We reported extensively on Discovery’s proposed increase in September: https://www.moonstone.co.za/discovery-announces-2025-contribution-increases-average-hike-of-9-3/