Old Mutual has paid more than 200 000 claims totalling R2.3 billion since the launch of the two-pot retirement system on 1 September, the financial services group said last week.

The group has received 226 000 savings benefit withdrawal claims, and it receives about 3 200 applications a day via the Old Mutual WhatsApp channel.

“The South African Revenue Service (SARS) has been prompt in providing tax directives, and this has enabled us to handle claims with minimal delays,” said Michelle Acton, Old Mutual’s chief customer officer.

SARS said this month it had paid out R21.4 billion in savings component withdrawal claims by 11 October.

The two-pot system provides for a savings component, to which one-third of a member’s contributions are allocated, and a retirement component, to which the remaining two-thirds are allocated. Members may withdraw the accumulated amount from the savings component once in a tax year, but the savings in the retirement component must be preserved until the member retires and used to buy an annuity.

To qualify for a withdrawal, members must have at least R2 000 in their savings component in a pension or provident fund, a retirement annuity (RA) fund, or a pension or provident preservation fund.

Acton advises members still considering a withdrawal to take a considered approach before accessing their retirement savings.

“There is no need to rush. The system is here to stay, so take your time to assess whether a withdrawal is the right choice for your financial circumstances,” she said.

“Old Mutual encourages members to carefully review their financial situation before tapping into their emergency savings. It’s important to speak to a financial adviser to understand the tax implications and how a withdrawal might affect long-term financial goals,” she said.

Pre-retirement withdrawals from the savings component are taxed at fund member’s marginal tax rate, and the fund’s administrator will deduct a fee for processing the withdrawal.

A survey conducted by Old Mutual months before the two-pot system’s implementation found that about 60% of its fund members were planning to withdraw money from their savings components.

Acton said although Old Mutual does not yet have specific data on how members are using their withdrawals, the 2024 Old Mutual Savings and Investment Monitor provides insights into expected spending patterns, with many members planning to use their savings for debt repayments (60%), emergencies (23%), and medical expenses (4%).

Impact on retirement income

Momentum Consult said last week that, according to its financial advisers, most fund members are using savings benefit withdrawals to settle short-term debt.

Marianne Smith, a financial adviser and franchise principal at Momentum Consult, said most of those dipping into their retirement savings are struggling financially.

“Statistics show us that most of those who have withdrawn from their savings pot are between the ages of 40 and 50 years old. Typically, these clients have home loans and vehicle financing agreements in place and were caught off-guard by the increase in interest rates over the last few years. They maxed out their affordability for their credit agreements and needed to tap into their retirement savings to bridge the shortfall.”

Smith warned that most clients, even if they belong to an employer-funded retirement fund, do not have sufficient retirement savings to sustain themselves in retirement.

“Even a once-off withdrawal of R30 000 from your savings pot will mean a reduction of around R500 000 in retirement savings over a 25-year period. So, you can imagine what annual withdrawals will do to your retirement nest egg. Accessing your retirement savings should be a last resort because it can compromise your future financial security.”

Smith, along with many other financial advisers, said members should only consider accessing their savings components before retirement if they are experiencing extreme financial hardship.

Paul Menge, an actuarial specialist at Momentum Investo, said although only about 1% of its clients made savings component withdrawals, it was a concern that many of those who did so were between 40 and 49 years, which means they do not have a lot of time left until they retire.

“Most of us realise that it is time in the market that earns us the most growth – and that the last couple of years are the ones where we build the most value. This is because the more money you have, the more your growth can snowball,” Menge said.

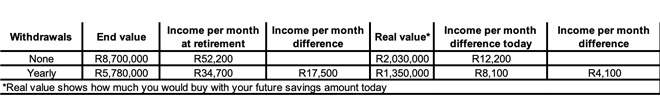

To illustrate his point, Menge provided scenarios where two people invest R3 000 a month in an RA for 25 years. They increase their contributions by 10% a year. The scenarios assume investment growth of 12% before fees, inflation of 6%, and that each R1 million can buy an income of R6 000 a month at retirement.

The table below shows the retirement values for the person who never withdraws and for the person two withdraws all they can every year.

Menge said the person who withdraws annually is giving up a third of their income during retirement. “With inflation being the bully it is, eating away at savings, this is not a great idea.”

He said people who have been withdrawing can ask a financial adviser for help. An adviser can calculate how much they must save to catch up to where they would have been if they had not made withdrawals.