Financial advisers are tackling a pressing challenge: attracting a younger client base. Bidvest Life’s 2023 claims report points to an effective approach – kickstarting conversations with income protection tailored for young lives.

Presenting the report to Bidvest Life’s financial advisers, Nic Smit, product and pricing executive, said a recurring concern in discussions is the challenge of an ageing client base.

“Many advisers have built their financial practices on established clients who are now approaching retirement, and if they want to continue to sell risk, they have to pivot to a younger audience.”

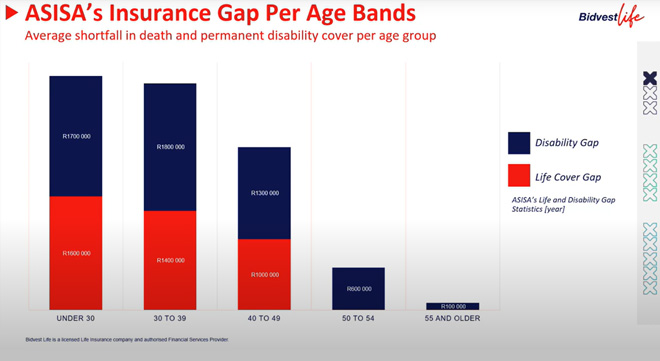

ASISA’s insurance gap analysis shows that younger South Africans are more likely to face significant insurance shortfalls. For those under 40, representing 56% of the country’s 14.3 million income-earners, gaps in disability and life cover are particularly pronounced.

Smit says this means that more than half of South Africans have substantial insurance gaps.

“If you’re concerned about ageing client bases and being unable to sell to younger clients, it’s not just in your head. The data agrees with you. Being able to sell to younger lives isn’t just good for your business and our business, it’s a necessity for us to address the very real need in the South African life insurance market today.”

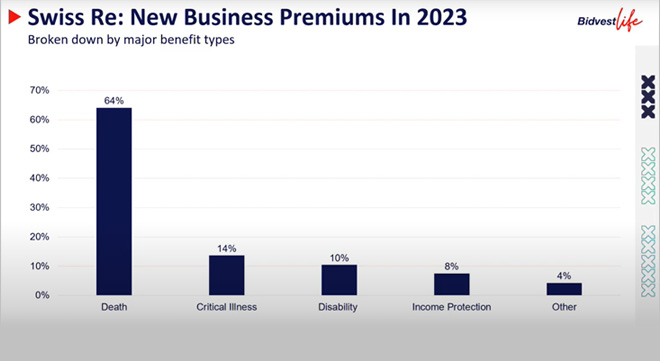

A Swiss Re survey on new business premiums in 2023, broken down into major benefit types, shows that death cover completely dominates life insurance sales in South Africa; nearly two-thirds of new business premiums are for death benefits.

Smit says death cover is important, but he asks whether this is the benefit that resonates the most with younger clients.

He says a key metric to consider is the likelihood of a claim on a benefit. Bidvest conducted an analysis in 2023, examining the probability of death claims compared to income protection claims among its policyholders.

The results were striking: policyholders were found to be 17 times more likely to file a claim for income protection benefits than for death benefits. This figure encompasses all age groups across the book. When the focus shifts specifically to millennials – those aged 28 to 43 – the likelihood of claiming income protection benefits skyrockets to 55 times more than that of death benefits.

In analysing Bidvest’s 2023 claims for income protection and death benefits, millennials represented only 12% of all death claims but a significant 50% of income protection claims.

Referring to ASISA’s gap study, Smit raises a key question: could millennials’ life insurance gaps be because of a perception that life insurance is primarily for death coverage, a risk that is “not most real to them”? He suggests shifting from the traditional approach of leading with death coverage to focusing on income protection when engaging younger clients.

To support this approach, Smit outlines four key concepts to guide advisers in repositioning their strategy.

Clients have a high chance of their income protection claim being paid out

Bidvest Life’s 2023 claims report highlights the two most common misconceptions young people hold about life insurance: first, that they don’t need it yet, and second, that it’s too expensive. But Smit says for younger lives, and across generations, income protection offers significant value at an affordable price.

“Even if your clients are young and healthy now, they need a safety net in case of an accident or illness that robs them of the potential to live the life they’re planning,” says Smit. “The younger a person is, the more affordable their life insurance will be, which can help you to attract younger clients.”

According to Smit, the average person has a negative view about life insurance claims, “and so in the main, they probably assume that they have a far less likelihood of their claim being paid out than they do in reality”.

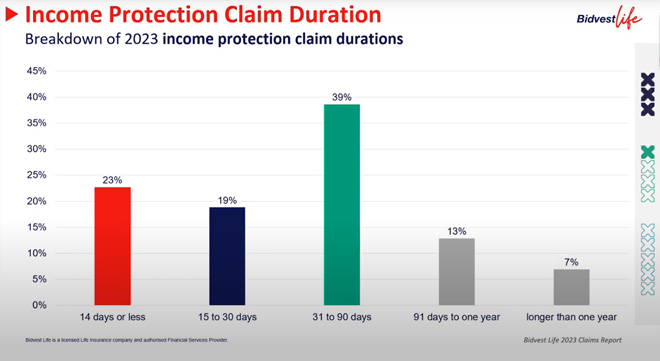

Bidvest’s stats show that with income protection, clients have a high likelihood of their claims being paid out. The report shows that 91.5% of all lodged, unique income protection claims were paid in 2023. The primary reason for non-payment was policyholders attempting to claim during their waiting periods – the number of days a policyholder must be sick or unable to work before an income protection claim policy will start paying.

Income protection is usually sold on either a seven- or 30-day waiting period. Bidvest also provides a 14-day waiting period as an option.

The report shows that the average duration of an income protection claim was much shorter for younger policyholders than the overall average. In other words, waiting periods become even more important for young lives. Smit explains this is because they typically have shorter claim periods, putting them at a much higher risk of being unable to claim if they do not have access to the right type of cover.

Income protection claims are paid out with speed and efficiency

In 2023, Bidvest Life paid out 8% of income protection claims in the first 24 hours, 33% within one week, 47% within two weeks, and 73% were paid within a month of submission.

“Some of these claims will have waiting periods of 30 and 90 days where it’s physically impossible to pay within the first month, so that really is an outstanding result,” says Smit.

On the technical side, he says Bidvest’s Fast-Track Criterion, which was added to its product in 2015, drives quicker claims processing.

“We recognised that like most, income protection claims are a result of a fairly short list of common things that happen to people. So, we identified what are the common things that happen to people and that cause people to have income protection claims. We listed 200-plus events. And when these things happen to you, the claim can start. We just need to verify that that thing actually happened to you.”

He says another factor driving the speed of claims processing is the mindset and experience of the claims team.

“The most progressive product in the hands of a bureaucratic claims team probably won’t result in a great claims experience, and we have in Bidvest Life the most experienced claims team in the country when it comes to dealing with income protection.

“They are familiar with the differences that need to be taken into account when you assess income protection claims. They understand that there will be lots of claims, there’s speed that’s important, and you need to be in constant communication with people when they are really stressed.”

You can claim multiple times on income benefits

In 2023, Bidvest conducted an analysis of its income protection claims, examining the claim history of policyholders who submitted claims during the year. The company found that 49% of all income protection claims paid in 2023 were for individuals who had previously claimed under the same policy.

One example shared by Smit involved a self-employed client who faced multiple unrelated claim events over a decade. These cumulative “days in claim” – days when she was unable to work – amounted to 305 days, resulting in a total payout of R254 023.30.

Reflecting on the case, Smit raises an important consideration: “But let’s consider if ‘Michelle’ had been salaried. And I think most people, when they earn a salary, when they think about income protection, go, ‘Well, I have sick leave, and my employer will look after me if I’m sick’.”

This assumption, Smit explains, may lead to unexpected risks. “The reality is that over 10 years, you would only have a sick leave rolling of 120 days access. So, if you’re unable to work for 305 days, [it] means that even a salaried person would have an exposure of 185 days over the past 10 years where they were unable to work.”

Envisioning a claimable protection event is easier than you think

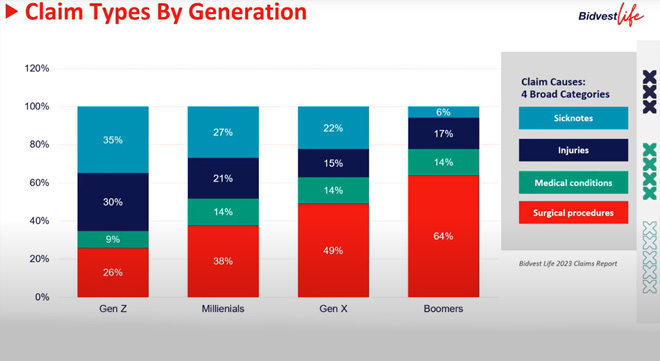

According to Bidvest’s claims experience, the younger you are, the more likely you are to have a “sick note” or an injury claim, and the older you are, the more likely you are to have a claim because of surgical procedures.

The “sick note” category typically involves short-term, minor claims: situations where a doctor’s visit results in a medical certificate confirming a brief inability to work. Injury claims, by contrast, often involve fractures or serious muscle tears stemming from physical accidents. Claims for surgical procedures are generally more complex, covering cases where a policyholder is admitted to the hospital, undergoes surgery, and requires recovery time following the operation.

The top five most common claim causes for millennials are childbirth, minor infections, cancer, mental illness, and haemorrhoidectomy, in that order.

The Deloitte Global 2024 Gen Z and Millennial Survey indicates that mental health is still a concern for younger people, with 40% of Gen Zs and 35% of millennials saying they feel stressed all or most of the time.

Given that the oldest millennials are now 43, and childbirth is the biggest event being claimed for in this age group, Smit says this also presents an opportunity for advisers to build a pipeline of future clients by including their clients’ children in their financial planning discussions.

For instance, he says, clients could start with the Child Protector benefit on a parent’s policy for children younger than 18, move into Student Cover provided by the child’s own Event Based policy from age 18, and from there the child could take on their own Comprehensive policy once they start working and are financially independent, essentially creating “clients for life”.