The FSCA is proposing to increase by 5% the levies paid by the entities it supervises in the 2025/26 financial year.

The Authority on Monday published its budget and levy and fee proposals for 2025/26 and its estimates of expenditure for 2026/27 and 2027/28.

The FSCA is not proposing to increase the fees it charges for performing supervisory activities in 2025/26. These fees increased by 6% at the beginning of this month.

Read: FSCA to implement fee increase in October

The Financial Sector and Deposit Insurance Levies Act provides for the imposition of levies on supervised entities to fund the Prudential Authority (PA), the FSCA, the Ombud Council, the Financial Services Tribunal, and the two statutory ombud schemes: the FAIS Ombud and the Pension Funds Adjudicator. It also provides for the imposition of levies on the banks to fund the Deposit Insurance Scheme.

In terms of the Act, the levies must be increased by the arithmetic mean of the Consumer Price Index (CPI) as published by Statistics South Africa in the preceding calendar year.

Stats SA published a CPI of 6% in December 2023, the FSCA said in the statement accompanying its budget and levy proposals. Therefore, the Authority is entitled to increase the levies by 6% in 2025/26. However, it is proposing a 5% increase “in line with its projected expenditure”.

The Levies Act empowers the Minister of Finance, by notice in the Government Gazette, to determine that there must be no levy increase or a below-CPI increase.

How much FSPs will pay

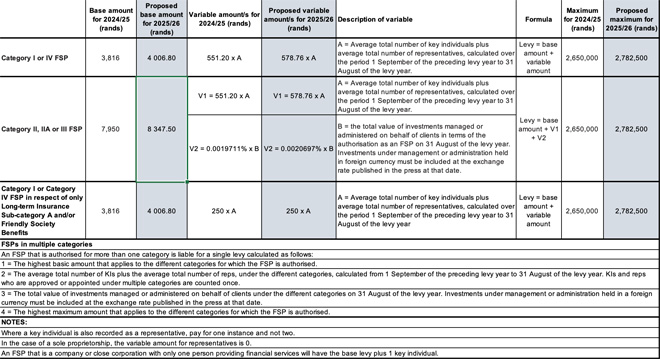

The FSCA levy comprises a base amount and a variable amount or amounts.

If the 5% increase is implemented, Category I and IV FSPs and Category I and IV FSPs that provide only Long-term Insurance Subcategory A products and/or Friendly Society Benefits will pay a base amount of R4 006.80 instead of R3 816.

The base amount for Category II, IIA, or III FSPs will rise from R7 950 to R8 347.50.

FSPs must add the amount per representative and KI to the base amount.

The amount for each rep and KI for Category I and IV and Category II, IIA, and III FSPs will increase from R551.20 to R578.76.

However, the Authority is – as was the case last year – proposing not to increase the rep and KI amount for Category I and IV FSPs that provide only Long-term Insurance Subcategory A products and/or Friendly Society Benefits. It will remain at R250.

A Category II, IIA, and III FSP must calculate its total FSCA levy by adding to the base amount its total rep and KI amount and the variable amount on the total value of investments under management or administration on 31 August of the levy year.

The percentage used to calculate the levy on investments under management or administration will increase from 0.0019711% to 0.0020697%.

The FSCA is also proposing a 5% increase in the cap on the maximum levy payable by any category of FSP, from R2.65 million to R2 782 500.

Other bodies’ proposed increases

The FSCA levy is only one component of the levies payable by FSPs and other entities regulated by the Authority.

Last month, the FAIS Ombud announced its proposed levy increase for 2025/26. It does not propose increasing the base amount, which will remain at R1 100, but it does propose increasing the amount per KI and representative by 4.6%, from R690 to R722.

Read: FAIS Ombud proposes increasing the KI and representative levy

The Pension Funds Adjudicator is proposing to increase its levy by 4.7%. If implemented, the increase will result in retirement funds paying R10.87 per eligible member instead of R10.38.

Read: Adjudicator says levy increase will support operational independence

The levy payable to the Ombud Council is equal to a fixed percentage (2.5%) of the levy amounts payable to the FSCA.

The levy payable to the Tribunal is equal to 2.65% of the levy payable to the PA and/or the FSCA.

Supervised entities had to pay a 7.5% special levy in the first two financial years after the implementation of the Financial Sector and Deposit Insurance Levies Act in 2023. The 2024/25 financial year was the last one in which the special levy could be imposed, and it falls away in 2025/26.

Budget for 2025/26

The FSCA is budgeting for gross revenue of R1.099 billion in 2025/26 (2024/25 budget: R1.088bn), with levies accounting for 92% (2024/25: 94%), or R1.014bn, of the amount.

Income from fees will contribute 3% (R32.823 million), and 4% will be derived from interest (R41.056m) and 1% from other income (R11.567m).

The Authority is budgeting for operational expenditure of R1.125bn (2024/25: R1.051bn), comprising staff expenditure of R800m (R748m) and general expenditure of R325m (R303m). This will leave the FSCA with a surplus of R25.297m.

Additional supervised entities

The FSCA said it will ask the Minister of Finance to introduce amendments to the Levies Act to include the following four entities: external central counterparties, external trade repositories, external credit rating agencies, and domestic and foreign benchmark administrators.

External central counterparties, external trade repositories, and external credit rating agencies are licensed financial institutions and as such are supervised entities as defined in the Levies Act.

Regulations that designate the “provision of a benchmark” as a financial service will be promulgated during the 2025/26 financial year. The regulations specify that the FSCA is the authority responsible for the regulation, supervision, and oversight of this financial service.

The FSCA also wants the way in which pension funds are classified in the Act to be amended.

Schedule 2 to the Act includes two categories of pension funds: “pension fund – occupational fund” (item 20) and “pension fund – pension preservation fund, provident preservation fund, and retirement annuity fund” (item 21). To reflect the categories of pension funds regulated by the FSCA correctly, the Authority will ask the minister to propose that the items are amended as follows: “pension fund – all pension funds not referred in item 21” and “pension fund – pension preservation fund, provident preservation fund, retirement annuity fund and beneficiary fund”.

Deadline to comment

Comments on the proposals must be submitted on this template by 10 December 2024 to FSCA.RFDStandards@fsca.co.za.

Click here to download the FSCA’s 2025/26 budget and levy proposals document.