The Office of the Tax Ombud (OTO) continues to grapple with delays in meeting resolution deadlines, despite the South African Revenue Service (SARS) maintaining a high rate of implementing its recommendations.

The OTO, established on 1 October 2013 under section 14 of the Tax Administration Act (TAA), is tasked with reviewing and addressing taxpayer complaints related to service or procedural matters stemming from the application of tax laws by SARS.

The functions of the OTO include assisting taxpayers with complaints against SARS, identifying the root causes of such complaints through systemic investigations and offering an impartial mechanism for dispute resolution.

The OTO’s 2023/24 annual report, released on 6 November in collaboration with the South African Chamber of Commerce and Industry, highlighted a busy year. The contact centre received a total of 17 014 interactions, an increase of 13.28% from the 15 020 recorded in the prior year. This included 12 338 queries and 4 676 complaints, marking year-on-year increases of 12.10% and 16.49%, respectively.

At the start of the 2023/24 financial year, the OTO carried over 281 unresolved complaints from the previous year. The OTO accepted a total of 2 393 new complaints, which were referred to SARS for resolution. Counting the unresolved complaints from 2022/23, SARS had 2 674 complaints to resolve in the 2023/24 financial year. Of these, SARS successfully resolved and closed 2 178 complaints – 99.77% of the OTO’s recommendations.

The total amount of the top 10 refunds that OTO helped to secure from SARS through its interventions increased to over R179 million compared to R103m in the prior year.

Yanga Mputa (pictured), the Tax Ombud, pointed out that although different stakeholders have raised concerns about the non-binding nature of the recommendations the OTO makes to SARS, the revenue authority had been consistent in implementing OTO recommendations.

“This is a strong indication of government institutions working in good faith towards the common goal of building a better tax administration system,” she said.

However, a concerning trend is that SARS often does not implement OTO recommendations timeously.

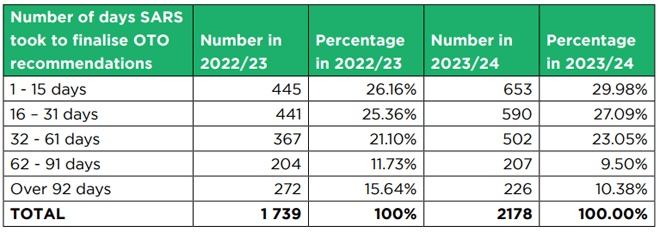

Of the complaints resolved by SARS, only 29.98% (653 cases) were finalised within the 15-business-day timeframe outlined in the Memorandum of Understanding (MoU) between the OTO and SARS. While this was an improvement from the 26.16% (445 cases) resolved on time in the previous year, OTO noted that a significant 70.02% (1 525 cases) in 2023/24 exceeded the agreed turnaround time. This was slightly better than the 73.83% (1 284 cases) reported for the 2022/23 financial year.

Time taken by SARS to finalise OTO recommendations

In the report, the OTO raised concerns about SARS’s failure to adhere consistently to the MoU’s timeframes.

“SARS’s non-adherence to the MoU timeframes remains a concern and has been escalated to the senior leadership of SARS’s Complaints Management Office. Furthermore, the OTO addresses this issue in its quarterly reports to the SARS Commissioner,” the OTO stated.

Mputa stated that “as such, the OTO will utilise other mechanisms available in the TAA to ensure that SARS implements the OTO recommendations timeously”.

16% rise in complaints as direct use by taxpayers grows

The OTO’s user population (all individuals and entities using the services of the OTO) consists of two main types of users: taxpayers and tax practitioners who submit complaints on behalf of a taxpayer.

During the reporting period, 4 618 complaints were validated, an increase of 16.62% compared to the 3 960 complaints of 2022/23.

“Notably,” Mputa said, “we have seen an increase of 13.28% compared to the previous year in the user population accessing the OTO’s services.”

She further noted that most taxpayers are now utilising the OTO’s services directly, without going through taxpayer representatives.

During the 2023/24 financial year, 76.03% (3 511) of the complaints received were lodged by taxpayers and 23.97% (1 107) by taxpayer representatives. In the previous financial year, 79.95% (3 166) of the complaints were from taxpayers and 20.05% (794) from taxpayer representatives.

“This implies that taxpayers are becoming more aware of the services of the OTO.”

According to Professor Thabo Legwaila, the chief executive of the OTO, there was an increase in complaints related to compliance audits, particularly the timeliness of the process. Some complaints related to the payment of refunds owed to taxpayers. Legwaila noted that the OTO facilitated the payment of refunds for various tax types that SARS had delayed paying.

“This retention of refunds by SARS can negatively affect the cash flow of small businesses and individuals, jeopardising their financial stability. Throughout the reporting period, we received numerous complaints about delayed payment of refunds, indicating a persistent issue that should be resolved with SARS,” said Legwaila.

Premature submissions drive complaint rejection rate

In the 2023/24 financial year, the OTO received 4 618 validated complaints, with service-related issues making up the majority at 76.20% (3 519). Procedural matters accounted for 13.12% (606), administrative issues represented 9.44% (436), and 1.23% (57) were other matters unrelated to SARS.

Of these complaints, the OTO forwarded 51.82% (2 393) to SARS for resolution. An additional 19.38% (895) of complaints were closed because SARS resolved them before the OTO’s review process was completed. However, 1,330 complaints—28.80% of the total—were rejected as they fell outside the OTO’s mandate.

Legwaila highlighted that the rise in queries and complaints reflects a growing demand for the OTO’s services and increased trust among taxpayers. Despite this positive trend, he expressed concern over the significant number of rejections.

“This is an indication that many taxpayers are aware of our services but do not understand our mandate and process or when to contact the OTO to file a complaint. Raising awareness about when the OTO can and cannot assist taxpayers remains a priority,” Legwaila stated.

Currently, taxpayers can reach the OTO for queries via email, in-person visits, and telephone calls, but formal complaints must be submitted by email or in person. The report noted that a key goal for the 2024/25 financial year is to complete the development of an online customer service portal.

Once complaints are documented in the OTO’s Service Manager system, they are passed to the Complaints Resolution unit and assigned to operational specialists for evaluation. This process, completed within eight business days from the date of acknowledgement, involves checking if the complainant has used all SARS complaint resolution channels or has valid reasons for not doing so, as outlined in section 18(4) of the TAA. The OTO also determines whether limitations under section 17 of the Act apply. Complaints that fail to meet these criteria are rejected, while valid ones are sent to SARS with recommendations for resolution.

A major reason for complaint rejections was that taxpayers approached the OTO prematurely, bypassing the required process of first lodging their complaints with the SARS Complaints Management Office, as mandated by section 18(4) of the TAA. These premature submissions accounted for 80.45% (1 070) of the total rejected complaints.

The report noted that overall rejections decreased by 23.78% (415) compared to the previous year.

“While the OTO sees the decrease in rejected complaints as positive, the number of complaints remains significant and is concerning since most rejections are due to complaints being prematurely lodged with the OTO,” the report stated.

Rising cases of eFiling profile hijacking

Meanwhile, Mputa noted that a significant task still ahead of the OTO is helping to address the growing incidence of eFiling profile hijacking.

In August, the OTO stated it had obtained approval from the Minister of Finance to conduct a review of possible systemic and emerging issues related to alleged SARS’s service failures in assisting taxpayers with eFiling profile hijacking timeously in terms of section 16(1)(b) of the TAA.

This investigation comes in response to complaints and queries received by the OTO from taxpayers, industry bodies, and participants in a public workshop held on 13 June with SARS, taxpayers, and industry representatives.

Read: Tax Ombud to investigate widespread taxpayer profile hijackings

In the report, Mputa noted that it is unsettling that scammers have been gaining unauthorised access to taxpayer filing accounts by using technology for criminal ends.

“Such as by filing false tax returns, redirecting tax refunds to their bank accounts, or using stolen information for other fraudulent activities. We are committed to being of assistance in addressing the scourge of eFiling profile hijacking,” she said.