South African multinational companies compare well with their African and global peers in terms of tax transparency. At least three South African companies rated among the top 10 companies globally, scoring high for their transparent tax reporting.

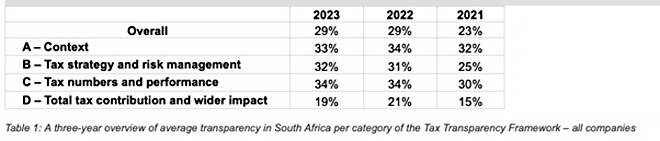

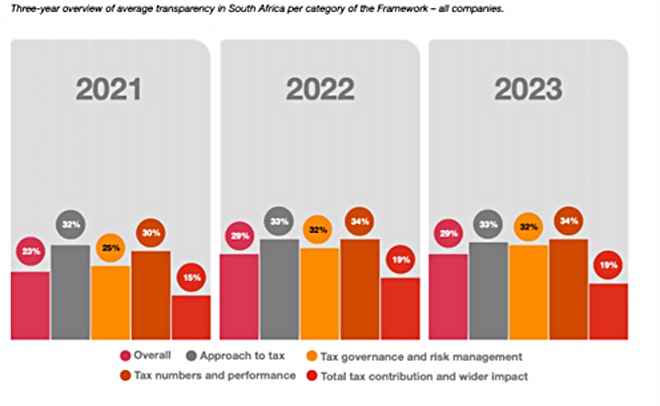

PwC last week released its ninth tax transparency review of the top 100 companies (based on market capitalisation) listed on the JSE. The reviewed companies scored an average of 29% for achieving total transparency.

The best-performing company was within the financial sector, while on average, the telecommunications sector consistently provided the most effective tax transparency.

Tax transparency disclosure is not mandatory in South Africa. However, the JSE has released sustainability disclosure guidance that includes tax reporting.

PwC tax reporting director and governance specialist Carla Perry says tax executives need to grasp the company’s business model, which includes revenue streams, cost structures, and market dynamics, to identify and manage tax risks.

The tax transparency reporting framework includes the context (tax communication), disclosures of tax strategy and risk management, tax numbers and performance, and the total tax contribution and impact on society.

Increased scrutiny

Large corporates are often accused of not “paying their fair share of taxes”. Increased scrutiny from revenue authorities and the public has driven more voluntary tax information disclosures.

Perry says the increased focus on transparent tax reporting seeks to address the trust deficit with the general public, revenue authorities, and investors.

The review sheds light on what the global and local tax transparency environment loos like and how a company can tell its tax story through its reporting, she adds.

Companies are judged on the disclosures of their tax strategy, how they address tax as a business risk, and detailed disclosure of tax risk management, governance, and controversy. The review also considers key financial indicators, comparing the effective tax rate to the cash tax rate, explaining tax incentives, and future tax rate performance.

The total tax contribution assesses disclosures detailing jurisdictions, entities, and primary activities, total economic contributions by tax type and jurisdiction, and other economic contributions to government.

There has been a drop in the number of companies in South Africa that attained a score of 30% or less for total transparency – from 70 in 2022 to 60 last year. “Even though the overall score remains the same from the previous year, it appears that more companies are embarking on a journey towards greater transparency,” the review found.

To disclose, or not

More than 50 companies disclosed their commitment to comply with tax laws and regulations, and half of those companies provided detailed disclosures to demonstrate their commitment.

In terms of tax governance, 45 companies have a formalised governance framework – setting out the tax strategy, tax policy, key tax principles, and key tax controls. This is up from 38 companies last year.

Only 22 companies provided a basic statement on their approach to tax planning, and 24 provided detailed disclosures of their commitment not to pursue “aggressive tax strategies”.

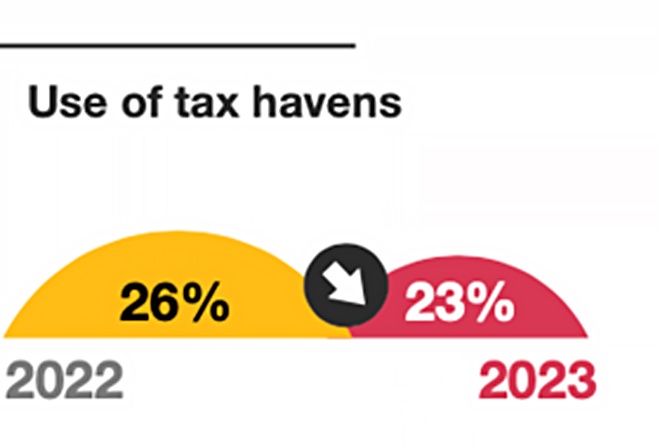

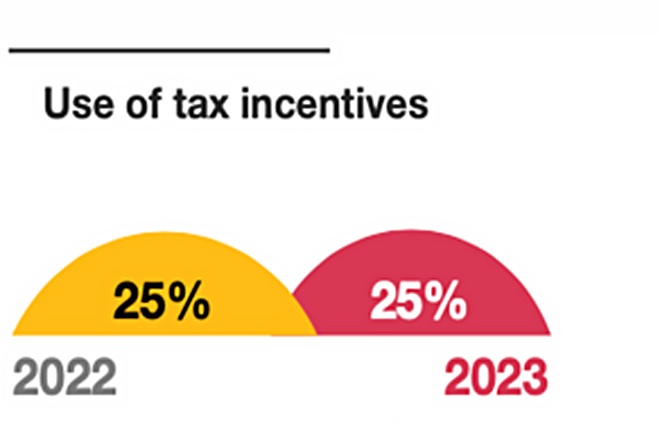

“Disclosure of the use of tax havens and tax incentives still remains low,” the PwC review revealed.

Stand-alone reports

This year, there was an increase in companies that produced a stand-alone tax report that did not form part of the corporate reporting process. About 20 companies either produced a tax transparency report separately or included it as a separate section of other reports (such as the governance report). This is up from 12 the previous year.

The companies’ performance was assessed by a panel of independent judges: Carolynn Chalmers, chief executive of the Mervyn King’s Good Governance Academy; Madeleine Stiglingh, head of the CA programme at the University of Pretoria; Tracy Johnson, head of postgraduate taxation at the University of Cape Town; and Zubair Wadde, head of the school of accountancy at the University of the Witwatersrand.

The panel commended the Nedbank Group for its consistent, high-quality tax reporting. “Nedbank presents tax as an essential component of its overall business strategy, not as an afterthought,” the judges found.

Impala Platinum Holdings was highly commended for its most significant improvement in tax reporting. AECI, Exxaro, Discovery, Old Mutual, and Vodacom were highly commended for their consistent performance in tax reporting.

Global performance

South Africa participated in a global transparency study (released in November) with a similar framework as the South African review. Globally, Spain took the lead, with an average score of 66% in total tax transparency, and Germany and the United Kingdom scored above 40%.

“We are far ahead of African countries that participated in the global study, but having said that, South Africa has been pushing transparency for over a decade,” says Perry.

Kenya scored 4.8% for total transparency, and Nigeria and Uganda both scored 12.8% for attaining total transparency compared to South Africa’s 29%.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning, legal, or tax advice that is appropriate to every individual’s needs and circumstances.