South Africans are generally optimistic, but the long, dark years of state capture and loadshedding have weighed heavily on the national psyche. With an energy availability factor hovering in the mid-50% range in 2023, South Africans braced themselves for stage 7 or higher load-shedding as winter approached. The electricity crisis acted as a permanent handbrake on our economy, leaving consumers and businesses idling in the parking lot of SA Inc.

Most of the reforms required to alleviate loadshedding were already enacted at the peak of the electricity crisis. The President’s establishment of a “war room”, in the form of the National Energy Crisis Committee allowed the government, business, and consumers to play a pivotal role in finding ways out of the energy crisis.

Since late March this year, we’ve had no load-shedding, and the energy availability factor is above 70%. Businesses and households have invested substantially in renewable energy, resulting in reduced demand on Eskom generation. It has also allowed the national power utility to perform critical maintenance at its power stations.

Renewable energy has become a much larger component of the energy mix, effectively doubling from about 10% of installed capacity to 20% over the past two years. The huge acceleration of private-public partnerships means that NERSA-registered projects are sitting at 9.7GW, with their capacity close to Eskom’s Medupi and Kusile power stations. Additionally, rooftop solar energy has almost trebled over the past two years to 6GW.

While rapid growth in energy generation is helping to get South Africa back on track, we are also seeing much-needed transmission reform.

Rand bouncing back

Substantial improvements on the electricity front have helped the rand to recover.

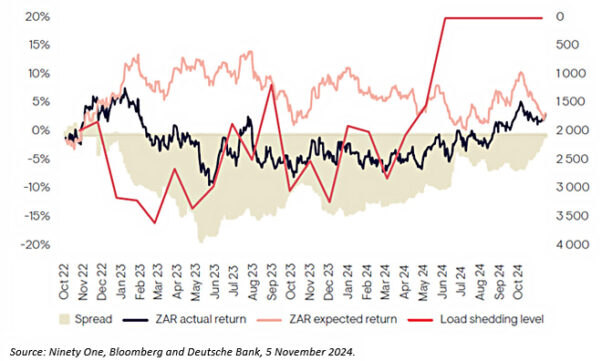

A staggering 75% of the rand’s underperformance over the past two years can be attributed to loadshedding. Figure 1 shows how the gap between the currency’s expected return and actual return widened dramatically as South Africa reached record-breaking levels of loadshedding in 2023. The peak of the rand’s underperformance was in May last year, but since then, the discount in the rand has steadily closed.

Figure 1: Loadshedding was the key driver of rand weakness

With the election out of the way and no loadshedding since late March, the rand looks fairly valued. We expect the currency to be more stable than in the past. Improving terms of trade, softer oil prices and stronger commodity prices also support the rand.

Infrastructure spend to provide much-needed ‘juice’ to SA economy

The Government of National Unity (GNU) delivered a pragmatic medium-term budget, vowing to get the debt-to-GDP ratio under control. This was in line with the fiscal consolidation path that National Treasury committed to ahead of the 2023 Medium-Term Budget Policy Statement (MTBPS).

In last year’s MTBPS, significant spending cuts were pencilled in to address revenue slippages. Ahead of the election, there was scepticism about whether politicians would give National Treasury the necessary space to maintain fiscal prudence. The GNU medium-term budget has stayed the course, with debt consolidation an essential strategy for putting government finances on a healthier footing.

While the government will have to do some tap dancing to keep investors, rating agencies, and public sector unions happy, a better growth rate will go a long way to help South Africa out of the debt hole.

Finance Minister Enoch Godongwana outlined additional reforms to support public and private investments in growth-boosting infrastructure, with the MTBPS dedicating a chapter to this important issue. The GNU’s strong commitment to infrastructure investment was evident in the MTBPS.

The second phase of Operation Vulindlela (a joint initiative of the Presidency and National Treasury to accelerate the implementation of structural reforms and support economic recovery) will build on this foundation, targeting critical infrastructure bottlenecks that stem from municipal capacity constraints.

Areas of focus will still be along the broad categories of energy, transport, digital infrastructure, and water. These initiatives will not only be a “life saver” for communities and businesses but will serve as an important engine of growth.

While public infrastructure spending has been largely absent over the last few years, the South Africa National Road Agency (SANRAL) has been carrying the infrastructure torch. The parastatal has reached for its wallet, allocating R26 billion to essential road upgrades from its R42bn cash pile. Further tenders are in the pipeline. SANRAL’s infrastructure projects are already having a powerful multiplier effect across the broader economy, supporting job creation, local businesses, and community upliftment.

Can the GNU deliver growth?

It’s too early to tell whether the GNU has moved the growth dial.

Although there are some policy disagreements among the GNU parties, they are united in getting growth going. Our new system of governance has sparked competition and co-operation among ministers, which should ultimately benefit SA Inc.

Some ministries now have a DA minister paired with an ANC deputy minister, and vice versa. They have to co-operate to get results.

But the GNU ministers are also in competition mode, because they need to sell their party’s service delivery success to voters in the next local and national election.

This situation has created some healthy competition, and like fund managers, ministers now must worry about relative performance – how are they faring relative to their peers? Some ministers are already hogging the limelight. For example, Home Affairs Minister Leon Shriver is spearheading visa reforms to boost growth while Trade and Industry Minister Parks Tau is forging a closer relationship with business, focusing on policy reforms that will help to attract investments into the economy.

Benign inflation outlook and rate-cutting cycle bolstering the economy

Growth has been limping along this year, but decelerating inflation and a lower interest rate environment are helping to lift business and consumer confidence. Two-pot withdrawals are also providing a short-term boost to households.

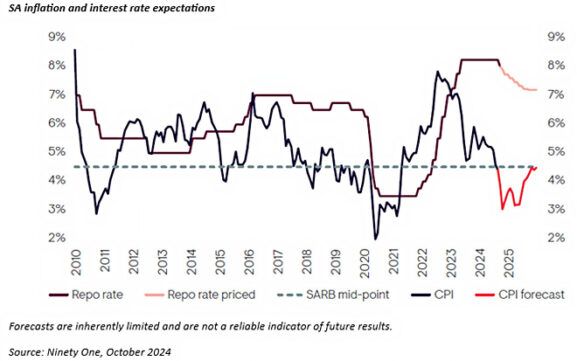

CPI inflation has remained comfortably within the target band, and we expect it to move lower, averaging less than 4% over 2025. This should give the South African Reserve Bank room to continue cutting interest rates. South Africa is now aligned with the global economic cycle for the first time in many years, which bodes well for local assets. Against this backdrop, we anticipate economic growth of 1.7% next year.

Figure 2: More rate cuts are on the table

A supportive environment for SA bond market

The favourable outlook for the rand, inflation, interest rates, and growth supports our bond market. We believe the high yields on South African bonds sufficiently protect against the risks and represent good value over the medium to longer term. Income will remain an important driver of returns, with high yields offering investors the opportunity to earn returns well ahead of inflation.

In conclusion, South Africa is in a much better place than it was a year ago, but the GNU needs to ensure it delivers on its promises. Now that the electricity handbrake is being lifted, there’s every chance that South Africa will get back on track.

Malcolm Charles is a portfolio manager for Emerging Market Fixed Income at Ninety One, and Sisamkele Kobus is an economics analyst at the same company.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning or investment advice that is appropriate to every individual’s needs and circumstances.