The Advertising Regulatory Board (ARB) has instructed Nedbank to amend or withdraw an advertisement for its Greenbacks loyalty programme, after finding it to be misleading.

The advert promotes a benefit whereby Nedbank clients who belong to the programme will receive 25 cents in Greenbacks per litre of fuel at BP filling stations.

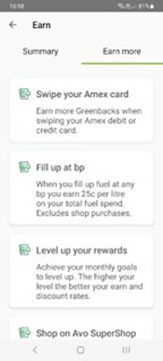

The advert appears below:

A Nedbank client complained to the ARB that she could not use her American Express (Amex) card to pay for fuel when she filled up at the BP at Waterfall in KwaZulu-Natal because this service station does not accept Amex cards for fuel payments. Therefore, she did not receive the advertised reward.

The complainant said Nedbank has informed her that only filling stations that have elected to accept Amex cards will offer this reward. She said the advert was misleading because it failed to state that the reward is available only at some BP service stations.

Nedbank’s submissions

Nedbank submitted that the advert is not misleading because the fuel reward applies to all BP filling stations across the country, not only to selected BPs, as contented by the complainant.

Nedbank confirmed that some of Nedbank’s merchant partners do not accept Amex cards.

However, the fact that some Nedbank partners, including certain BP filling stations, do not accept Amex cards did not make the advert misleading. Nedbank clients are entitled to access the fuel reward at BP stations that do not accept Amex cards by using any other Nedbank card linked to the programme (including a Nedbank Visa or MasterCard).

Clients who have a transactional account with Nedbank are issued with both a Mastercard (debit or credit card) and an Amex card, both of which may be linked to the loyalty programme.

Each claim is true in isolation

The ARB’s Directorate said it was apparent that the complainant conflated the claim that clients will earn rewards by swiping an Amex card and the claim that they can earn rewards by filling up at BP.

It was also apparent that Nedbank intended the claims as distinct communications. One way to earn rewards is to use an Amex card, another way is to fill up at BP.

The Directorate said there are four distinct sections within the advert, and there is no conjunction such as “and” or “also” between the sections.

The advert makes two claims. The first is “Earn more Greenbacks when swiping your Amex debit or credit card”. The Directorate said this claim appears to be true.

The Directorate believed that consumers who have Amex cards are aware of the limitations related to the use of these cards, particularly that they are not universally accepted by all retailers. Therefore, this portion of the advert is not misleading on its own.

Then there is the fuel claim, which states that “when you fill up at any BP you earn 25c per litre on your total fuel spend”.

Again, in isolation, the claim appears to be true, the Directorate said. Clients can earn rewards by filling up at BP. Any Nedbank card-holder should be able to do so, because Amex card-holders also have a Mastercard.

Placement of the claims

The Directorate said the question was whether it is reasonable for Nedbank to expect consumers to conclude for themselves that, because of the limited usability of Amex cards, the rewards might not apply at all BP filling stations.

“Because of the placement of the two claims, the word ‘any’ in the second claim, as well as the fact that it appears that some (or even many) BP stations accept Amex, it was perfectly reasonable for consumers to have reached the same conclusion as the complainant did in this instance: namely, that all BP fuel stations would accept the Amex card and qualify for the fuel rewards programme,” the Directorate said.

Whether the complainant had another Nedbank card available to use in this instance was not relevant because the advertisement was not clear in this regard.

The Directorate took issue with the advert’s not including any asterisks or disclaimers.

For the above reasons, the Directorate found that the advert is misleading and in contravention of clause 4.2.1 of section II of the Code of Advertising Practice. It instructed Nedbank to withdraw or amend the advert in its current format wherever it appears.

The ARB’s ruling highlights the importance of transparency and clarity in advertising, particularly for loyalty programmes with nuanced terms and conditions. Businesses are encouraged to:

- Include disclaimers or clarifying statements in advertisements to prevent misunderstandings.

- Avoid ambiguous phrasing that may mislead consumers.