The Pension Funds Adjudicator, Muvhango Lukhaimane (pictured), has questioned whether it should be compulsory for security firms to belong to the Private Security Sector Provident Fund (PSSPF) because “several” employers fail to pay contributions to the fund.

The PSSPF remained the biggest contributor to the new complaints received by the Office of the Pension Funds Adjudicator (OPFA) in its 2022/23 financial year. The Adjudicator said almost 50% of complaints about withdrawal benefits and the non-payment of contributions came from members of the PSSPF.

At the end of August, the FSCA published the names of 3 262 employers that, as of 30 April, it said were in arrears with their contributions for four or more months. Most of these employers owed contributions to the PSSPF. Some employers on the list said the Authority had defamed them because their contributions were not in arrears.

Membership of the PSSPF is compulsory in the private security sector by virtue of the National Bargaining Council for the Private Security Sector’s collective agreement, which also applies to entities that are not party to the agreement.

Section 13A(1) of the Pension Funds Act requires an employer of a retirement fund member to pay contributions deducted from the member’s remuneration, as well as the employer’s contribution, to the fund.

The non-payment of contributions is not the only reason Lukhaimane questioned compulsory membership of the PSSPF.

The fund does not appear to be achieving its purpose of providing retirement benefits because, given the nature of the occupation, most of its members do not remain in the fund until retirement age, she said in the OPFA’s 2022/23 integrated report.

“The PSSPF has also failed to allocate hundreds of millions of rands in contributions paid by employers, leading to utter frustration for employers and members. It does not seem as if there is a plan to bring the allocation of contributions up to date anytime soon.”

Lukhaimane’s observations should be seen in the context of the troubled history of the PSSPF, which emerged from statutory management at the end of April this year following four years of intervention by the FSCA.

Read: Statutory management of Private Security Sector Provident Fund to end

Investigations by the Authority and a private forensic firm into the fund’s previous board of trustees uncovered evidence of mismanagement, including improper procurement practices and the trustees remunerating themselves for attending a golf day and a conference.

As a result of the findings, the FSCA imposed administrative penalties on several trustees. Those who were on the board of the PSSPF, or other funds, were asked to vacate their positions, while those who had left the board were served with fines ranging from R10 000 to R230 000.

The FSCA and the fund’s new trustees and principal officer signed an enforceable undertaking on 30 March this year. Among other things, the trustees and the principal officer undertook to the ensure that fund will comply with the Pension Funds Act, and that members, former members, and their beneficiaries are treated fairly and lawfully in relation to their benefit claims.

The fund is administered by Salt Employee Benefits, which was appointed by the previous board through a process that the FSCA and forensic investigations found to be flawed.

Ongoing problems at the Chemical Industries Fund

Another provident fund with a troubled history, the Chemical Industries National Provident Fund (CINPF), once again earned a “dishonourable mention” in the Adjudicator’s report.

“During several meetings with the principal officer of the fund, concerns were raised, ranging from data issues, poor service, and failure of the previous administrator to issue proper benefit statements to members,” Lukhaimane said in a word-for-word repetition of what she wrote in her 2021/22 report.

She said a regulatory instrument, in line with the Treating Customers Fairly (TCF) principles, is required to regulate the conduct of retirement fund administrators during a transfer of administration, “to avoid members’ best interests being sacrificed at the altar of profit-driven motives”.

In June last year, the High Court in Johannesburg found that three CINPF officials received bribes from Neighbour Funeral Scheme, a company related to Akani Retirement Fund Administrators.

The Court found that the purpose of the bribes was to secure the removal of the previous fund’s administrator, NBC Holdings, and appoint Akani in 2020.

Akani has said it will appeal the judgment because it “made certain incorrect findings in law and fact”.

Read: Akani to take legal action following the FSCA’s search and seizure operation

N-e-FG default determinations

The FSCA’s decision to place N-e-FG Administrators (Pty) Ltd under statutory management in June last year “triggered an avalanche of complaints by concerned members of the associated funds under administration”, Lukhaimane said.

Her office did not receive a response from the statutory manager despite several correspondences. This resulted in engagements with the FSCA and the board members appointed by the Authority to the other funds under N-e-FG’s administration.

“Due to N-e-FG’s inability to provide responses timeously or at all, a decision was eventually taken to close such complaints by issuing default determinations against the associated funds. The issuing of default determinations is undesirable due to the potential prejudice that other members of the fund could suffer as a result and the lack of information available from the fund to ensure the soundness of the decision,” the Adjudicator said.

Complaints trend returning to normal

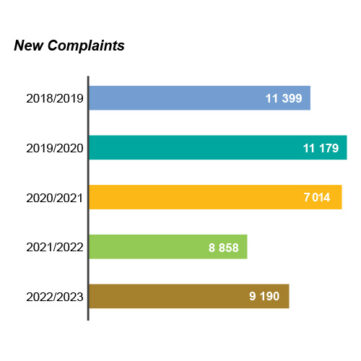

New complaints received for 2022/23 increased by 4% compared to the previous year and by 31% compared to 2020/21. It seems the complaints trend is returning to pre-pandemic levels.

Lukhaimane said the increase in complaints may be attributed to:

- greater awareness among the public of the OPFA and what it does, and trust in the Office to fulfil its mandate; and

- retirement funds not doing enough to resolve disputes internally.

As she did in her 2021/22 report, the Adjudicator urged funds to embrace the refer-to-fund (RTF) process, whereby the OPFA facilitates the lodging of a complaint by a complainant with the fund for internal dispute resolution.

She said the process resulted in the resolution of 620 disputes before the lodging of a formal complaint for investigation. As such, it has largely been welcomed by the industry.

“Some funds still failed to take any advantage of the process. However, it is hoped that with time and constant encouragement, all funds will fully embrace the RTF process as a means of addressing dissatisfaction by their members and in keeping with the spirit purported by the TCF principles.”

Decrease in finalised complaints

The OPFA finalised 7 809 complaints during the reporting period, a 7% decrease compared to the previous financial year.

Lukhaimane attributed the decrease to “certain retirement funds that are habitually uncooperative by failing to provide proper responses to complaints or funds undergoing some form of regulatory intervention by the FSCA where the grievances raised by complainants are of secondary concern to the statutory manager or section 26(2) board member appointed. Reporting such matters to the FSCA continues on a regular basis.”

Among the finalised complaints, 56% (4 368) were resolved through investigations and determinations, an increase of 15% compared to 2021/22.

A total of 1 382 complaints were closed as settlements, 1 326 were deemed to be outside the Office’s jurisdiction (mostly for being out of time), and 733 were resolved through alternative means.

She said 82% of the cases were finalised within six months of receipt.

As of 31 March 2023, the Office had 3 970 active complaints, of which only 4% exceeded six months.

Main reasons for complaints

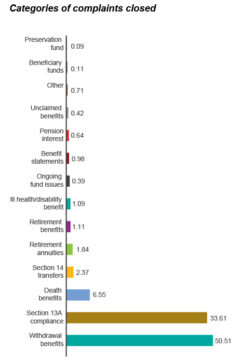

Similar to previous years, most complaints related to withdrawal benefits (50.51%) and the non-payment of contributions by participating employers (33.61%), constituting 84% of all closed complaints.

The two categories often overlap, with complainants only discovering that the employer failed to pay contributions when they are withdrawing their benefit.

“The persistence of these issues and the significant volume of complaints are causes for substantial concern. Stakeholders are strongly encouraged to address and rectify this undesirable outcome, stemming from inadequate fund governance, management, and administration.

“If left unaddressed, this situation effectively undermines the government’s endeavours to enhance trust, coverage, adequacy, and sustainability within the retirement funds system,” Lukhaimane said.

She said even where employees are ordered to pay outstanding contributions, prescription and time-barring means that, in a significant number of matters, only a partial recovery is realised.

Lukhaimane said the Office has observed a new trend involving the exploitation of the FSCA’s “Covid-19 relief”, which enabled funds to amend their rules to suspend the payment of contributions (other than for risk benefits). Unscrupulous employers continued to deduct contributions from members’ pay but failed to pay them over to retirement funds.

53% of the Adjudicator’s determinations upheld

The Financial Services Tribunal (FST) is a fee-free appeals avenue for aggrieved persons who want to challenge or review the Adjudicator’s determinations.

During 2022/23, 72 applications for reconsideration were submitted to the FST. The Tribunal issued 69 decisions, with 37 OPFA decisions (53.6%) upheld and 32 sent back for reconsideration.

Lukhaimane said 99% of the determinations were remitted because the aggrieved party submitted new evidence during the FST proceedings, which had not been presented before the OPFA.

Click here to download the OPFA’s 2022/23 integrated report.

Adjustment fund ccma security granted review arbitration