Building on President Cyril Ramaphosa’s recent announcement of a sweeping investment in infrastructure of the next five years, Alexforbes Investments this week announced the launch of the AF Infrastructure Impact Fund-of-Funds.

In his address at the opening of Parliament last week, Ramaphosa said government intends to transform the country into a construction site, encompassing new roads, bridges, houses, schools, hospitals, clinics, broadband fibre, and power lines, spanning from the largest metros to the most rural areas. However, given the current constraints on public funding because of limited public finances and high government debt, substantial private investment and partnerships will be essential.

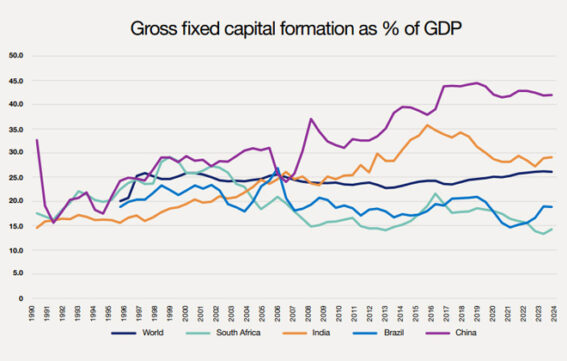

Compared to its emerging-market peers, infrastructure spending in South Africa is low relative to what is considered adequate for a developing economy. The level of gross fixed capital formation (GFCF) as a percentage of gross domestic product (GDP) reflects the extent of infrastructure spending in an economy. The most recent statistics show that GFCF as a percentage of GDP in South Africa dropped below 15% in 2024.

Atlehu-edu, an educational initiative aimed at improving financial literacy, states that, according to several studies, the norm for a developing country should be about 30% to 35% of GDP.

There have been rumblings in Parliament that the government will look to South Africa’s savings portfolio, more specifically retirement funds, “to help finance growth in the capital stock”.

Read: Proposed Regulation 28 amendment – are prescribed assets coming back?

Regulation 28 of the Pension Funds Act now includes a framework for retirement funds to allocate up to 45% of their assets to infrastructure, and further separates private equity and other assets from hedge funds in the limits to promote investment into infrastructure because these investments are often housed in alternative asset classes, such as private equity and private debt.

Despite the provisions of Regulation 28, the actual allocation of retirement funds to the alternative asset class remains low, with many funds still heavily weighted towards traditional assets.

For example, according to Alexforbes Effective Asset Allocation Survey (Best Investment View), the Public Investment Corporation, South Africa’s largest asset manager, allocates only 8% of its R2.548 trillion of assets under management to alternative investments: 3% in private equity, and 5% in real assets.

According to Alexforbes, the AF Infrastructure Impact Fund-of-Funds responds to growing interest in infrastructure investments, following National Treasury’s announcement permitting retirement funds to invest up to 45% in infrastructure.

The fund is set to launch in July with an initial close date targeted towards the end of the year.

The financial services provider says the fund will provide clients with exposure to an asset class offering long-term inflation-beating returns, while addressing the country’s critical infrastructure needs.

The fund, which has a classic closed-end partnership structure, will operate as a multi-managed, multi-strategy fund, offering investors a diversified portfolio.

AF Infrastructure Impact GP (Pty) Ltd will serve as the general partner, overseeing strategic direction, while Alexander Forbes Investment Administration (Pty) Ltd will manage the investments. A dedicated investment team focused on managing alternative asset classes will be responsible for the management of the fund.

The Alexforbes South Africa Private Markets portfolio, which includes investments from several of Alexforbes Investments’ portfolios, has approved a R1-billion allocation to the new fund.

Targeting a fund size of R5bn, investments will span various sectors such as energy, transportation, and public utilities. Projects will encompass renewable energy (such as solar and wind) and essential infrastructure (including roads, railways, and public health facilities).

Moreover, Alexforbes states, the fund aims to advance inclusivity and competitiveness in the asset management industry, providing access to premier black-owned/managed infrastructure portfolios.

Lebo Thubisi, the deputy chief investment officer at Alexforbes Investments, said: “This initiative marks a significant milestone in our commitment to driving positive change and building a future for our nation that we can all connect with.”