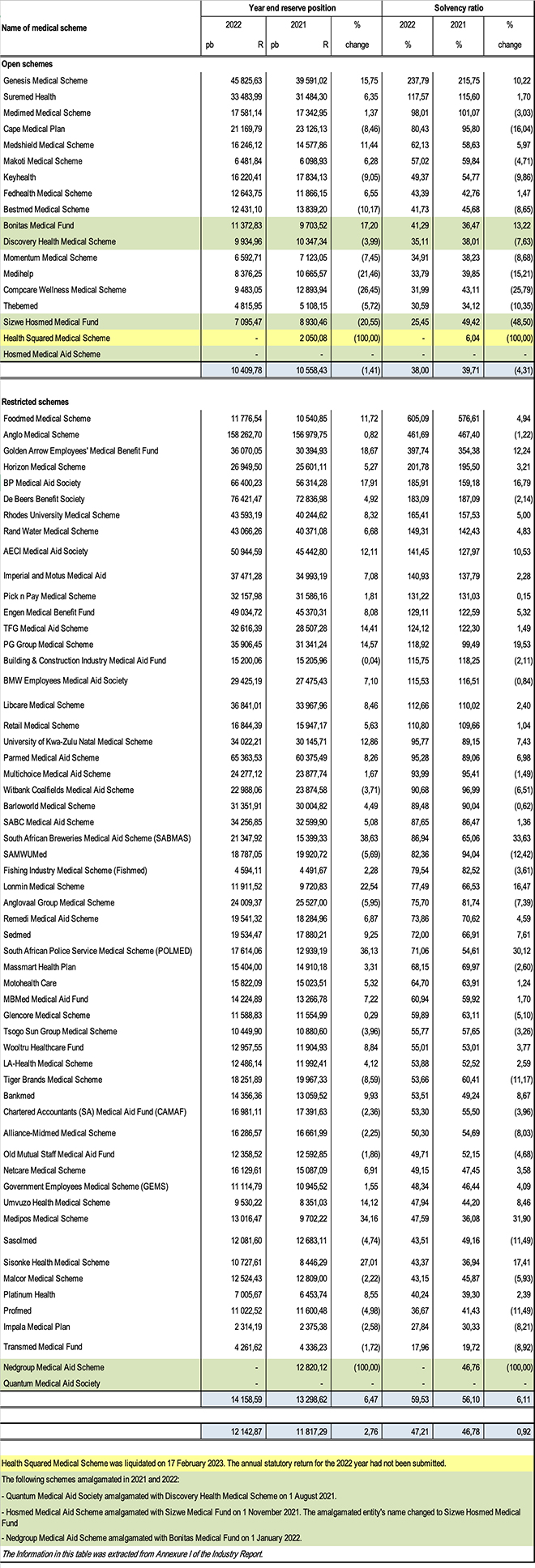

Only one open medical scheme failed to meet the minimum prescribed solvency ratio of 25% last year, but it was liquidated earlier this year, the 2022 Industry Report from the Council for Medical Schemes (CMS) shows.

The number of open schemes that failed to meet the prescribed solvency ratio has fallen steadily since 2018, from four to one in 2021. That non-compliant scheme was Health Squared, which was placed under provisional curatorship in September 2022 and liquidated in February 2023. The scheme did not submit any data for 2022, so the CMS’s report records the number of open schemes that did not meet the prescribed ratio as “none” last year.

The membership of Health Squared, which was established in 2018 through the amalgamation of Resolution Health and Spectramed, accounted for only 0.58% of beneficiaries of open schemes.

The industry’s solvency ratio rose from 46.73% in 2021 to 47.21% last year.

The solvency ratio of open schemes decreased by 4.31% to 38% in 2022 (2021: 39.71%). Restricted schemes experienced an increase of 6.11% in their solvency ratio, from 56.10% in 2021 to 56.53%.

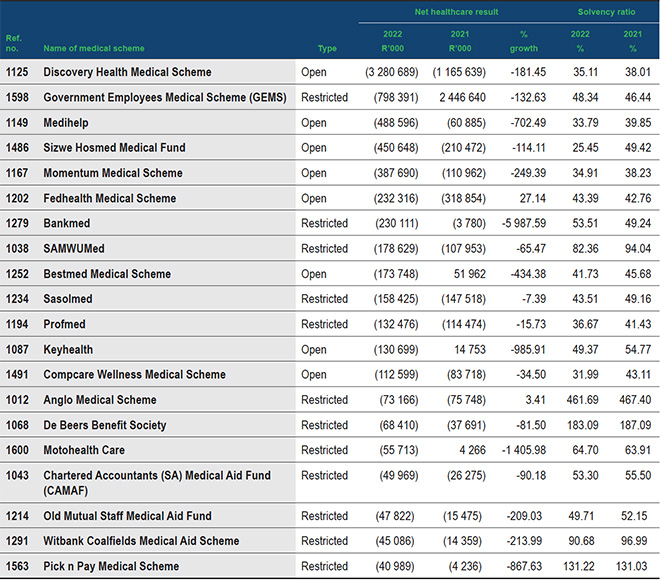

The CMS said solvency levels increased significantly in 2020 because of the higher net surpluses incurred because of the decreased utilisation of benefits brought on by the lockdowns. Although the industry saw a significant decline in net healthcare results in 2022, from a surplus of R820.52 million to a deficit of R6.16 billion, overall solvency levels increased because of investment income.

The solvency of open schemes is positively correlated to the movement in the solvency of the biggest medical scheme: Discovery Health. The scheme’s solvency decreased from 38.01% in 2021 to 35.11% in 2022; similarly, a decrease was noted in the industry average.

The solvency of restricted schemes is positively correlated to the movement in the solvency of the biggest medical scheme, the Government Employees Medical Scheme. The scheme’s solvency increased from 46.44% in 2021 to 48.34% in 2022; similarly, an increase was noted in the industry average.

Transmed’s solvency ratio declines

The solvency ratio of the restricted scheme that has repeatedly failed to meet the statutory minimum deteriorated last year. Off the 55 restricted schemes, the Transmed Medical Fund was the only scheme that failed to comply with the prescribed solvency ratio last year. Its solvency ratio fell to 17.96% in 2022 from 19.72% in 2021 and from 22.37% in 2020.

“Schemes with higher demographic profiles are at particular risk of the so-called ‘death spiral’, where adjustments to price appropriately for the profile of its members might result in the unaffordability of contributions and the subsequent loss of its younger members, therefore exacerbating the effect,” the CMS’s report says.

The Transmed Medical Fund has a worse demographic profile than the industry averages. The average beneficiary age across restricted schemes is 31.69 years, whereas the average age of the Transmed fund’s beneficiaries is 57.28 years. The pensioner ratio across restricted schemes is 6.9%; the fund’s is 49.44%.

Last year, the fund had 24 117 beneficiaries, accounting for 0.55% of all beneficiaries in restricted schemes.

Open scheme with the lowest ratio

Of the 17 registered open schemes in 2022, Sizwe Hosmed Medical Fund had the lowest solvency ratio, 25.45%, a marked decline from 49.42% in 2021. The Industry Report said the decline was in party because of the amalgamation in November 2021 with Hosmed Medical Aid Scheme, which resulted in the annualised contributions (representing the denominator in the solvency calculation) increasing significantly in 2022.

“It is, however, of concern that the scheme incurred the fourth-highest operating deficit, given its low solvency level. This seems to suggest that the scheme has experienced much worse claims than anticipated at its pricing for its 2022 benefits.”

Th table below shows the 20 schemes that incurred the highest net healthcare deficits during 2022.

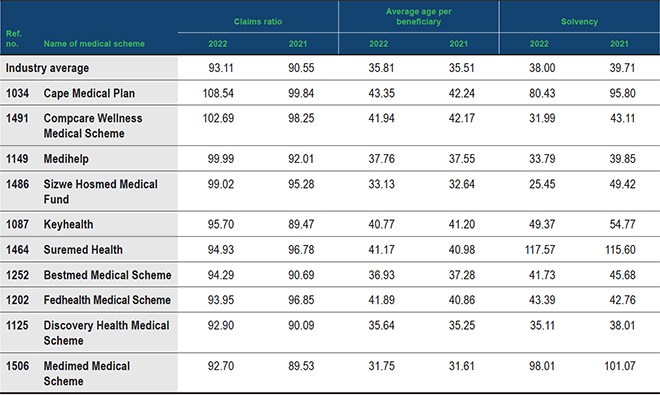

The table below shows the ten open schemes with the highest claims ratios in 2022.

The CMS said it was “interesting to note” that of the eight in the above table whose claims ratio exceeds the open scheme industry average of 93.11%, only Sizwe has an average beneficiary age that was younger than that of the industry: 33.13 years compared to 35.81 years.

Click here to download the Industry Report.

Click here to download the annexures to the report.