Taxpayers who have a dispute with the South African Revenue Service (SARS) will in future be able to rely on the less expensive and faster alternative dispute resolution (ADR) process much earlier.

The ADR process will be accessible at the objection phase of the dispute, whereas it is currently available to taxpayers only at the appeal stage.

Comparative research has indicated that in other tax jurisdictions, where ADR is available at the objection stage, it has “greatly assisted” in the early resolution of disputes, rendering further costly litigation for both parties unnecessary.

“The introduction (in South Africa) of ADR at objection stage will have the same effect and assist taxpayers to attain the early resolution of their disputes without incurring unnecessary legal expenses,” National Treasury said in the October draft response document on the tax Bills.

Positive step

Tax commentators have welcomed the amendment to the Tax Administration Act, noting it is a positive step “reflecting SARS and Treasury’s responsiveness”.

However, they emphasised the importance of updated, clear, and specific timeframes to align with the proposed expanded process, to ensure the effectiveness of the amendment.

They also remarked that many of the disputes between SARS and taxpayers would not have arisen if SARS’s assessments were better, including assessments arising because of SARS system challenges.

“We would have preferred that these operational matters rather be improved than adding another process in law,” one commentator remarked.

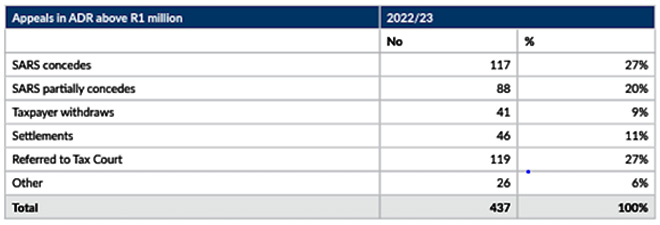

Treasury noted that ADR proceedings are not obligatory. It highlighted statistics in SARS’s 2023/24 annual report, which stated that 97% of tax appeals were resolved using the ADR process, and 95% were resolved through ADR in the 2022/23 financial year.

“It is clear that the majority of tax disputes are thus resolved by making use of ADR.”

Source: SARS Large Business and International Unit.

Joon Chong, a tax partner at Webber Wentzel, says based on the number of cases reported as resolved using ADR, it is expected that the availability of ADR at the objection stage will result in the quicker resolution of disputes, the reduction in the backlog of cases, and significantly fewer cases proceeding to the appeals stage and to the Tax Court.

Unfavourable outcome

Tax commentators recommended that the procedural steps be clarified if the ADR outcome (at objection level) is unfavourable and whether a second ADR process will be allowed if a taxpayer opts to continue to the appeal process.

Nico Theron, founder of Unicus Tax Specialists and a dispute resolution specialist, says SARS and taxpayers are subject to specific timelines once a taxpayer has submitted an objection.

Commentators on the proposed amendment want the rules governing objections and appeals to be updated so that the periods will be suspended when ADR is relied upon at objection level and resumed when the ADR is terminated.

Treasury accepted the comments, stating that the current dispute resolution rules will be reviewed to make provision for the introduction of ADR proceedings at objection stage and will provide for all procedural steps.

“The procedures and time periods may not necessarily be the same as the current framework for ADR proceedings during the appeal stage of a dispute. The proposed amendments will be circulated for public comment as is usually the case.”

There have also been concerns that SARS will “abuse” the system by taking its time to set the matter down for ADR. Treasury notes that the proceedings, whether at the objection or the appeal stage of a dispute, are voluntary processes that can be terminated at any time.

“If the taxpayer is of the view that the proceedings are delaying the finalisation of his dispute, the taxpayer may terminate the proceedings and move forward to the next stage of dispute resolution. However, if the proceedings are successful, it will significantly shorten the time period within which the taxpayer’s objection will be finalised,” Treasury said.

Public engagement

The effective date for the provisions will be determined by the Minister of Finance in the Government Gazette, to ensure operational and system readiness from SARS’s side, before the provisions come into effect.

Theron says allowing for discussion, debate, and more “human interaction” at objection level is welcome. “It should, in principle, make for more effective resolution of tax disputes.”

However, he is slightly sceptical about the practical implementation because it could result in disputes being further delayed if not properly implemented.

“But to be fair, I am sure SARS is very much aware of these issues and will no doubt try to prevent them, as is also evident from the effective date of the proposal (to ensure SARS readiness).”

Treasury has indicated in its public workshop that details of how the new process is going to work will require changes and updates to the Tax Court’s rules. These changes and updates will also undergo a public consultation process.

“I don’t expect this amendment to become effective very soon,” Theron adds.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law, and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning, legal, or tax advice that is appropriate to every individual’s needs and circumstances.