Actively managed exchange-traded funds (AMETFs) are rapidly gaining momentum, offering investors greater diversification and flexibility while reshaping investment strategies on the JSE.

The Johannesburg Stock Exchange welcomed its first AMETF in May 2023, following amendments to the JSE Listings Requirements. These new instruments differ from traditional exchange-traded funds (ETFs), as their goal is not simply to track a benchmark index but to outperform it. AMETF asset managers achieve this by selectively choosing stocks that they believe will provide higher returns.

Mark Randall, a member of the Investments Committee of the Actuarial Society of South Africa (ASSA) and director of information services at the JSE, refers to AMETFs as the next-generation building blocks for investment portfolios, offering the same investor protection as traditional collective investment schemes (CIS), such as unit trusts.

“An AMETF is an innovative wrapper that combines the investment flexibility offered by CIS portfolios with the efficiency and transparency of listed securities. It is simultaneously a CIS and an ETF, harnessing aspects of both to showcase manager expertise in a transparent and efficient structure,” explains Randall.

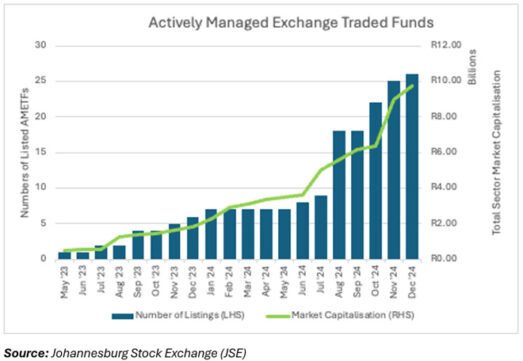

By August 2024, the number of AMETFs listed on the JSE had reached 10, and by the end of the year, that number more than doubled to 26. Randall notes that this new investment vehicle is expected to keep growing, providing further opportunities for local investors.

At the end of December 2024, AMETFs listed on the JSE held assets of R9.7 billion. Meanwhile, global AMETFs surpassed the US$1 trillion mark in August 2024.

New-generation building blocks

To be classified as an AMETF, the product must be registered under the Collective Investment Schemes Control Act and governed by the JSE’s Listings Requirements.

The key difference between AMETFs and unit trust portfolios is that AMETFs are listed on the JSE, allowing investors to buy and sell shares throughout the trading day via a share-trading platform. In contrast, unit trusts can only be bought or sold through a unit trust company or a linked investment services provider (Lisp) and are priced based on the portfolio’s net asset value (NAV) determined at the close of each trading day.

“The appeal of AMETFs lies in the ease of access, the cost efficiency of a listed instrument, client liability management via STRATE, and the absence of minimum investment amount requirements,” Randall explains.

Any investor who already trades on the JSE can access AMETFs.

“Some investors may prefer this method of accessing discretionary funds over traditional platforms for reasons such as intraday price formation, platform independence, administrative efficiencies, and service consolidation,” he adds.

Financial advisers may also find value in incorporating AMETFs into their model portfolios. “Including actively managed funds alongside single equities and passive products across asset classes can provide a diversified portfolio of listed instruments on a single platform. AMETFs with no performance fees could also qualify as a tax-free savings account investment,” Randall says.

Global portfolios

Several of the 26 AMETFs listed on the JSE are classified as global portfolios, investing at least 80% of their assets outside South Africa.

“The fact that AMETFs are rand-denominated does not necessarily imply domestic exposure. AMETFs classified as global portfolios offer investors the opportunity to diversify offshore without utilising their foreign allowance, without an additional layer of costs generated by exchanging currency, and without foreign platform fees,” Randall explains.

AMETFs are expected to come with higher fund management costs than traditional ETFs, because they are actively managed. Although ETFs typically have lower fees because of their passive nature, AMETFs are likely to have a cost structure similar to that of unit trusts, both of which must publish the Total Expense Ratio TER and NAV daily.

Randall points out that the difference in costs will mainly stem from access fees, including brokerage and other trading costs for AMETFs, and potential platform or provider fees for unit trusts.

He adds that although AMETFs may not offer entirely new advantages, they do combine the benefits of both a CIS and a listed investment product.

“This means an actively managed fund with a professional asset manager and a licensed provider – the trusted bedrock of the South African CIS industry today,” says Randall.