The major sell-off on heavy volume of Anglo-American PLC (“Anglo”) stock following the official future production guidance at the end of November last year was eye-catching. Anglo is not a growth stock but at certain times in the investment cycle, it is worthwhile holding the stock.

Analysing Anglo

I found analysing mining conglomerates such as Anglo an arduous task and, therefore, avoid making calls on cash flows, earnings, and dividend payouts. As analysts, we also look at discount to net asset value. Anglo American Platinum and Kumba are Anglo’s only listed assets, with Anglo’s share of their market capitalisation currently accounting for about half of Anglo’s own market capitalisation. To place a fair value on the unlisted investments could be highly subjective.

Furthermore, an analyst has no insights regarding specific contracts, market timing of sales and hedging of production or exchange rates of any of the entities under Anglo’s umbrella.

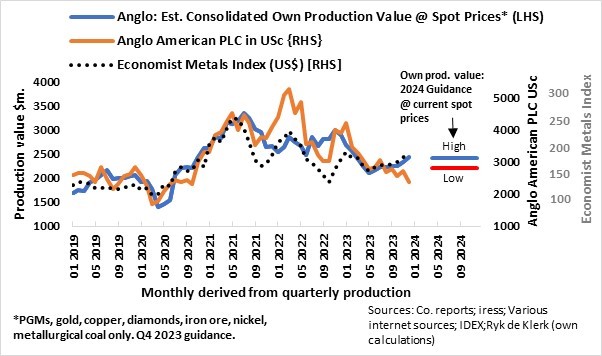

My approach to analyse Anglo and other mining conglomerates is to look at the company’s own mining production and the spot prices of the major commodities produced by the companies. I calculate the value of Anglo’s mining production by applying monthly spot prices per commodity to the quarterly production numbers.

In the case of PGMs, I used a constant Prill Split (percentage of the individual PGMs contained within reefs mined), while, in the case of diamonds, I used the sales price of De Beers in the first half of 2019 as base and adjusted the prices with the IDEX Diamond Price Index going forward from there.

The monthly estimated consolidated value of Anglo’s own production is the sum of the value of mining production of all commodities.

It is not the actual value that counts but the trend.

From the accompanying graph, it is evident that, since January 2019, Anglo’s stock price in terms of US dollar is influenced by metal prices as measured by the Economist Metals Index in US dollar as well as the consolidated value of Anglo’s total mining production in terms of US dollar.

It is also evident that, from end-2021 to June 2022, Anglo’s traded at exceptionally large premiums to both the metals index as well as the estimated consolidated value of mining production but subsequently pulled back in line.

Diverging price and value trends

Lately, Anglo’s stock price has diverted from the metals index and the estimated consolidated value of own mining production for the fourth quarter 2023. The estimated value of production is rising on the back of higher commodity prices and the bottoming out of diamond prices while Anglos stock price is falling, probably emanating from negative sentiment on the back of the latest guidance on future production and concerns about the Woodsmith project (a huge fertiliser mine being built under the North York Moors National Park in the UK). The precarious political and economic environment in South Africa also add to negative sentiment among foreign investors.

Anglo regularly provides guidance about future production estimates, ranging from high to low. It is, therefore, possible to estimate future consolidated value of mining production by applying current spot commodity prices. After factoring in Anglo’s production guidance (high and low ranges) for 2024 and applying current commodity prices, it is evident that Anglo’s stock price has diverged significantly from even the low range of production guidance. I am, therefore, of the opinion that the fair value of Anglo should be closer to 2 700 US cent (GBP 21.2; ZAR 500) per share compared to the stock price of about 2 400 US cent (GBP 18.8; ZAR 441) per share at Friday’s close.

Curtailing production and furloughing projects at this stage of a commodity cycle should be expected as mining companies are under pressure to curtail costs and conserve cash.

The outlook for the markets in which Anglo operates has turned for the better as, albeit still in its infancy, the next bull market in commodities driven by supply deficits is already underway.

Platinum Group Metals (PGMs)

Russia’s invasion of Ukraine in the first quarter of 2022 saw the prices of PGMs (platinum, palladium, ruthenium, and rhodium) spike as market players had to rush to secure their metal requirements. Subsequently, weak economic growth dampened the demand for PGMs in general, while investors in PGMs headed for the hills, causing a collapse in PGM prices, specifically rhodium. According to data released by the World Platinum Investment Council (WPIC), holdings of physical platinum etfs (exchange traded funds) and exchanges fell by about 1.3 million troy ounces, or one quarter’s mining supply, from the first quarter 2022 to the third quarter 2023.

The drawdown in PGM prices was such that, according to WPIC, 35% of PGM production outside Russia is running at a loss. Producers have already started to scale down production and furloughed future projects as pay limits (the PGM ore grade required to break even on costs) are rising, limiting current and potential ore reserves.

The supply/demand equation changed dramatically in the third quarter of last year as net demand for platinum via exchanges surged. New York Mercantile Exchange Platinum contracts held by non-commercial traders jumped to a net long position of about 1.4 million ounces from a net short position of about 200 000 ounces in mid-November last year.

The apparent change in investor sentiment towards PGMs is likely to remove a significant source of metals available for industrial use and cause a supply deficit, underpinning PGM spot prices.

Copper

Copper is one of the most essential metals needed to facilitate the shift to green energy globally. The metal traded in a tight range over the past year with supply and demand in balance. The prospects for copper took a sudden turn over the past month or so. The closure at one of the world’s biggest copper mines and Anglo curtailing copper production due to apparent operational issues stand to remove about 3% of global copper production.

The copper market, therefore, enters 2024 in a supply deficit that will underpin copper prices going forward.

Iron ore and metallurgical coal in steel production

According to industry sources, steel production is the most cost-effective by using metallurgical coal.

Since the second quarter of 2023, iron ore and metallurgical coal prices have turned for the better as China’s stimulatory measures, specifically aimed at reviving the weak property sector have finally, albeit slowly started to take effect. Steel production is a major input in China’s economy. Construction’s share of China’s GDP is about 7%, while sources indicate that construction consumes more than two-thirds of China’s steel production.

Diamonds

After a strong first half of 2022, an increasingly uncertain global economic outlook and disappointing recovery in mainland China post the last Covid-19 restrictions exerted downside pressure on diamond prices – rough and polished. Despite weaker jewellery demand at retail level, cutters, and polishers (midstream in the diamond chain) experienced an increasing oversupply of diamonds as mining companies, especially Russian producers, continued to sell rough diamonds. By the end of October 2023, diamond prices, as measured by IDEX were more than 30% lower than the peak in March 2022.

Market conditions have changed over the past few months, though, as the oversupply of polished diamonds is easing. According to Rapaport, De Beers (a subsidiary of Anglo and a major producer of rough diamonds) now focuses on flexible supply rather than price cuts.

In September last year, India, which cut and polishes more than 80 percent of the world’s diamonds, decided on a voluntary 2-month moratorium on rough diamond imports. The IDEX diamond Index rose by about 3% since bottoming at the end of October last year but is still about 5% below the low reached in March 2020 when the coronavirus struck in earnest.

Yes, diamond prices have bottomed.

Time to own Anglo

I hold Anglo due to the quality of its assets, the apparent discounts to the metals index and consolidated production value at current prices and the possible early stage of a new commodity super cycle.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.

Hi Ryk

Every time I followed an investment based on sum of parts and implied valuation for each part , I made loss

Your logic and reasoning is sound , you however have to couple it to gearing workings , working capital , earnings forecast and sensitivity analysis

Tempted to buy but wished the above was included