The following article was written by pension lawyer Advocate Brett Ladoucé, who is the author of the book Pensions for Palookas.

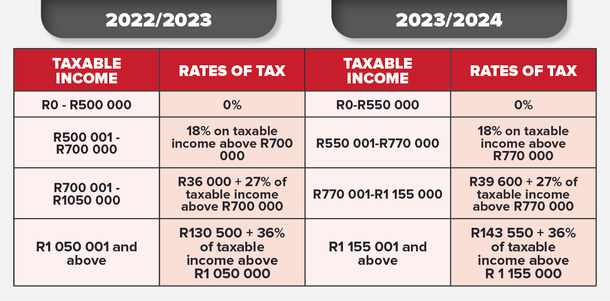

The Minister of Finance gave retirement fund members some good news when he announced the latest Budget. For the first time in nine years, the tax-scale amounts for lump-sum retirement benefits were adjusted, from 1 March 2023, by about 10% (to compensate for inflation at a rate of 1% a year?), to lower the tax burden, as shown below:

The limit on the tax-free amount was raised from R500 000 to R550 000.

It is always nice to have an extra R50 000 in your pocket, but does the tax change result in your receiving an extra R50 000 at retirement?

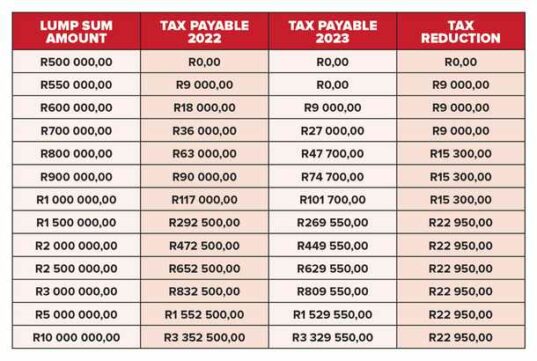

Not really. As the table below illustrates, the adjustment to the tax scales on lump-sum retirement benefits results in a tax reduction and thus cash in your pocket of only R9 000 at the lower end of the scale and only R22 950 at the top end of the scale.

The “gift” of a reduced lump-sum retirement benefit tax bill is always welcome, but as is illustrated above, the benefit might be significantly less than it seems at first glance.

The annual inflation-linked adjustments to the income tax scales offer a greater benefit than an adjustment to the lump-sum tax scale by 10% every nine years. Put differently, over time, the reduction of the annual income tax payable on annuity income from your retirement fund might be more significant from an inflation perspective than the ad hoc changes to the lump-sum tax scale every few years.

It is therefore important to obtain the advice of a financial adviser and tax expert to strike the right balance between the portion of your retirement savings you take as a tax-effective lump-sum benefit and the portion you use to buy a “tax-free” annuity income stream to meet your living expenses after retirement.

It might make sense to take less as a lump-sum benefit at retirement at a lower tax rate than the tax you will pay on your monthly annuity.

This article was republished with the permission of the author and Personal Finance. Click here to read the original article on the Personal Finance website.

Disclaimer: This article does not provide financial planning or tax advice that is necessarily suitable for everyone’s circumstances. Please consult a qualified expert for advice that is appropriate to your needs.