Retirement fund arrears are spiralling out of control in local government, putting municipal workers’ retirement savings in jeopardy. With billions in unpaid contributions, the fallout could devastate the financial futures of those relying on these funds.

Last week, the FSCA released its latest list of employers allegedly non-compliant with section 13A of the Pension Funds Act (PFA) as of 31 December 2023. Benefit payments are either delayed or do not amount to monies deducted from members.

The 109-page document names 2 330 entities.

The FSCA reported receiving the details of 7 770 employers who violated section 13A of the PFA by 31 December 2023, based on information from the retirement funds under its supervision.

Read: Arrear contributions: FSCA publishes third list of defaulting employers

Most of these employers are small businesses with fluctuating incomes and contract employees. In many cases, the problem with unpaid contributions arises because the employers have not informed retirement funds that they do not have an income or employees.

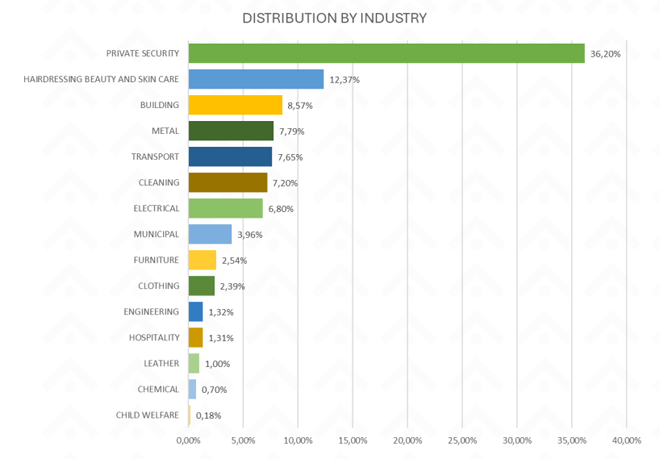

The largest share of unpaid contributions is owed to the Private Security Sector Provident Fund, followed by the Transport Sector Retirement Fund, the Hairdressing, Beauty, and Skin Care Industry Fund, and the Metal Industries Provident Fund. Other frequently mentioned funds include the Contract Cleaning National Provident Fund, the Municipal Councillors Pension Fund, and the Furniture Bargaining Council Provident Fund.

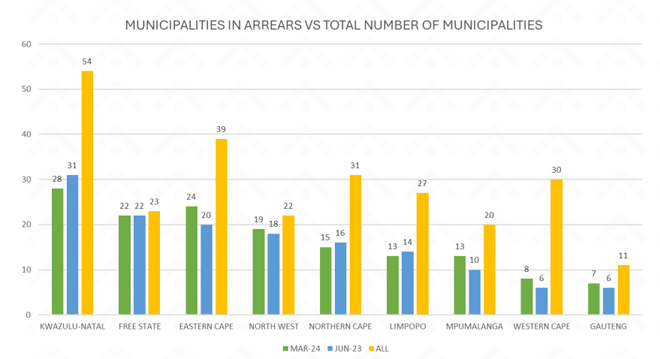

Of the 257 municipalities in South Africa, 149 municipalities are reported to be in arrears. In other words, 58% of the municipalities in the country are in arrears.

The unpaid contributions from municipalities alone are estimated at R1.4 billion across 10 retirement funds. Sixty-nine percent of arrears are in the Free State. Of the 23 municipalities in the Free State, 22 were in arrears.

Across the board, the total outstanding contributions have now reached about R5.2bn, affecting about 310 000 members.

Recycling of employer contributions

Unathi Kamlana, the Commissioner of the FSCA, explains that in the local government sector, one particularly harmful practice contributing to financial mismanagement is the recycling of contributions. This occurs when municipalities divert money intended as retirement contributions and instead use it for operational expenses or to pay salaries.

“This practice not only breaches fiduciary duties but also exacerbates the financial instability of the municipality, as it creates a backlog of unpaid pension obligations that accrue interest and penalties over time,” Kamlana said.

This practice places employees in an untenable situation, sacrificing their long-term financial security to address the municipality’s short-term financial needs. “And importantly, it increases the contingent liabilities of the state.”

Encouragingly, Kamlana points out that law enforcement agencies are beginning to take action, holding both individuals and municipalities accountable for failing to meet their obligations.

In the Northern Cape, the Directorate for Priority Crime Investigation (the Hawks) has pursued cases against officials from Renosterberg Municipality. Three senior managers were charged with fraud, theft, and contraventions of the Municipal Finance Management Act and the PFA for failing to remit R73.5 million in pension contributions between 2018 and 2023. The contributions were related to the Municipal Workers Retirement Fund and LA Retirement Fund.

The two former Renosterberg municipal managers, Mosang Molaole and Veli Goodman, along with the current unit manager, Sandile Dick, made their first court appearance on 14 October, when their case was postponed to 19 November.

In October, Johnny Mackay, the former municipal manager of Kai !Garib Municipality, was arrested for violating the PFA during his tenure. Mackay, now the head of the Department of Public Works in the Northern Cape, was arrested by the Upington-based Hawks’ Serious Commercial Crime Investigation Unit on 25 October.

According to Ofm, Mackay was arrested for alleged offences committed between September 2021 and March 2022, during which he failed to fully remit payments to the Consolidated Retirement Fund for Local Government. He faces 271 counts of violating the PFA.

His second court appearance is scheduled for 25 November.

The most recent case involves the arrest of Rufus Beukes, the manager of Kamiesberg Municipality, for violating the PFA. Beukes, who was released on R10 000 bail, is accused of failing to pay or making late payments of both employee and employer contributions to the Consolidated Retirement Fund from September 2019 to April 2024. The late-payment interest amounts to more than R2 million.

Beukes made his first court appearance on 7 November, and the case has been adjourned until 5 December to allow him time to secure legal representation.

Kamlana emphasised that such enforcement action highlights the importance of holding officials accountable for retirement fund mismanagement, ensuring compliance with the law, and protecting employees’ retirement savings.

“We hope to see more of these actions and hope to secure convictions as well,” he said.

The fallout for members

Kamlana explained that timely and consistent contributions are critical to the ultimate value of retirement savings over time, and by extension, are a significant determinant of whether or not an employee secures a comfortable retirement. When an employer fails to make timely payments, it has a major negative impact on the employee’s retirement savings.

“Potentially undermining the financial foundation that many South African workers depend on, leading to a direct loss in the growth potential of their savings and leaving workers vulnerable to financial insecurity in their retirement years.”

This issue is not only significant in terms of lost retirement savings, but there are also other severe risks at stake. Retirement contributions typically include risk benefits, designed to provide financial protection in the event of unforeseen circumstances. These risk benefits typically cover death, disability, funeral expenses, and sometimes temporary disability.

If the employer fails timeously to transfer pension fund contributions to the relevant retirement fund, employees can lose access to these crucial risk benefits. Specifically, death and disability benefits may be affected. Without the correct contributions being made, the employee or their beneficiaries may not be covered in the event of death or disability. In some cases, the policy may lapse because of non-payment, leaving the employee or their family without vital financial protection.

Members are also losing out on the benefits of the two-pot retirement system’s savings component, which was specifically designed to provide access to funds in case of emergencies.

As of 1 September, 10% of a member’s retirement savings, up to R30 000, were allocated to the savings component. Funds in the savings component can be withdrawn at any time, provided the withdrawal is R2 000 or more. If the balance is less than R2 000, no withdrawal is allowed until it grows to that amount. This means the fund credit had to be at least R20 000 by 31 August to allow for immediate access to the minimum withdrawal amount.

The introduction of the two-pot system led to a surge in withdrawals from members’ savings components. However, it also exposed issues of maladministration, as many members desperate to access their savings discovered that their employers had either failed to make timely contributions or made no contributions at all. As a result, many were left with insufficient funds in their savings component to make a withdrawal.

Kamlana said the negative impact on the value of retirement savings has made the issue of arrear contributions increasingly problematic and a key concern for the retirement system over the years.

While the R5.2 billion in arrear contributions – representing only 0.2% of the total R3.15 trillion in assets within South Africa’s retirement funding system – do not pose a threat to the system, Kamlana warned that if arrear contributions continue to grow to a prudentially significant amount, they could destabilise the broader retirement ecosystem.

Retirement funds rely on consistent contributions to maintain liquidity and meet their obligations. When contributions are delayed or inconsistent, the funds can become strained, limiting their ability to invest in long-term projects and reducing their role as major institutional investors in the economy.

“So, it’s not just the employees who suffer; the entire retirement system becomes more vulnerable. This is why addressing the issue requires a regulatory and legal response that is comprehensive, closes enforcement gaps, and ultimately secures positive outcomes for retirement fund members,” Kamlana said.

Currently, the PFA places the responsibility for ensuring compliance with contribution requirements on the boards of retirement funds.

While the COFI Bill is still to be tabled in Parliament, its enactment will broaden the FSCA’s regulatory reach, bringing participating employers under its supervision as regulated entities, alongside those already under its oversight.

Read: Unpaid contributions: FSCA prepares to hold non-compliant employers accountable

“This expanded mandate will enable the FSCA to directly engage with employers involved in retirement funds, enhancing compliance and accountability,” Kamlana said.