Sales fraud – dishonest intermediaries writing-up policies for clients without their knowledge to earn commission – makes up 57% of all fraud cases recorded by members of the Association for Savings and Investment South Africa (Asisa) in 2022.

Asisa’s Forensic Standing Committee this week released its most comprehensive set of fraud statistics yet, which for the first time includes fraud reported by investment companies and a new category for sales fraud.

Previously, Asisa released only fraudulent and dishonest claims statistics reported by life insurers.

Jean van Niekerk, the convenor of the Forensic Standing Committee, says according to their findings, sales fraud resulted in a loss of R14.1 million to companies, while fraud worth only R719 688 was prevented.

Van Niekerk said that because Asisa members published their sales fraud figures for the first time in 2023, trends will only emerge in 2024.

“Deliberate attempts by sales agents (call centre agents and tied agents) and independent financial advisers to benefit financially through the earning of commission and fees instead of acting in the customer’s best interests are considered extremely serious by the industry,” Van Niekerk says.

Sales fraud involves dishonest intermediaries writing-up policies for clients without their knowledge to earn commission from the life insurer.

Van Niekerk says that, in some cases, dishonest intermediaries colluded with human resources staff to obtain employee payment information. He adds there have also been cases where fraudulent business was written using existing customer details.

He says actions taken against dishonest sales agents include debarment, dismissal, the cancellation of broker contracts, and criminal charges.

R77 million lost to fraud in 2022

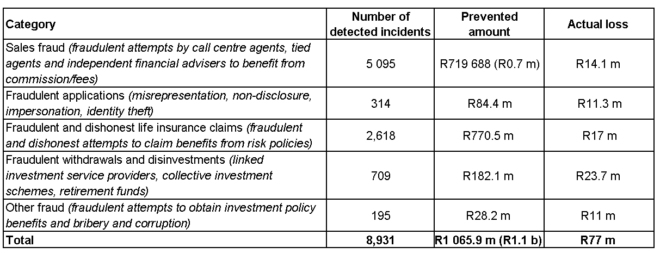

In total, South African life insurers and investment companies detected 8 931 cases of fraud and dishonesty in 2022. While losses worth R1.1 billion were prevented, the industry lost R77m to fraud in 2022.

The Asisa fraud statistics are divided into five categories, as outlined in the table below:

Following sales fraud, fraudulent life insurance claims (2,618) accounted for the second-highest number of fraud cases, making up 29% of total cases in 2022. However, the value of these claims significantly exceeded all other fraud categories in 2022, with R770.5m in losses prevented and actual losses of R17m recorded.

By comparison, honest policyholders and beneficiaries received claims and benefits payments worth R578 billion from South African life insurers in 2022. The payments included claims against life, disability, critical illness, and income protection policies, and retirement annuity and endowment policy benefits.

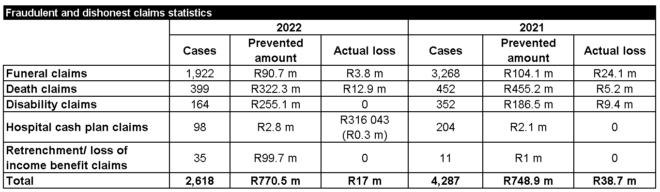

Van Niekerk says that compared to 2021, when 4 287 cases were detected, there has been a significant decrease in fraudulent and dishonest life insurance claims. However, the value of losses prevented remained sizeable, dropping off only slightly from the R787.6m thwarted in 2021 across all lines of risk business.

According to Van Niekerk, the drop in claims fraud in 2022 is aligned with slower sales of new policies. Some 1.2 million fewer recurring-premium policies were sold in 2022 than in 2021.

Funeral insurance once again attracted the highest incidence of fraud and dishonesty in 2022, followed by death cover, disability cover, hospital cash plans, and retrenchment/loss of income benefit cover.

Read: Funeral policy fraud: know how to protect yourself

A point of interest is the increase in the value of fraudulent and dishonest disability, as well as retrenchment and loss of income benefit claims.

Although the number of dishonest disability claims was lower in 2022 than in the previous year, the value of the losses prevented increased by R68.6m. Similarly, the value of fraudulent and dishonest retrenchment and income benefit claims jumped from R1m in 2021 to R99.7m in 2022.

Van Niekerk says these risk products are often targeted during times of economic hardship by desperate policyholders.

“Retrenchment and loss-of-income claims are flagged as fraudulent when submitted even when there was no retrenchment or loss of income.”

Loss of income benefit products are relatively new on the market and, says Van Niekerk, were created to help entrepreneurs protect themselves against sudden loss of income. These products have increased in popularity since the pandemic, but have also attracted fraud and dishonesty, according to Van Niekerk.

“We have seen cases where opportunistic self-employed individuals and entrepreneurs selectively provide information relating to loss of income to make it appear as if they have suffered a complete loss of income,” he says.

The third-highest number of fraud cases was recorded for withdrawals and disinvestments from linked investment service providers, collective investment schemes, and retirement funds. These cases comprised 8% of the total number reported for 2022, with a value of R182.1m prevented and R23.7m lost.

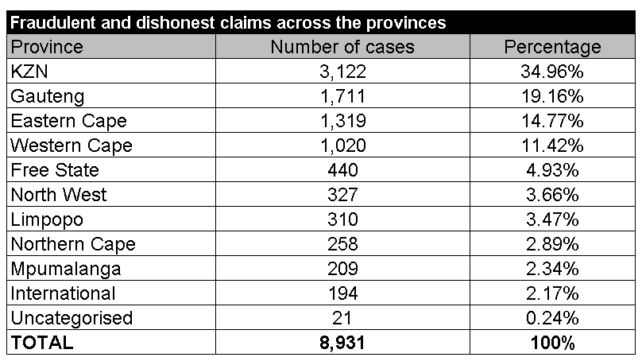

Most fraudulent and dishonest claims were uncovered in KwaZulu-Natal, followed by Gauteng, the Eastern Cape, and the Western Cape.

‘Measures to combat fraud are working’

Van Niekerk says the fraud statistics provide a better overview of the magnitude of the problem with which the industry is grappling.

“The statistics also send a strong message that the industry’s preventative measures to combat fraud are working.”

He says the committee significantly increased its focus on data collection and trend analysis in the past year because early detection of changing trends is key in the fight against fraud and dishonesty.

“Furthermore, collaboration by the forensics departments of life insurers and investment companies with other crime prevention initiatives is delivering promising results,” says Van Niekerk.

The Fraud Symposium, with representation from the financial sector and law enforcement, is one initiative committed to addressing crime in the financial sector as a priority.

According to Van Niekerk, other successful preventative measures deployed by life insurers and investment companies are the use of big data, machine learning, artificial intelligence, improved data sharing, and enhanced authentication mechanisms such as biometric customer identification.

He warns that the consequences of being caught for fraud are severe and can result in criminal charges and potential jail time.

According to Van Niekerk, the drop in claims fraud in 2022 is aligned with slower sales of new policies. Some 1.2 million fewer recurring-premium policies were sold in 2022 than in 2021.

Does this indicate a industry which is over regulated ? Would like to know how many new entrants in the industry is recorded and how many has left the industry?

the update and information of fraud cases should be made available to agents so they see how its affecting the industry and honest agents, representatives.