Sygnia wins appeal over advert’s claims about RA fees

The independent modelling submitted by Sygnia made it clear that the claims in the advert are mathematically and factually accurate.

The independent modelling submitted by Sygnia made it clear that the claims in the advert are mathematically and factually accurate.

Business Unity South Africa and the South African Medical Association are unhappy about references to NHI in the document.

The type of fund to which a member belongs may improve or undermine the preservation of retirement fund assets, says Allan Gray.

The FSCA says prescribed assets will compromise the fiduciary duty of retirement fund trustees.

The syndicate gained unauthorised access to two accounts belonging to a German national on multiple occasions.

Public Compliance Communication 59 has been issued following two rounds of public consultation.

The man persisted with his abusive emails despite being found in contempt of court twice and being sentenced to a period of direct imprisonment.

The 2023 FPI Financial Planner of the Year reflects on her career and shares some advice for young professionals entering the industry.

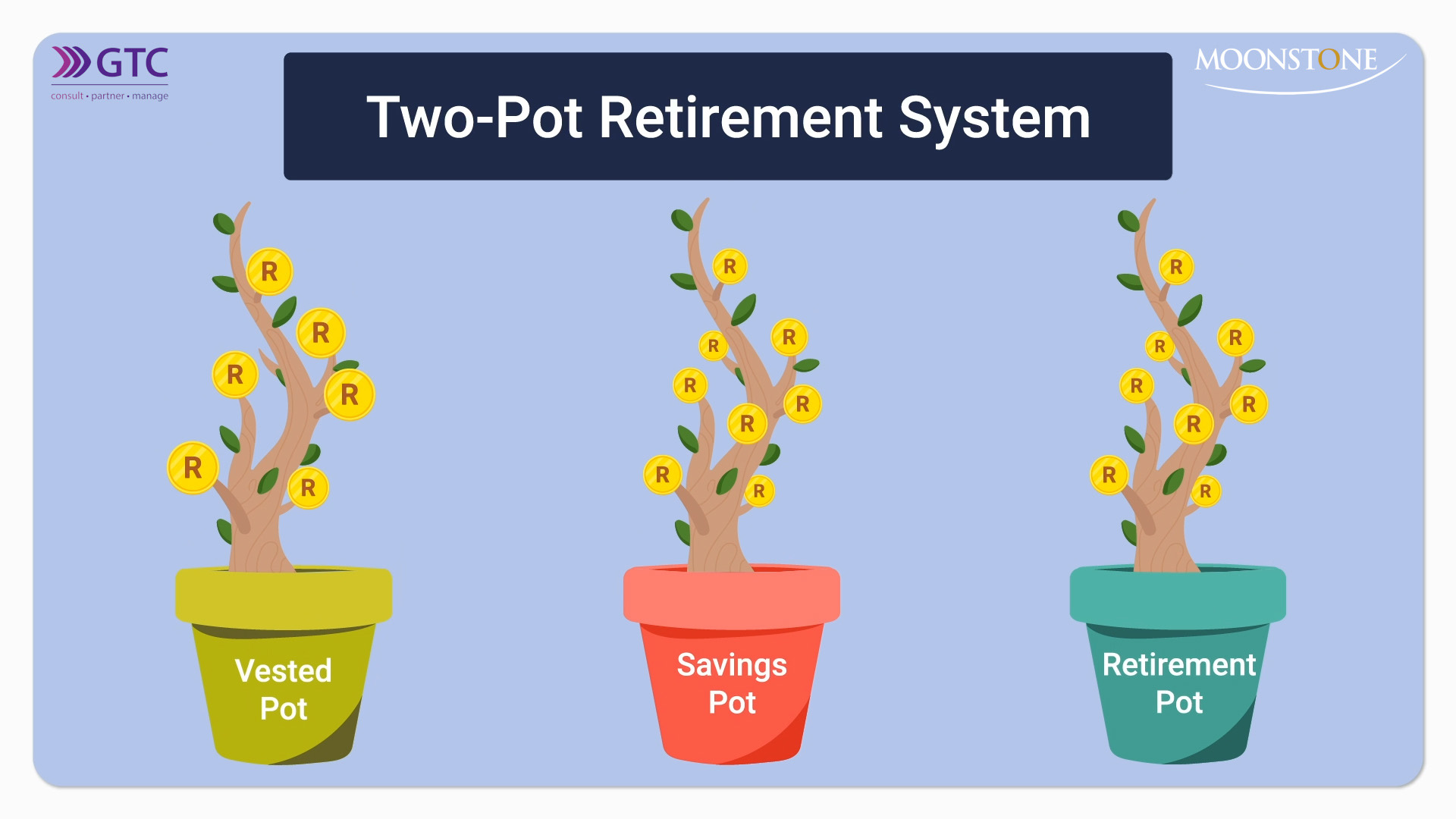

It is accompanied by three brochures that unpack different aspects of the two-pot system in more detail.

The house, which belonged to the broker’s brother, was set alight after the sheriff served an eviction letter on the occupant.

A recent study by Schroders and Ad Lucem highlights significant challenges and opportunities for advisers to address the evolving needs of female clients.

The non-compliance was discovered during inspections by the Prudential Authority in 2020 and 2022.

The bank also faces a R4.9bn claim arising from SARS’s alleged inability to collect taxes and penalties from former foreign exchange clients.

Understanding how an excess works can help to strike a balance between minimising risks and saving on premiums.

Tarina Vlok, MD of Elite Risk Acceptances, explains the importance of educating policyholders about their insurance coverage and exclusions.

If a person’s year of assessment is less than 12 months, the allowable retirement contribution deduction will be applied pro rata.

The Council for Medical Schemes has advised medical schemes to limit their contribution increases for 2025 to 4.4% plus ‘reasonable’ utilisation estimates.